SPInvest A Quarter Million Dollar Fund

We started just shy of 2 years ago. It was a slow process to start. We had some tough times getting going. However, persistence has paid off.

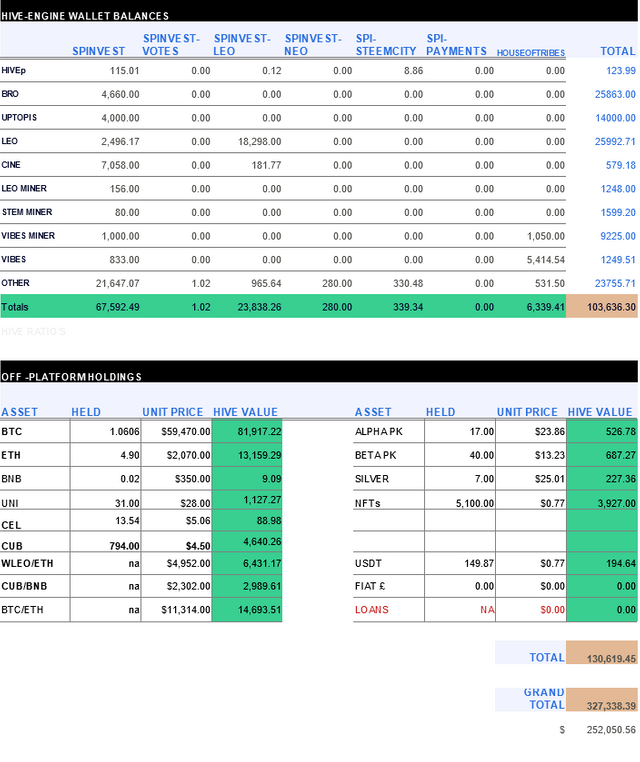

Looking at the most recent earnings report, we see the value of the account is now more than $250K. Of course, this can vary based upon a number of factors.

All SPI holdings are converted back to Hive. To figure what the amount is in USD, we then need to go one step further. Of course, the price of Hive is fluctuating a great deal of late. When the price of Hive is closer to a dollar, the value of the fund is much greater.

Either way, we can see the account has over 375K Hive as of the report date. Over time, we could see this value explode, in USD terms, if the price of Hive takes off.

This is an important point to consider. If we see the price of Hive push towards the $5 mark, this will push the value of the fund to just shy of $2 million.

Why is this is important other than for the value of the holdings?

The answer in this lies in the ability to forge other ventures. As mentioned in past articles, SPInvest could end up being, at least in part, a venture capital fund. We can invest in new projects, hoping to capture some highly successful runs. Getting in early, i.e. having a good stake, will give us even greater potential returns as compared to just investing at market rates.

It is important to remember that a lot of what SPInvest does, as compared to @-lbi-token, is to seek out off-chain opportunities. Here is where the increased value of Hive assists in the value of the fund. Essentially, the more there is to invest, the greater chance of the returns.

Of course, we are not simply dependent upon the value of Hive. For example, SPInvest holds more than a full Bitcoin. At $60K, this is a nice asset to have, considering we purchased at a much lower prices. If, however, the estimates are correct, we could see the price of BTC explode this years. An analyst from Bloomberg put a projection of $400K by the end of the year.

That would seriously add to the value of SPInvest if it does take place.

There is also the expansion of DeFi. Ultimately, the more assets the fund holds, the more options we will see. There could be a day when we do not sell tokens that have huge runs but, rather, stake them in liquidity pools to bring protect the downside of the value of the token.

Naturally, the other big advantage to this concept is the APY that the DeFi fund can offer.

We are seeing people taking advantage of this through CubFinance. People are adding more to their holdings as more tokens are distributed.

In short, we have a lot of options before us. The key is for the holdings to keep increasing in value as well as pulling more Hive in each week. Over time, in keeping with the Get Rich Slowly, we look to keep things growing on a consistent basis. Active and passive approaches will help to make for greater returns than one can get on his or her own.

What is now a quarter of million dollar fund could well be worth a few million dollars over the next year or two.

Posted Using LeoFinance Beta

Compounding is a big factor and people I think are learning a lot more about it in real world operation. I continue to compound my HP, by using the 50/50 split, some of the non compounded Hive gets sent to H-E and then converted into other holdings such as SPI/LBI and a few others. My HP grows, my vote grows, my vote value on SPI and LBI post increase, and thus the rewards received on those post are just a little bit larger.

It will be interesting to see where SPI and LBI sit in a couple more years.

that is amazing

wooow

Posted Using LeoFinance Beta

When describing the difference between SPI and LBI, would you say it's those non-Hive blockchain based investments that are the main differentiator?

Posted Using LeoFinance Beta

Taskmaster4450 wrote the post, silverstackeruk replying

In the scale of time, LBI at 5 months old is much further on the path than SPI was.

SPI was pretty much 100% HIVE POWER for its first year with off-platform investments representing 4,407 HIVE this time last year. SPI converted its STEEM to BTC/ETH & USDT but SPI was also holding 20k LEO that was only worth 1102 HIVE back then so growth for SPI has come from all angles. SPI was set up during the bear market and was very lucky the HIVE airdrop happened to be honest. It basically doubled the fund value overnight as 98% of the fund's assets were STEEM POWER.

As for LBI, it's 5 months old and already has a 5 figure wallet on CUB. It's still early days but I'd assume sooner are later we'll convert some stuff from CUB to other investments. LBI will do well from this bull year we are in but not as well as SPI due to the fact, SPI has been planning for this year for 2 years already. I think in market cycles and would expect LBI to see its massive growth period to come during the next bullrun in 4-5 years. The LBI tokens will of course continue to grow in LEO value but the dollar value might slip off during the next bear market as expected. When 2025 is here, LBI I hope will have had more time than SPI to prepare and I'd hope the epic raise will make SPI's 20x look small. 2025 is a long time off but 4 years ago doesn't seem that long ago either, right?

The plan for both SPI is the same. SPI is maybe a little more centralized than LBI is but the investment model is the same. There are lots of variables to consider for both, SPI would not be as valuable today if HIVE was never forked. The CUB airdrop for LBI was worth more in terms of dollars so has less impact but then Blank is coming soon and LBI still has to venture into new HIVE chain income streams to boast weekly earnings. Good question

Not sure if I answered your question.

Posted Using LeoFinance Beta

Thanks for taking the time to answer. You did great :)

Posted Using LeoFinance Beta

I still confused abour SPI Do we earn passive income by holding the token? Is the earning paid everyday?

Posted Using LeoFinance Beta