Moving From Speculation To Income

There is no doubt that cryptocurrency gets everyone's juices flowing. Well, at least those who are involved in it.

Source

Many get involved to treat it like stock: buy low and watch it go higher. While this deters for the original idea of "currency", what the heck, take the money.

It is easy to get excited when something we put money into started to move a great deal. When we watch out tokens go up by a factor of 5x, 10x, or even more, it is hard to contain ourselves.

Of course, this can get very addicting. Simply put, we want more. This is where danger can come in.

FOMO in the markets is what can cause massive losses. When markets are running, and all are in a state of euphoria, it is best to step back and remember our money management strategies.

In markets, we make money when they go up. We only get paid, however, when we sell (and cash out).

Now this is not a post about getting off the ride and selling out early. We all have to utilize our own money management protocols. What we need to focus upon is what to do once as cash out.

Here is the scenario:

We get involved with a particular project. The price of the token skyrockets and we make a great deal of money. Let us say we got a 20x off the move.

That is a stellar return. It won't take too many of them to put us on the Forbes 500 list.

The challenge with this is that even though we got paid, the desire to head right back into the same pool might not be smart. What this means is adding more speculation to our previous speculation might not be the best course of action.

Is it a good idea to put some in this arena? Certainly. However, to be sensible, we need to get some of it put away.

This is how we can protect our wealth that we are generating.

So how do we go about this?

The easiest way is to take a portion of the money we made from the speculation and put it into income producing assets. This means the profits are rolled into something less risky yet can provide us with some steady cashflow.

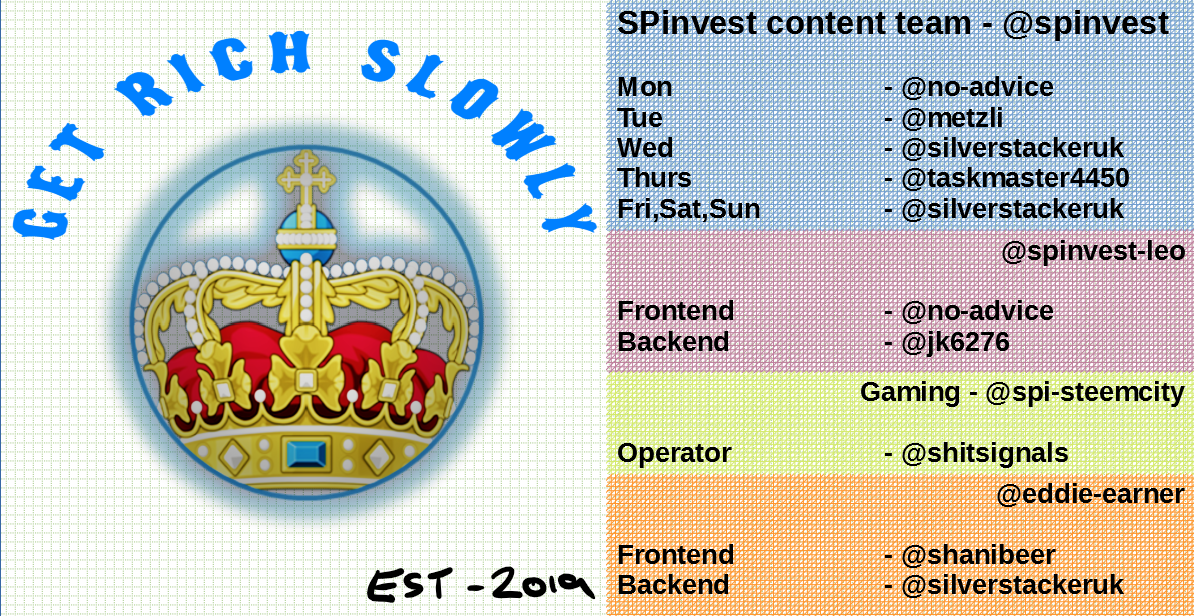

SPInvest created the EDS token for this purpose. Each week, the token pays out, presently at an annualized rate of 15%. Thus, if one has some nice gains that are being cashed out, perhaps put a portion of those profits in EDS will enrich one's portfolio over time.

After all, 15% is nothing to sneeze at especially in light of the low risk nature of the token.

Is this exciting and a way to get the blood flowing? No it is not. However, even though a lot less exciting than chasing after the next "moon token", it is a way to preserve gains while adding a fine return.

Naturally, there are many other avenues to pursue with this. Many opt to take gains from markets and roll them into real estate. This is a way to get into income producing assets with speculation profits.

Of course, that takes an entirely different set of skills and knowledge as compared to what we are dealing with here. It is why a token like EDS is ideal for this situation. One can cash out with the proceeds and quickly turn it into an income producing tokens.

The idea is to move from speculation to income, at least in part.

This is how one protects overall gains while also improving upon them.

Posted Using LeoFinance Beta

Your post was promoted by @taskmaster4450le

On April 1st I had 33.980 SPI, Now I am at 60.29. A slow haul but building to my goal of 100.

I acquired my first EDSM on March 8th, and my second one today, my goal after reaching 100 SPI was going to be a doubling of my dhedge holdings, but I am leaning more toward getting up to at least 10 EDSM.

The last time I sent Hive to HE was when I purchased that EDSM, prior to that it was in December, So pretty much all of my purchases on HE have been funded by all the little drips from ARCON, DHEDGE, SPI, and HE-index, and I guess soon LBI will be adding to my purchasing power. Slow growth, but growing pretty good and steady.

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.Just wondering, is there a cut off for who gets dividends from SPI? I currently have 2 SPI that I won from a contest and it would be helpful to know.

Also I am loving EDS and EDSM for the extra earnings.

Posted Using LeoFinance Beta

I understand the goal of collecting money to secure part of the profits so as to suffer less from the shocks of the ups and downs of the market. However, investing in EDS brings in 15% of HIVE and therefore continues to be subject to market jumps, right? It is true that the price of SPI is referenced in HIVE.

How much does an EDS cost and how can it be obtained?

Posted Using LeoFinance Beta

well, i am investing most of my gains in my property with the long-term plan of putting it for rentage in the next 6-12month. this in turn will provide me with annual revenue that would be invested in other ventures.

Posted Using LeoFinance Beta