The Secret to Legally Paying Zero Taxes on Bitcoin Profits

What's up bloggers it's been a while

SilverGoldHunter here

And today I have something interesting for you to read as the title of this blog says it all.

Since Bitcoin has been soaring since last year and it is currently sitting around the $60,000 mark

Now we talk about the dreaded word

TAX

now for a lot of us hate this word 'Tax' because we have to pay our money back to your governments.

But investing into it does not mean you or we are exempt from taxes because we would have to give them a percentage of our profits that we would earn from this.

But however, there's a way for you to lower your tax or pay no tax from your cryptocurrency earnings.

(NOW BUT BEFORE WE GO INTO THIS I MUST LET YOU IN SOME IMPORTANT INFO)

- I AM NOT YOUR FINANCIAL ADVISOR

- THIS IS FOR THE PEOPLE OF THE UNITED STATES OF AMERICA

- THIS METHOD MAY OR MAY NOT WORK PENDING ON WHICH STATE THAT YOU ARE RESIDING

- DO YOUR HOMEWORK

Ok Let's begin

According to the IRS does view Bitcoin as property but now as cash or currency. This does mean that selling your crypto for profit would actviate CGT (Capital Gain Taxes) as it's the same of selling stock.

As far I am aware that there are 2 types of CGT, which is short and long which depends on how long you are hodling them. If you sell it on a short term basics, it would be a short-term capital gain and then you have to add on the Income tax reate which depends on which state that you are residing.

Then we have which the long term, If you hold onto your Bitcoin for over a year because not only that this is a long-term capital gains tax, that would mean that you would be unlocking the 0% tax bracket on any bitcoin profits that you may make.

How do we maximizing your gains

The Trick to this is

Keep Bitcoins in for the long term for over a year, so that you pay 0% but please keep tabs on your taxable income.

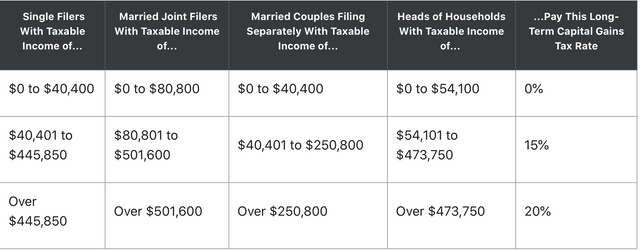

Long term capital gains can grant you access between 0-20% on tax. but to qualify you must keep your investments for more than a year. Then you must keep track of your income as well becuase it also has a key role.

Let me show you why,

If you have an taxable income of $25,000 and $15,000 in Long term capital gains from Bitcoin, you're total would be $40,000 and the end of that result would mean that it would be 0% tax for you to pay, because you have kept the ivestment of Bitcoin for more than a year and would have kept a strong income of $40,000 which is a total of $25k & $15k.

Once you have done the income threshold, you may get bumped up to 15% long term bracket. So if you have $20,000 in long-term gains from Bitcoin, the first $15,400 would get the 0% rate, but the remaining $4,600 would get taxed at 15%.

Also, you really don't want to lose that extra income just because you may get taxed, but however the option to choose when that income comes in, you might have to do a smart tax planning which can save you some money.

Here is 2021 IRA's Tax bracket for you to go through.

Don't forget to do your deductions and other investments

Tax deductions can make it a bit easier to land in the 0% long-term capital gains bucket.

For an example in 2021, a single person can make up to $12,550 before having to share earnings with the IRS, a married couple can claim a standard deduction of $25,100 and also contributing to a traditional IRA which could help you reduce your taxable income so that more of your Bitcoin gains would qualify for lower rates.

These deductions and long-term capital gain benefits also apply to any profits earned in the stock market.

As we understand that stocks can intend to be less volatile than Bitcoin and have proved to be a great and possibly safe to get started as an investor.

No matter what you decide to invest in, make understanding taxes is a priority and if you want to make thinga less stressful you may want to hire a professional to help with the best strategies.

I hope this may help you in a way

And I will catch you all in the next blog

PEACE OUT EVERYBODY

SilverGoldHunter

Posted Using LeoFinance Beta