DeFi And Crypto Are Starting To Take Over

There is an amazing amount of progress being made. We are nearing the Rubicon for crypto whereby there is no turning back. While almost all in the industry agree there is no stopping things, we are still a fair ways from mass adoption.

That does not mean, however, that the metrics are not validating what we said for the last couple years.

Decentralized Finance will be the ultimate successor to our present financial system. The numbers are still heavily skewed in favor of the Wall Street world. Nevertheless, the drop in the bucket that is DeFi is growing at a massive rate.

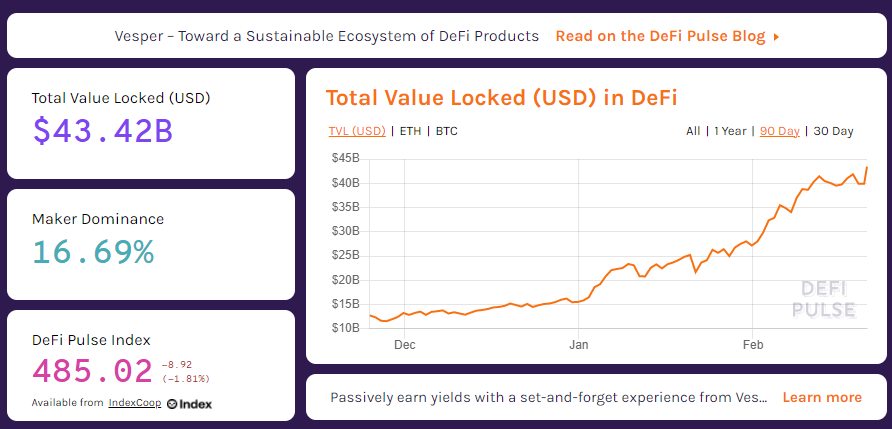

According to Defipulse, the activity is growing.

As we can see, there is over $43 billion locked up in the major DeFi applications. This is up from $275 million in early 2019 and $1 billion a year later.

The key will be to see how things unfold over the next couple years. We could easily see another 10x of this total throughout the rest of 2021 was more money enters the industry along with appreciating prices.

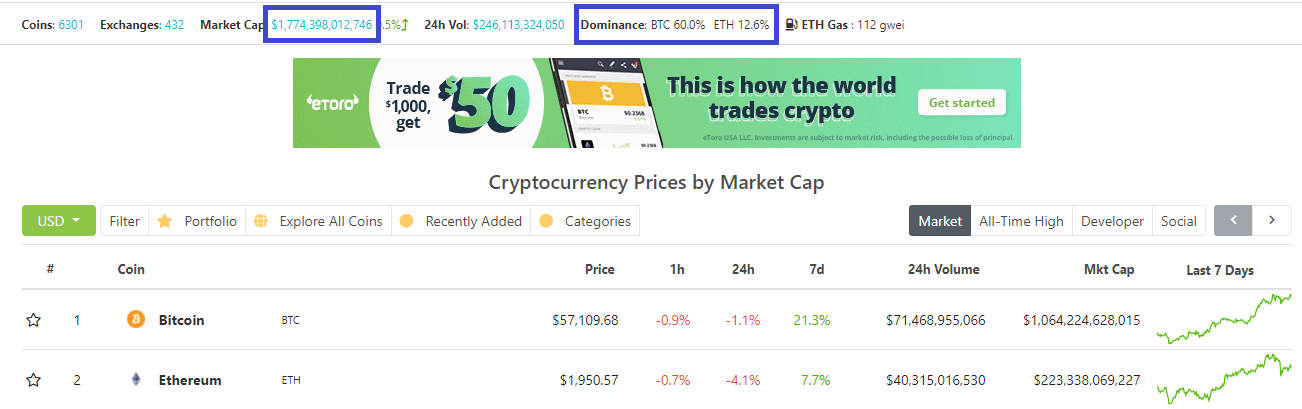

Speaking of pricing, we all know that Bitcoin and Ethereum are at all time highs. This has led to an explosion in the total market cap in dollar terms. This, too, is at an new high, far eclipsing what was achieved before.

As we can see from Coingecko.com, the market cap of the crypto they list is nearing $1.8 trillion. The previous high during the last bull market was about $800 billion.

We also can see that Bitcoin makes up 60% while Ethereum near 13%. This means those two coin account for near 3/4 of the total crypt value.

This has led to a strong move in the entire industry. However, this is not where the paradigm shift for society is going to come from. If we look at this from a distribution/resiliency standpoint, we see this is too top heavy. There is far too much concentration in these two coins as compared to the rest.

It is not something that is surprising or unnatural. In fact, it is to be expected. Over time, things tend to fan out further. So the concentration will natural migrate elsewhere as other projects gain attention. We are not as that point yet as shown by the lack of network effect in many areas.

Ben Geortzel is one of the leading AI minds in the world. For the past 30 years, he immersed himself in the field of advance human technology in an effort to achieve superintelligence.

Somewhere along the way, he realized that humanity's future is not serviced is the advanced technology we were creating was in the hands of a few countries and a handful of corporations. This was not a distribution model that would help to serve the global population.

For this reason, he started SingularityNet, a blockchain based, decentralized platform for Artificial Intelligence. It had one of the more successful ICOs during that craze selling out in under a minute.

His feeling is that we all must participating in taking on Big Tech. The power structure that is forming is not going to be helpful to anyone. Thus, SingularityNet along with hundreds of other projects can shift the power through the decentralized and distributed process.

One area that Goertzel sees an issue is with the liquidity of many projects. While Bitcoin and Ethereum get a lot of attention, many alt-coins are tied to valid projects yet simply lack the liquidity to see much happening with their token. This tends to lead the market to overlook them, stifling innovation and growth.

Goertzel has an answer for this too. He is spinning off a DAO from SingularityNet called SingularityDAO. Not surprisingly, he believes that adding AI to DeFi, especially among the lower liquidity tokens will yield huge benefits for the entire industry.

The SingularityDAO project, spinning off from the SingularityNET AI/blockchain platform I lead, aims to use DeFi tools together with neural-symbolic AI to foster liquidity, increase value and decrease volatility for lower-liquidity altcoins. SingularityDAO’s AI-DeFi mechanisms make it more beneficial and less risky to hold portfolios of utility tokens that individually have only modest liquidity.

This could really go a long way to assisting many overlooked applications. Their tokens could be more desirable if investors knew they would be able to exit their positions when needed. A lack of liquidity turns a lot of people away from specific projects.

From a numerical perspective, something like this could really grow the total numbers. While Bitcoin and Ethereum saw massive growth, as a percentage it is hard for just a couple tokens to pull everything along. It is far easier when the breadth of the run is much wider. Having hundreds of tokens growing at 10x-100x rates would really enhance the total market cap, at a far greater pace than what the other two could do on their own.

Cryptocurrency and the new paradigm is going to benefit from the two important features. The first is outside money entering the industry. This will help to propel the values higher, pushing greater capabilities to DeFi and crypto based projects.

At the same time, the network effect from users will also add a tremendous amount of value. We see the likes of Facebook and Google achieving trillion dollar market cap as companies. Much of this is from the network effect those companies were able to attain.

There is no reason why hundreds of applications within cryptocurrency cannot do the same thing. While single projects might not achieve the same values, the totality can far exceed what we see the in the present system. This will only provide more liquidity into the market as this captures the attention of even more money players.

Essentially, we are creating a powerful feedback loop that just keeps moving forward and higher.

In raw numbers, DeFi and cryptocurrency is still very small. As a comparison to the existing system, the numbers are miniscule. However, the growth rate is tremendous and this is without much of a network effect from the general public.

once that starts to take place, it is likely we see an explosion that we really have no imagined before. The path to $10 trillion could happen a lot quicker than we think.

None of this is financial advice and the mention of SingularityNet and its spin off project is for informational purposes only.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1363487164517019649

This is a real use case and why it will explode even more. I read somewhere that an Australian chap changed his mortgage and is using defi to finance his house purchase. Many more will follow suit taking banks out of the equation and who knows how big this defi thing can become. 10 x or 100 x is very possible.

Posted Using LeoFinance Beta

I am not sure how advanced that network is at this point but I can see DeFi being used to finance things such as real estate. I dont know what infrastructure is in place but it will most certainly be there.

The same with car loans and other forms of debt.

Posted Using LeoFinance Beta

Anything that it can be leveraged against debt and lending as this is the new way forward. Looking forward when we have our own internal defi on Leofinance without the gas fees of Ethereum.

Posted Using LeoFinance Beta

Defi is a printing press, it will get completely out of hand like Bitconnect did. I fear the government will step in eventually because there are major risks involved and people are just going to go ape with it. The good thing is this bubble is just going to inflate so crazy.

Yes it does seem like a bubble and we all know bubbles do pop when they get too big. The defi thing came from nowhere and has transformed crypto speeding up the process of mainstream which is something to be thankful for. Like you I do believe the Government will step in as the risks will increase the bigger it becomes.

Posted Using LeoFinance Beta

I can feel the real momentum in the Cryptosphere. Amazing times to be involved in this space !

Posted Using LeoFinance Beta

There does appear to be a momentum. We still do not have the massive numbers flowing in with the user base. However, that will come. Just need a couple applications to catch people's attention.

Posted Using LeoFinance Beta

Of course the outside money coming in will more than benefit crypto. We can see this with Elon musk and all the money flowing in into BTC.

Posted Using LeoFinance Beta

There is a lot of money flowing into Bitcoin and some into Ethereum. I am not sure how much is flowing into other tokens.

That is the point that I think Goertzel is making. Get some AI trading going on and providing liquidity.

Posted Using LeoFinance Beta

Well truth is not many people pumping in money into bitcoin realises that they can pump in money into coins with projects and even earn more. Bitcoin seems like the honey comb. Means these projects built on these altcoins needs that money boost.

Posted Using LeoFinance Beta

@taskmaster4450le true.....

If the money flow will bring in more development to the cryptocurrency world then it is really going to be appreciated.....AI trading on cryptos is going to be a good experience too...

The Defi is really blooming in this bullrun. But having it in ethereum also lead to another problem, the gas fee. As the gas is quite big in ETH, with the price increase in ETH, it also increase the gas price.

For now, I think several Defi project already moving into BSC platform. some might not seeing it as a good sign for decentralization,as it stick to Binance. With the cheaper fee, it might be a better choice isn't it?

Posted Using LeoFinance Beta

Certainly that is the case. As gas goes higher, less people can realistically participate.

This means that we will see other options step up. It is why I am excited for Leofinance's LeoFI to come out and see all that is offered there.

Posted Using LeoFinance Beta

The gas fees have really discouraged so many Ethereum users....well just like you said,I too really can't wait to see the LEOfi project become fully out so that we can enjoy the benefits that comes with it...

The ETH gas fees are a grand opportunity for Hive. We just need to reach out and grab it.

Posted Using LeoFinance Beta

only when the bull run calms down and the dust settles we will see which defi projects succeed and which were just riding along the hype train.

Posted Using LeoFinance Beta

There will be a lot of them that disappear, just like with the ICO craze. Even projects that were good ideas ended up failing for a variety of reasons.

That said, there are some legitimacy to what is being created. We just need to clear out the junk first.

Posted Using LeoFinance Beta

There's no turning back now, these new financial instruments will overtake and change the world as we know it. Regards.

Posted Using LeoFinance Beta

Terimakasih infonya

@taskmaster4450 on point....

Defi can be used for so many sectors which includes the business,real estate sectors ,etc....the growth rate is awesome and for me that is very important,the crypto market itself is no more predictable and it could reach the $10trillion dollar earlier than expected....

Your writeup is awesome sir...

I think the fact there is a lot missed in the total marketcap will lead into explosive growth. Many projects are not listed and the entire NFT market is absent.

We will see a lot of growth there too.

Posted Using LeoFinance Beta

yeah I feel amazed whenever I see or open coinmarketcap and see who crypto is booming and I loved that hive and hbd increased in price

Posted Using LeoFinance Beta

The trend will continue to repeat itself with bear markets reaching higher lows and bull markets reaching higher highs. And each time more institutional money will flow in, while some will heavily double down on spreading FUD.

SingularityNet is one of the best examples to use in terms of the fact that blockchain is much more than just finance. At some point we will also have a shift from less finance and more use case. Those will be exciting times in more ways than one.

Posted Using LeoFinance Beta

I think we are going to see a big shift with Leo and 3Speak when they introduce their updated applications.

We are going to see a couple of powerful social media apps that are decentralized and can provide people with a blockchain option to what is used now.

Posted Using LeoFinance Beta

True. The more applications emerge, the more discoverability. I mean, sure, someone can miss Hive or noise.cash or dBuzz or #projectblank, as individual projects. But what are the statistical odds someone misses all of them.

If there's one bakery in town, you might not buy any cakes, but if the town is full of bakeries, you're bound to try a pastry or 2, or 3, or 4.

Posted Using LeoFinance Beta

It is the car dealership idea.

They pack them together in a row knowing that someone can say no to one dealership but the likelihood of saying no to all of them is less.

With blogging, tweeting and decentralized video, Hive will have a powerful set of social media applications that we can promote as a unit, leveraging each one to much greater overall heights.

The totality will be greater, especially when we tie the financial aspect of things in.

Posted Using LeoFinance Beta

@taskmaster4450 honestly I think it will be good if defi and crypto take over....it will help us make progress especially in the finance and technology world....

Defi is nice but I think most people only know about the ETH options. With the huge gas fees, I can't recommend them to friends or family. The other Defi options are all in their early stages so I hesitate to recommend them.

However I feel Defi has a ways to go and it will definitely be more mainstream as banks are considering it as well. Banks can create their own stable coin and incentives people to participate by giving them more interest. When a liquidity pool exists, fast transaction times are a benefit.

Posted Using LeoFinance Beta

The next step, in my view, is to step off Ethereum. I think Binance is going to gain a lot of traction in this area.

Eventually, a great deal of our system will find its way to these platforms.

Posted Using LeoFinance Beta

Yea but I don't exactly like the entire Binance US section. It has made everyone much more annoying and I haven't touched it as much because of it.

Posted Using LeoFinance Beta

That is true.

Some believe Cardano or Polkadot are also vying for the Ethereum title.

Amazing how most overlook EOS and do not believe that is in the discussion anymore. I guess that is one of those blockchains that was a lot of hype without the substance.

Posted Using LeoFinance Beta

Congrats, you were upvoted from this account because you were in Top 25 engagers yesterday on LeoFinance .

You made a total of 40 comments and talked to 23 different authors .

Your rank is 3 .

For more details about this project please read here - link to announcement post

You can also delegate and get weekly payouts.

!BEER

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @fiberfrau for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.It is only a matter of time before this happens completely.

Posted Using LeoFinance Beta

Changes in investment preferences like you're showing in the banner chart is what made Central Bank in Nigeria to start fighting crypto. Their commercial banks were losing customers and are losing more.

Posted Using LeoFinance Beta