Liquidity Issues: Not Enough Ethereum?

Is this a lesson?

It is easy to fall prey to the idea simply because something in not in demand now, that is how it will always be.

Liquidity is an important issue when it comes to markets. Without enough liquidity things dry up.

For all their misguided models, one things central banks do understand is the need for liquidity. If there is an area they excel, it is here. The entire Repo crisis of a year ago was 100% about the liquidity since the overnight lending market was drying up. Without it, things fall apart quickly.

In cryptocurrency, we are starting to see platforms evolve. This has the potential to cause issues as we see advancement. Even without a big influx of users, there are some challenges being uncovered.

Source

Ethereum is obviously one of the best known blockchain, ranking second in total market cap. As most are aware, Ethereum 2.0 is being developed. This will switch the network from PoW to PoS. It is being done in an attempt to improve the scalability of the network, something that the DeFi explosion has further exposed.

The challenge that is forthcoming with this switch is that the security of the network could be compromised by the DeFi applications. Presently, there is over $12 billion locked in DeFi, a number that keeps growing on a monthly basis.

This present an issue for Ethereum since staking ETH is required for the security of the network. People will stake their ETH to pools which will handle the validation of transactions.

Here is where the DeFi protocols can present a problem. With the return they are offering, the fear is that most will opt for the higher return, leaving the network without enough stake. Investors, after all, are going to see the best return for their money. Trying to match these returns, if possible, would only make the network more expensive to operate.

It is easy to see how the success of DeFi on the Ethereum blockchain is causing it a host of problems. Hence, the switch to Proof-of-Stake, while addressing a major issue, could come at the cost of creating another one.

Liquidity is something that is very difficult to guess beforehand. Markets do things that are unexpected, especially as new development is taking place. A number of years ago, DeFi was not on the minds of most individuals within the crypto world. The same is not true today.

Thus, in two years, something that was on the backburner, talked about only in articles as a future possibility, is now the crypto story of 2020. And the second largest blockchain is having a host of issues associated with it.

Source

Which brings us to Hive. Is this a foreshadowing of what could take place?

The key in this discussion is that it only takes one idea to breakthrough. We are in an industry that is in the early stages. Much of what we see taking place is "copycat". This is the value of open source systems.

At the same time, it cannot be overlooked that Hive offers both fast and fee-less transactions. With the transaction fees on both Bitcoin and Ethereum bouncing around like a ping pong ball, it only stands to reason that applications are going to start to suffer as a result of that. In time, people will start to seek something more consistent.

With systems of this nature, it does not take a whole lot to move the needle. While Ethereum is big for the blockchain world, it is really very small in the overall financial arena. The billions that are pouring in with DeFi is no comparison to the tens of trillions of the present financial market.

On Hive, it is even worse. Instead of billions, we are talking a marketcap of tens of millions. Here again, we can see how easily things can shift if that breakthrough does occur.

Presently, many are looking at the blockchain and taking measure in anticipation of future events. This is a sound approach, a path to avoid the inability to scale preciously when it is needed. However, few are mentioning the financial aspect to this. Everyone is so focused upon token price, they overlook the fact that liquidity issues could be encountered at some point. While many think this is a nice problem to have, in crypto it is not. Unlike the central banks, the printing press cannot suddenly be turned on.

It is best to remember how quickly things can change. A little over a year ago, many were questioning whether Tesla would go bankrupt or not. Today, they have one of the best balance sheets in the automotive industry and many are now asking if Tesla can be stopped.

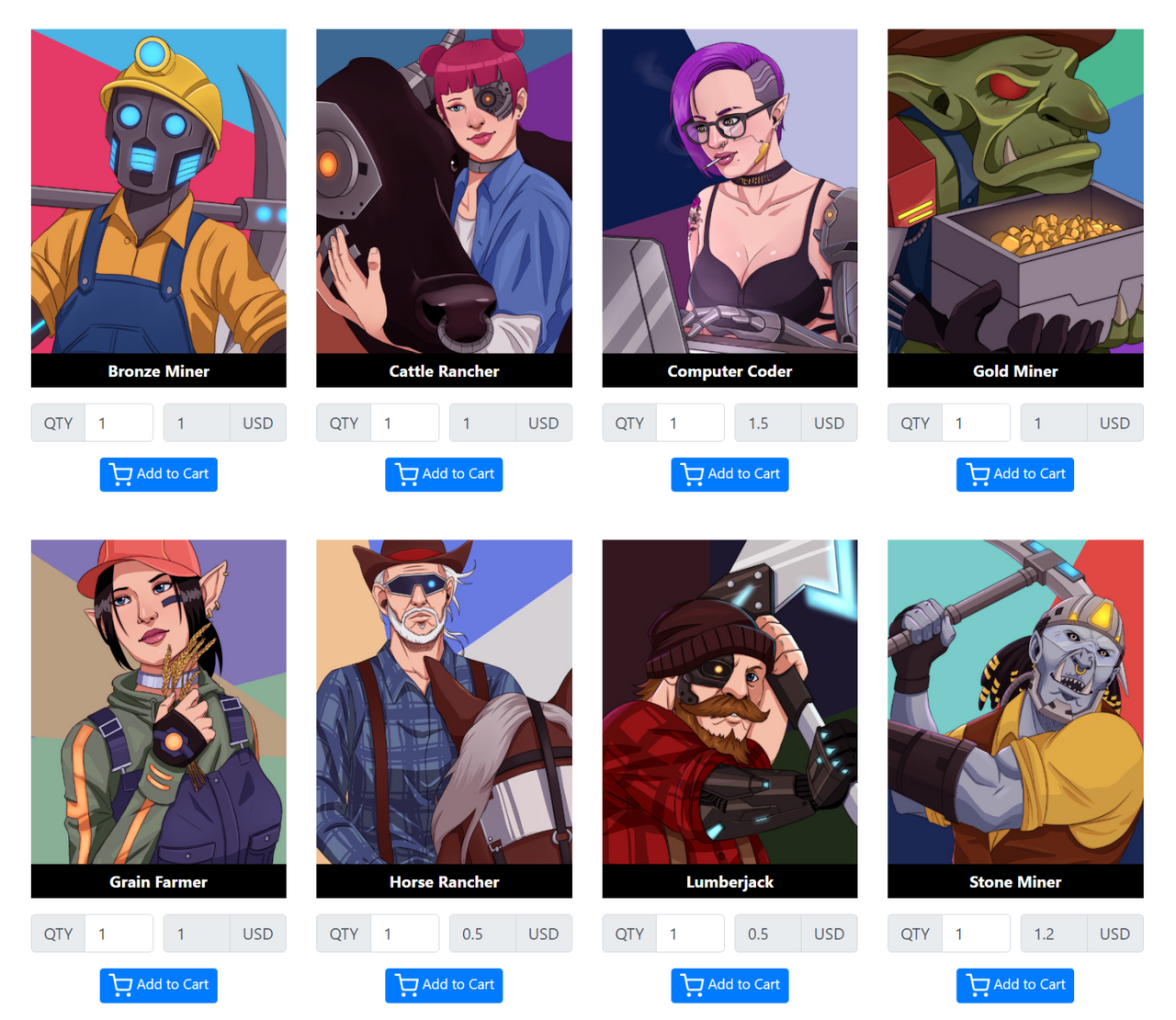

The other day, @ggroed, announced a new project on Hive-Engine that moves this ecosystem into yield farming. This game is the first of many that are expected as the H-E smart contract capability expands.

My point here is what happens if this takes off to a minor degree. We all know yield farming is the craze and it is not likely to slow down anytime soon. As long as investors can get the return, they will keep flocking to this concept.

With Hive, if there are 4 or 5 projects of this sort that come out over the next 6-9 months, how much is needed to really move the needle? Again, with a marketcap of $45 million, even a few million invested will radically alter things.

And, as with Ethereum 2.0, the Hive that is used for this purpose, will end up in the H-E account as a backing for Hive.swap. This means it is not used for staking purposes on the network.

A situation that some are starting to raise as an issue for Ethereum as they roll out their second version.

Remember, things have a way of changing quickly.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

wow you if you know how to put things in perspective, if that takes off here it will be a time bomb, to see how the returns take off and investors could start to arrive, and with them of course the knowledge and of course the high prices.

The good thing is that we are already here and we will be able to take advantage of these projects at the first moment because we are part of those that already have the know-how.

Let's hope we don't burn our hands as has happened to many with the DEFIS, since there have been great losses for quite a few but some have been able to take advantage of this.

Well thank you for making us dream, hopefully these dreams come true.

Posted Using LeoFinance Beta

The Defis themselves, some were great, others just scams. That is what happens in the "Wild West". However, Ethereum did not suffer because of them. The blockchain is still going strong although some have griped about the transaction costs and time it takes for transactions to go through.

That is where Hive has an advantage.

Certainly, anything built on Hive is definitely "buyer beware". People need to be smart about things and know what/whom they are getting involved with.

Posted Using LeoFinance Beta

The bigger the liquidity pools get, the smaller the rewards. There's a direct inverse relationship. Seen from another point of view, if I only pay 0.25% to buy and sell on a centralized exchange, why would I pay more on a decentralized exchange?

Lots of what has been going on in early DeFi has been pyramiding, and, once that is over, things will come back into line with economic reality ... for everything legit enough to be listed on normal exchanges anyway.

Certainly many will do that. However, some do object to KYC while others find the centralized exchanges difficult to get listed upon. Binance just make some news stating that it is going to drop tokens without a great deal of activity.

I agree, once the insanity of DeFi diminishes, we will see legitimate use cases emerging.

Posted Using LeoFinance Beta

And probably lot lower rewards/APR for even the smaller tokens that can't get listed on bigger exchanges. I agree that the use case certainly exists, but I'm not sure the astronomical earnings can survive long, even in those cases.

You've stated it thus far, a few million investment will alter things. I believe things can change quickly like you said. We actually need that change going forward for hive

Posted Using LeoFinance Beta

Development is what will pave the way. Perhaps this is an interesting approach to really start to get Hive into the game. We saw what Leofinance was able to do in the short period of time with wLEO. There is a lot to attract from. It is just accessing those markets.

Perhaps a new form of yield farming will attract some outsiders.

Posted Using LeoFinance Beta

Yeah, we however need to brainstorm ideas that's going to take hive to the next level. Like hive 2:0 Something attractive and I think we haven't been up to par in the marketing aspect. Khal's exposure has made leo really attractive

I think it is a lot different marketing a project like Leofinance versus a blockchain like Hive. The only ones who really will be interested in the later are developers. That is where the focus should be since attracting them if vital.

Outside of that, I wish people would spend a lot of time promoting different projects. These are what will attract the users and many of them already have enough updates to be attractive, especially some of the games.

Posted Using LeoFinance Beta

Is yield farming similar to TRON staking gaming?

I cannot answer that since I am not familiar with what TRON is doing. However, I would guess it probably falls under the category.

Yield Farming is a nice term given to the DeFi apps, most on ETH but I guess they are elsewhere, where people put up their tokens as stake for a return. Turning it into a game like Aggroed is talking about and what it seems TRON did is an interesting twist.

Posted Using LeoFinance Beta

Yah I had received about 4800 Tron and this was during the 'war' . I ended up gambling it all lol but it yielded these dice tokens that you stake and now I just get Tron back every day / every other day. I looked into to it and TRON has a ton of those staking games.. it 'looks' like Aggroed wants to do similar thing. Not much of an original idea if it is, but I guess it helps Hive to a degree.

Posted Using LeoFinance Beta

The great thing about crypto, no need to be original. Much of what is taking place is copycat anyway.

They key is to keep offering more to the userbase and promote what is here. This will increase the wealth people have which opens the doors for more things.

Posted Using LeoFinance Beta

ETH 2.0, by my understanding, is planning to take the D out of DPoS. No doubt, because they have watched the shit show of the HIVE/STEEM fork and see the error of design in its governance.

ETH 2.0 should have simular network speeds as HIVE and likely lowered gas fees yet without the potential drama and loss of trust which DPOS has suffered in my opinion.

My cryptfolio has some exposure to ETH which was aquired as a long term bet on ETH 2.0.

Yes, Ethereum 2.o will be PoS chains as it was always going to be.

The main difference between the two consensus mechanisms is that not every stakeholder needs to be a block validator in DPoS unlike in PoS. The flaw in DPoS is the high witness rewards which can lead to the centralization of stake ownership unless they are distributed to a large enough group of people. Work has been done for years to lower the cost of running a witness node on Steem/Hive. It would be cool if the number of consensus witnesses were increased in response but I don't believe that will get done any time soon.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.@taskmaster4450, In my opinion no one Technology is creating all the solutions. In my opinion this is the time to see the whole Cryptocurrency Ecosystem as a hub of Opportunities. Stay blessed.

It is clear that without a decent return for investors, probably nothing offered will be attractive to them. Without liquidity nothing survives and it will be very interesting to see more yield farming projects for Hive. I still have hope for better days.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: