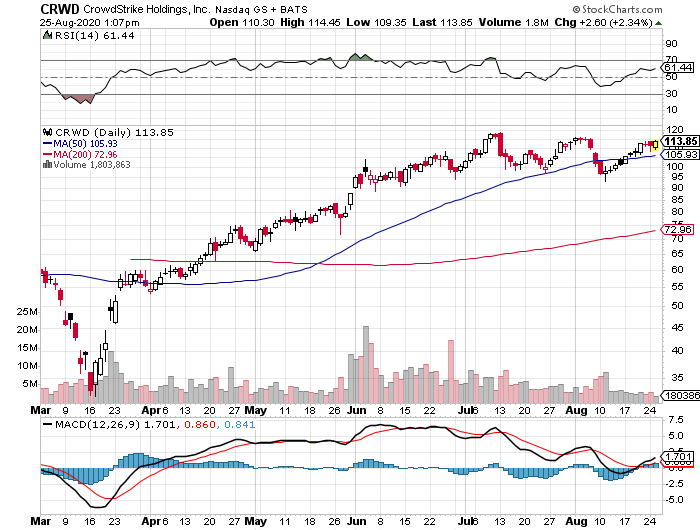

Option Income (CRWD)

The Gurus Are Buying Collect Income Today

Institutional investors are required to report their holdings every quarter through the SECs form 13F filing. Today's opportunity is a rapidly growing company which was purchased by seven very smart investors.

Chase Coleman, Steven Cohen, Stanley Druckenmiller, Paul Tudor Jones, George Soros, Joel Greenblatt, and Julian Robertson are all buying the cybersecurity firm CrowdStrike (CRWD).

Coleman has grown his fund from $3 billion to $26 billion mostly from outstanding investment performance.

Druckenmiller has an incredible history managing his fund Duquesne Capital Management where he has been able to earn $1 billion dollars in a single year.

Jones is one of few investors who during one part of his career he was able to have 5 consecutive years of growing greater than 99% per year.

Greenblatt had average annual returns of 40% from 1985 to 2005.

CrowdStrike is leading the security industry. They offers subscription and cloud based services providing customers a lot of flexibility. Cybersecurity business is booming with more hacks and security problems increasing by the day.

Sales are up over 300% since 2018 and free cash flow has turned to a positive $116 million over the last 12 months.

Shares have reacted to this impressive growth more than doubling the march lows.

CrowdStrike will report quarterly earnings on September 2 and the stock has a history of going up after the announcement. There is always a chance of a miss or disappointment so today's trade is structured to limit risk (selling a put spread).

Sell to open October 16 $110 put and buy to open October 16 $95 put for a net credit of $5.25 or better for a 33.5% annualized return.

If CrowdStrike is trading below $95 on expiration day both puts will be exercised. Your broker will automatically by 100 shares for every put sold at $110 and then sell 100 shares at $95 for a total loss of $9.75 ($15 spread - $5.25 premium received) for an 8.86% loss on purchase obligation of $110 per share.

If CrowdStrike is trading between $95 and $110 on expiration day you will purchase shares at $110 and the $95 put will expire worthless. Your adjusted cost basis will be $104.75 about 6% below today's price. This is a decent outcome as you will own shares cheaper than purchasing today and can turn around to sell covered calls for more income or letting your long position ride for future potential gain.

If CrowdStrike is trading above $110 on expiration day both puts will expire worthless and you will have earn 5% return in less than two months for a 33.5% annualized return.

During the trade we have a built in maximum loss of 8.86%. If you are put shares of stock I would recommend a stop loss at 10% below cost basis of $78.50.

Disclosure: I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. The information provided should NOT be considered advice. The topics discussed are risky and have the potential to lose a substantial amount. I am not an investment professional and therefore do not offer individual financial advice. Please do your own research before investing.

Need a Hive account? Sign up free here!

Posted Using LeoFinance

I like the set-up.

Posted Using LeoFinance

Thanks for reading.

We will soon see how it plays out!

Posted Using LeoFinance