Kucoin: Another Move Towards Decentralization

We all know the old saying in cryptocurrency: Not Your Keys, Not Your Coins.

The essential word here is "Your". This denotes ownership. While many in the cryptocurrency world still keep a vast majority of their tokens on centralized exchanges, we are seeing more events that will wake people up. However, this could easily be offset by the newer entrants into the space, those who believe it operates similar to the way things do in the present financial system.

Source

While one's money is "safer" because accounts tend to be insured against loss, the centralized situation is the same no matter what the type of asset. Ultimately, when it comes to anything centralized, it is not yours. Everything that exists on a centralized platform is under the realm of those who control it.

This is a vital point that people need to wake up to.

Most of us are aware of the power of Facebook, Twitter, and Google. Does anyone believe that what they do on these platforms is "theirs"? At this point, I would say no. The majority of users are apathetic to the situation but at least they do not believe they own what is being done on there.

Here we see where things are starting to take their toll. The same social media entities are getting a lot of attention of deleting tweets, shutting down accounts, and basically engaging in limiting behavior. While the claim they are private entities free to do as they wish is valid, we are going to see this escalate to even greater heights.

Censorship is wonderful when those being silenced have a view that you oppose. After all, why not shut those idiots down. Of course, the situation takes on new meaning when there is a change in winds and suddenly you find yourself censored.

The hack of Kucoin is just another example of the vulnerability of centralized entities. In short, they are completely unable to protect our data. Here, we see the data being more than $150 million worth of cryptocurrency.

Source

What is very interesting about this situation is the coins were moved to Uniswap, a decentralized exchange. This brings up the argument that decentralized systems have no oversight, hence are more dangerous. The reality is that the hackers are between a rock and a hard place. It is true they can easily swap the Ethereum based tokens for whatever they want. However, no matter what they swap them into, there will be a trail left.

All this comes less than a week after it was revealed that the regulated banking institutions moved more than $2 trillion through their system in laundered money. Here we see how the oversight of the present financial system, something many feel is necessary, is a complete farce.

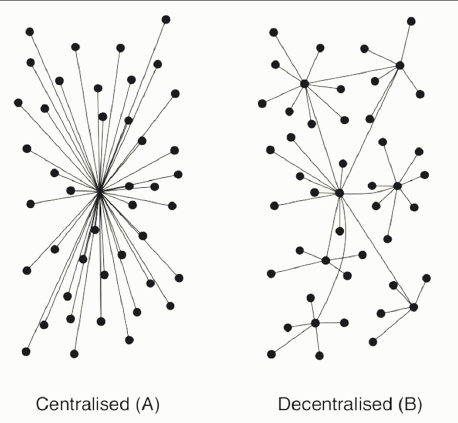

It is becoming evident where things are going in the future and what the "killer DApp" is going to be for blockchain world. Decentralized data is crucial for the decades ahead. It is time to end all the controversy associated with the centralized/decentralized debate.

One only need to look at the track record of centralized entities to understand they are fossils. They excelled in the non-digital world. However, as we move deeper into digitization, we see the shortcomings painted in neon.

Kucoin is no different than Bank of America, Target, or Facebook. At the core, it was unable to protect people's data. In this instance, the data had direct value because it was cryptocurrency. Others, require a dump of said data on the dark web to find buyers of things such as credit card numbers and identifications.

Source

Either way, centralized entities fail to provide the protect people need. For this reason, it is time for people to start moving everything they can away from these entities. It starts with getting all of our coins off centralized exchanges. There are enough secure wallets around that people can easily do this without too much technical expertise.

If we are not willing to lead the way, who will? After all, those who are presently involved in cryptocurrency tend to be outliers. This is true for most early adopters.

The example we provide can help to spread the message. No matter what the data is, it is not safe on a centralized platform. If we want to move away from the dystopian Internet that is forming, this is key. Control, ownership, and ability to profit need to be in the hands of individuals, not giant corporations who could care less.

With each passing week, the amount of money locked up in DeFi keeps growing. At the present moment, it is over $11 billion. This is a large sum. However, we must keep in mind, it pales in comparison to the existing financial system.

For this reason, exponential growth is required. It is a trend that we must keep going. The move away from centralized entities can be sped up if we show the power of decentralized ones.

With the foundation starting to take shape, we can build upon it.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

Your current Rank (29) in the battle Arena of Holybread has granted you an Upvote of 20%

The ironical thing is that the hackers moved the stolen fund to uniswap a decentralised setting once again proving how insecure centralised exchanges can be. The case for kucoin is pathetic I guess "not your key not your coin" still hasn't been fully understood by many.

Posted Using LeoFinance

Yeah. That is one way to decentralize $150 million in a few clicks of a button.

Maybe the new motto is going to be "decentralize your funds or the hackers will".

Posted Using LeoFinance Beta

These Centalized Exchange defeats the purpose of creating cryptocurrency.

It is supposed to be peer to peer transaction without any dependency on third party.

Following the same path as the Internet unfortunately.

That was supposed to be the free flow of data, peer-to-peer. Instead, we get a centralized server based system.

The optimistic thing about this is the centralized exchanges came into being and now DEX is gaining in power and functionality. So there is hope that the centralized ones eventually get taken out.

Posted Using LeoFinance Beta

It will soon be like that.

Sure, Lot of effort are going on for Decentralization.

The good news keeps coming, haha!

What a blast!

It is a great point of view. Today many exchanges are larger than many banks, maintaining centralization, against the proposal of financial decentralization that Bitcoin initiated. Hack can happen. And it will be important how they respond to that. Insurance and guarantees are important for these events. But in a way, they are also part of the investment and growth of the crypto universe. I wanted to see Leo on the Kucoin exchange, maybe a soft staking. Anyway i hope that decentralization and DEX wallets continue to advance.

Posted Using LeoFinance Beta

I can almost guarantee that there will be a devastating hack in 2021 that drains way more than $150M due to the honeypot increasing in size by a x20 bull run. The more value Bitcoin gains, the bigger targets the exchanges become.

I won't be surprised if it's an inside job that cleans out an entire gigantic cold wallet.

These honeypots will become too large to justify existence when we already have decentralized solutions.

A hardware wallet should beat any exchange or online holdings ecosystem out there and when it comes to cryptocurrencies and considering their value we need to take all the security that we can.

I remember when I first starting mining and while I was holding the private keys I've forgotten the password. I've tried brute force the blockchain using approximate words but without any luck and in the end I got used with the idea that I've lost what it was on that wallet. As I had a rather small amount I was fine after it, but that was a lesson I had to experience in order to change my behavior to holding the keys and the passwords.

Posted Using LeoFinance Beta