Perfect Trade for Income Setup (CPB)

Low Risk Low Stress Trade For Income Setup

Selling put options is a great way to generate income and solid annualized returns by taking less risk than owning the same amount of common stock long. When I look for these trades I target earning 2% or more for every 30 days of expiration time.

Selling a put option is a strategy where you are slightly bullish on a stock and this reduces your risk by being able to name the price (called the strike price) you are willing to pay for the company. This contract is valid for a specific amount of time called the expiration date.

These terms are set by you and for agreeing you are paid upfront for the potential obligation to buy 100 shares of stock for every put sold. I typically look at options expiration dates between two weeks and two months.

The Setup Is Simple

Shares of a great business spend lots of time bouncing around going no where.

This is a sign the market believes the value of the business is stable around the current price and this will not change unless other events change this outlook. If you are an ordinary shareholder you are probably bummed with the only hope of collecting dividend payments if the company pays a dividend and waiting around for the share price to do something (poke it with a stick meme).

This is where trading for income shines. As long as the stock goes no where (and doesn't fall too much) we can collect nice monthly premium payments for as long as the situation lasts. This can be done selling puts by naming the price you are willing to buy the stock or existing shareholders of at least 100 shares can sell covered calls and achieve similar results.

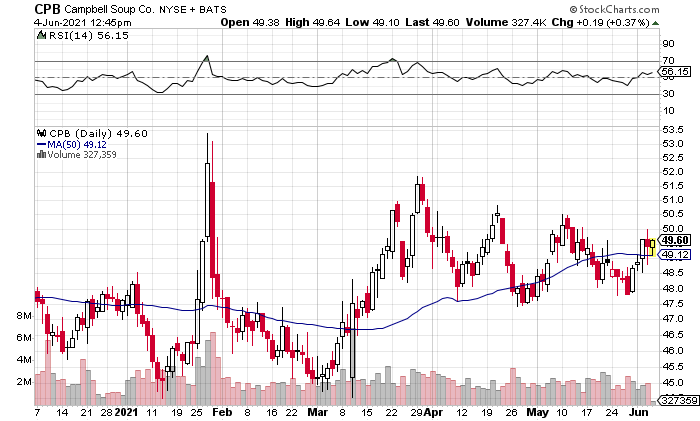

Campbell Soup (CPB) is today's perfect setup.

The $15 billion company sells a variety of packaged food and drinks with major brand names such as Campbells, SpaghettiOs, Pepperidge Farm, Prego, Snyder's, Pop Secret, V8 and more.

These brands have incredible consumer loyalty who will likely continue to buy similar or increasing amounts year after year depending on their family needs.

The pandemic has been good to Campbell producing record sales of $9 billion at a great 11% profit margin.

The market is already discounting that sales will likely drop a bit given the pandemic is ending with shares trading cheaply at 11.6 EV/EBITDA ratio. And as you can see shares have been relatively stable in the high 40s for some time.

Trade details:

Sell to Open July 16 $48 puts on Campbell for $1.10 using a limit order. You are paid 2.3% upfront on your purchase obligation for agreeing to buy shares at a discount.

If shares are above $48 on expiration: Put sellers earn a 19.9% annualized return. Time to look for your next trade.

If shares are below $48 on expiration: Put sellers will buy shares at a 5% discount to yesterday's closing price. You now own 100 shares of stock for every put sold and can start selling covered calls for more income.

For protection use a 25% stop loss on your cost basis (at about $35.18). This gives you plenty of wiggle room on a wonderful business that can be held long term.

Disclosure: I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. The information provided should NOT be considered advice. The topics discussed are risky and have the potential to lose a substantial amount. I am not an investment professional and therefore do not offer individual financial advice. Please do your own research before investing.

Need a Hive account? Sign up free here!

Posted Using LeoFinance Beta

Congratulations @slider2990! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 56000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP