Time to get to work: Chinese tech giants drive digital yuan adoption

CBDC tests move toward launch as Chinese Internet, financial technologies and e-business giants remain leading the way in the digital yuan vanguard.

As key central bank figures in the West, such as Jerome Powell and Christine Lagarde, appear to be procrastinating on the issue of central bank digital currencies, China continues to make significant progress.

China's digital currency plan for electronic payment, led by the territory's central bank, continues to attract critical private sector collaboration. From tech giants to monumental e-business conglomerates, many leading private sector organizations remain to play an important role in building the digital yuan.

DCEP tests additionally continue to expand, with trials by means of lotteries possessing site in numerous metropolises. Banks like Agricultural Bank and Industrial Commercial Bank took a leading role in such DCEP pilot protocols, building customer wallets for customers.

Throughout the various DCEP pilots across China, the lack of Ant Group and Tencent, operators of both of the territory's largest electronic payment platforms (AliPay and WeChat Pay) caused relevant speculation. Incidentally, the digital yuan plan was touted as Beijing's response to curb the duopoly of the two organizations.

Such rumors further intensified in late 2020 after Jack Ma, co-founder of Alibaba, withdrew from the public scene, apparently, following comments labeled as criticism directed at Chinese financial regulators. In a speech at the Bund Finance Summit in Shanghai in October 2020, the billionaire accused Beijing of stifling innovation and called Chinese banks pawnshops.

Source

Ant Group, as a holding company, which was on the verge of a USD 37 billion initial public offering, saw its IPO plans suddenly halted. Commentators at the time attributed Ma's demise and the IPO imbroglio to comments made throughout the event.

However, as Ant Group continues to come under deep regulatory scrutiny in China, news has emerged that a financial holding company has been involved in the digital yuan scheme with the central bank from 2017. Incidentally, this revelation assumes that Ma's firm and the Known Bank of China (PBoC) were collaborating on what is now known as the DCEP years prior to the PBoC officially debuting the DCEP in 2020.

Furthermore, MYbank, backed by Ant Group, is additionally one of the financial institutions inclined to give the digital yuan. The PBoC's digital currency inquiry separation has been using Ant's mobile app development scope to generate capable phone apps for the DCEP.

In February, MyBank and Tencent-backed WeBank additionally were confirmed as competitors in the expanded digital yuan trials. WeBank, probably the largest digital bank in China with well over 200 million consumers, has a significant history with Blockchain technology with the financial organization, filing the third largest number of patents in relation to the new technology in 2019.

Commenting on the possibility of DCEP competing with China's established electronic payment rails, Yifan He, one of the territory's most important blockchain service network infrastructure providers, mentioned, I don't think the purpose of DCEP is to compete with Alipay and WeChat pay. If the regime really wants to muzzle them, it has several procedures. The prospect of DCEP is much, much more enormous.

From lotteries to shopping festivals, Chinese banks have mobilized to encourage the adoption of digital yuan in the retail business in numerous metropolises across the territory. These trials seem to focus on achieving DCEP adoption on account of users, and having a direct relationship with wallets and payment platforms.

Nonetheless, it could be replicated that digital yuan requires a bigger adoption in the framework of company-to-company payments, so it could function as a full-fledged CBDC compere to the fiat that exists as envisioned by the central bank. E-business major JD.com is one of the few organizations testing DCEP for B2B payments.

Source

In early April, the online retailer revealed that it was already using the digital yuan for B2B payments to related organizations, as well as for interbank settlements. Such types of use cases are likely to bring the boundaries of DCEP in today's form to an actual CBDC.

JD.com further disclosed that it was already employing digital yuan for salary payments as of January. The company has sponsored several DCEP trials, contributing some USD 4.6 million for the second public raffle held in Suzhou.

The company is also another example of the pivotal role the private sector is playing in driving greater DCEP adoption. In the last month of the year, the large online retailer began supporting digital yuan as a payment method on its platform, receiving nearly 20,000 DCEP-funded requests in the week following its announcement at that time.

Like Tencent and Ant Group, JD.com additionally participates in the development backend of the DCEP parent. Incidentally, the organization's fintech spinoff, JD Technology and Digital Currency Research Institute, was a development partner of the PBoC as of September 2020.

It is in the interest of these organizations to partner with the PBoC to develop the digital yuan. However, this trend is likely to elevate the position of financial technology organizations in China's financial services framework, likely to the detriment of commercial banks and their functionality to control the sector.

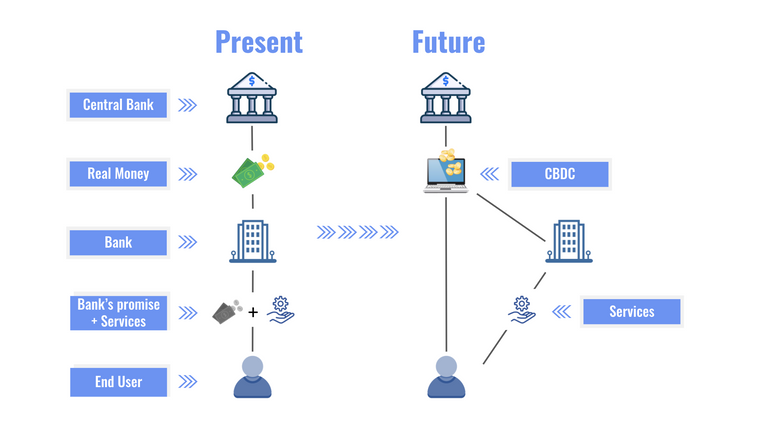

Central bankers, as they comment on CBDCs, constantly talk about how domestic digital currencies could lead to the disintermediation of commercial banks.

The deployment of blockchain across multiple asset classes is inevitably going to go viral as incumbent processes and services become increasingly obsolete. Blockchain technology in large-scale capital markets, banking, exchanges, lending and other financial services is triumphing extraordinary encouragement as stakeholders seek to erase inefficient processes across the lifespan.

Digital processes, as the shared ledger technology, will eventually become the backbone not only of banking, but of the entire global capital market infrastructure. However, DCEP will not spell the end of banking in China.

For the foreseeable future, every single DCEP occupation has to go through commercial banks, according to the recent design and composition. Consequently, it has rather little effect on commercial banks. However in the extended term, once the PBoC makes it possible for third parties to open DCEP accounts or enter DCEP accounts anywhere around the world, then it is going to have a monumental effect on Chinese commercial banks.

The digital yuan will undoubtedly force commercial banks to rethink their trading models, especially in the face of competition from fintech firms. However, I don't think they will be killed, as the primary functionalities of commercial banks are to provide services to end users.

Source

It is feasible that the digital yuan is not yet a full CBDC, however China's accelerated rise in the development of a national digital currency probably puts it ahead of other relevant economies. There are even reports that the territory plans to allow foreign athletes and other visitors to use the digital yuan throughout the Beijing 2022 Winter Olympics.

As China is in accelerated testing stage, the European Central Bank continues to assess the need to begin a formal analysis on CBDCs.

Incidentally, privacy concerns are common in CBDC conversations, as customers are wary of the greater visibility of their monetary occupations under the national digital currency paradigm. There are already fears in Macau casinos that a fully traceable digital yuan will succeed in taking the demise of junket operators for granted.

Posted Using LeoFinance Beta

This is such a brilliant write up on the development of digital yuan. Well articulated facts about Ant and Tencent makes it even more interesting

Source of plagiarism

There is reasonable evidence that this article has been spun, rewritten, or reworded. Posting such content is considered plagiarism and/or fraud.

Fraud is discouraged by the community and may result in the account being Blacklisted.