All Honey swap Investors lose their funds in a Rug Pull.

What is a Rug Pull?

Define Rug Pull.

In American English this is an idiom which means to pull the rug someone is standing on, out from under their feet.This usually causes them to lose their balance or support, and they fall down.

Rug Pull in Liquidity Pool

In a Liquidity Pool, a rug pull still involves pulling something and cause a fall. It means to pull the best asset out of a pair, so that the remaining asset price falls down.

Example Liquidity Pair Rug Pull

So a Liquidity Pull Rug Pull would go like this:

A developer intending to perform the rug pull creates a new Liquidity Pool on Uniswap or Pancakeswap, and one of the assets is Ethereum, and the other asset is Token X.

Investors come to Uniswap or Pan cake Swap and buy both Token X and Ethereum, then deposit dollar equivalents into the Liquidity Pair.

The developer waits until a certain amount of funds like 500,000 or one million dollars USD has been deposited by investors.

Then the developer withdrawals or Pulls out all the Ethereum from the Liquidity Pair, causing the price of the remaining asset Token X to drop or fall down.

So literally they pulls out the strong asset Ether, upon which the weak asset Token X is standing, and the price of token X falls down.

This leaves the investors with a Liquidity Pair with no Ethereum and a whole lot of Token X, whose value has now dropped to zero. Now the investors have lost most if not all of their capitol invested.

This type of theft happened a lot in the early days of Uniswap, Tron JustSwap, and BSC Pan cake swap.

This can happen because the software developer writes the software with a built-in mechanism which allows them to withdrawal all the funds investors have deposited in a project and send it to their wallet, effectively robbing the investors of their cryptocurrency.

Other Rug Pulls: Migratory Function Exploit

Another type of Rug Pull is done a little differently, and effects Liquidity Pulls on large Platforms with multiple Liquidity Pairs. One such platform was Honey Swap.

Honey swap rug pull

This was the theft of all the cryptocurrency deposited in all the liquidity pairs on honey swap by a developer.

What was the software exploit or vulnerability?

The information I have been able to gather suggests that the developers who stole the investors tokens used a “Migratory Function” exploit. The developers for Honey swap liquidated the Liquidity Pools and depository accounts, by pulling out the assets trading them for ETH on the Honeyswap exchange and moving the Ethereum off the platform into the wallets of the developers. They were able to do this by exploiting a software code feature called the migrate function. #Caution: I am not a developer, so I am writing and communicating to the best of my non-developer ability.

Migratory Function

The purpose of the migrate function is to move all deposited assets should the developers create a new version of the current trading platform, and it allows the developer to send all the finds from the old version to the new version.

For example, the developers create a Honey swap version 2.0, and once it is ready they move all the assets to that new version. This software code feature is present in Pan cake swap, Goose-swap and Honey swap. This feature was disabled on Goose-swap as a protective measure. This feature was activated on Pan cake swap, but has since been disabled, so the current migration of investors’ funds to the new version of Pan Cake Swap will be done manually by the investors. They will withdrawal their tokens and redeposit their tokens in the new version.

The Honey finance platform started with a migrate function, which read the amount to be migrated was -1, which meant the amount of token they could remove was infinite. However this feature is coded as bal not -1 or +2. The minus one means the amount to be migrated is infinite. The +2 means only 2 tokens and the code bal means the balance described by previous code only can be migrated.

I am not a developer, so I can’t attest to the validity of these claims. I read an article by a software developer, who doesn’t know/write code in Solidity, the code for these Smart Contracts, and another written by a software developer who does write Solidity code and they has different explanations. So I went with the Solidity code developers explanation.

Honey Pot wasn’t the first Rug Pull using this exploit

Surprisingly or not, this wasn’t the first platform Rug Pulled in this manner. The information I found on the internet suggests that this is a well-known rug pull mechanism on both Ethereum and Binance Smart Chain. This was used in the rug pull of these platforms: Honey Swap, Croissant Swap and Turtle Dex.

DeFi Platform risks

These type of risks are usually noted by the code auditors, but it is up to the developers to fix such exploits, so if they placed them intentionally they won’t fix them. Additionally it is possible to activate the exploit, reset certain parameters and then execute the theft. This is a tricky area to navigate, and is so you should read the Software Audit carefully and if possible get an interpretation by a software developer, specifically someone who writes code in Solidity.

Last words and Thank you Cubfinance:

My research for this article really helps me better understand the potential risks we face, and more importantly appreciate how lucky we are on Hive to have a two year relationship with @khaleelkazi and the Cubfinance development team, because we have a safe place to invest our funds in Liquidity Pools and Yield Farming opportunities. Thanks.

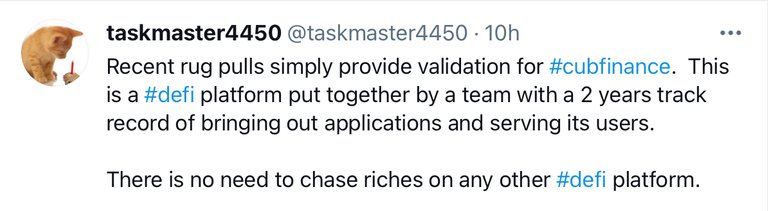

And this post from @taskmaster4450le says it all. 🦁

Further information

I found these two Video Explaining the Rug Pull

Python Developer

Solidity developer

Cub finance Certik Audit

You can watch these videos and then read the Cubfinance Audit to determine if these vulnerabilities exist and if they have been modified. This should be part of your due diligence.

✍️ by @shortsegments

Shortsegments is a writer focused on cryptocurrency, the blockchain, non-fungible digital tokens or NFTs, and decentralized finance, where finance meets technology.

Read more of shortsegments articles here: https://leofinance.io/@shortsegments

https://leofinance.io/@shortsegments/an-ode-to-ethereum-defi-poetry

https://leofinance.io/@shortsegments/using-cdp-loans-on-a-defi-lending-platform-to-double-your-eth

https://leofinance.io/@shortsegments/a-bitcoin-christmas-carol

https://leofinance.io/@shortsegments/leofinance-the-michael-jordan-of-social-media

https://leofinance.io/@shortsegments/leofinance-the-michael-jordan-of-social-media

Leofinance, where you can blog or share financial topic content to earn cryptocurrency, as part of a passionate social media community.

Learn more about Leofinance with my Seven Minute Quick overview and QuickStart Earning Guide. Then you can Join for FREE! Signup takes 20 Seconds!

Click Here

Posted Using LeoFinance Beta

This post has been manually curated by @bala41288 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 80 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Thank you for your support.

Posted Using LeoFinance Beta

When I swap the Honey Swap and Honey Pot, I was reminded of the honey-swap in HIVE. I think I have seen some people use that to transfer between wallet and HE but I am unsure it was the same name.

Also great job on the post. I feel like I learned quite a bit about an actual rug pull.

Posted Using LeoFinance Beta

Ha Ha I just realize your pointing out the similarity in names with our Hive-Engine :)

LOL 😂

Thanks

Posted Using LeoFinance Beta

No I haven't really stepped much into putting money into Defi and right now I only have a small amount of CUB in the DEN. I plan on entering slowly next month in Cub Finance and I don't think they will rug pull me

Posted Using LeoFinance Beta

Wow! Someone who was on Honeyswap!

I can’t wait to hear if anything happened to you!

Posted Using LeoFinance Beta

I wasn't on honey swap but I have seen some people use it via wallets or what not on the HIVE wallet page. I think it was around the time I started when I was still learning the system. If you read my message correctly, I stated that I saw some other people use honey-swap and not myself.

Posted Using LeoFinance Beta

Thank you for your comment. I am glad you enjoy the post and learn about Rug Pulls. Tats truly the purpose here; share knowledge and experiences.

Posted Using LeoFinance Beta

Your post was promoted by @jfang003

Thank you! @jfang003

Posted Using LeoFinance Beta

Thanks for the information. I hadn't realised there was more than one type of rug pull. I've made a note of your post so I can watch the videos before getting into any other liquidity pools.

Posted Using LeoFinance Beta

Your welcome. I was surprised myself to learn of the extent and methodology. There is a lot to learn in this space. It truly is a voyage of discovery.

Posted Using LeoFinance Beta

Wow! I had no idea this was happening. Decentralized exchanges are a bit dangerous. Thanks, forewarned is forearmed. Good warning post of the need to invest with trusted people.

Posted Using LeoFinance Beta

Thank you for your comment. I am glad you enjoyed the article.

Posted Using LeoFinance Beta

Eye opening post @shortsegments. Rug pulls are so common these days and it's difficult for newbies like me to judge which platform is trustworthy.

This post helps everyone to understand the importance of research before investing your hard earned crypto into DeFi platforms.

Fortunately, CUB Finance is the first platform I tried in the DeFi space. I have full faith on Leo Finance team it got only stronger after they published the Certik's Audit Report.

Posted Using LeoFinance Beta

Hi @finguru

Your right. Do your own research. Invest in what you know or with honest people.

Posted Using LeoFinance Beta

!SEOcheck

Posted Using LeoFinance Beta

Title is of good length- Perfect

Permlink is of good length-Perfect

Both headers found - Perfect

Image available-Perfect

Title keywords are used in header-Perfect

Internal link found-Perfect

External link found-Perfect

Thanks @seo.bot

It’s nice to know my SEO is optimized, so I maximize the use of Google to market our community.

Posted Using LeoFinance Beta

Thanks

Posted Using LeoFinance Beta

Yep, DYOR and learn what to look out for, or invest with who you know.

Posted Using LeoFinance Beta

Hi @cryptowendyo

Your right. Do your own research. Invest in what you know or with honest people.

Posted Using LeoFinance Beta

To some extent many of the DeFi projects are fitting the ICO pattern of 2017.

Posted Using LeoFinance Beta

Hi @acesontop

I think you make a good point. I can see how the ICO boom where lots of money was raised from investors for projects that never developed into anything of substance resulted in investors losing their money as the tokens became worthless, is similar to the tokens becoming worthless due to the Rug Pulls.

Good insight.

Posted Using LeoFinance Beta

I want to do more with DeFi, but things like this scare me. I think that is part of the reason I am mainly sticking with CUB. I did start doing a little bit of PanckakeSwap the other day, but it is such an insignificant amount that I don't really care what happens to it. Everything I have invested is ancillary profit from other things, so if I end up losing it all, it isn't that big of a deal.

Posted Using LeoFinance Beta

Hi @bozz

It’s a wise person who is cautious about the unknown. I think we are all smart to invest with people we know and trust while we learn about these things. So I agree with your strategy and that’s what I am doing.

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

Read how this all have started with Toruk

Posted Using LeoFinance Beta

Thank you very much for your support.

Posted Using LeoFinance Beta

Thanks for this article! I was just reading more about rug pulls since it was mentioned the migration code was removed from CubFinance which makes migrating the funds impossible.

I'm not sure if any devs can answer this but pancakeswap dev dismissed this migration code because apparently you need it to upgrade the platform and without it projects are probably not looking at long term growth. How does CubFinance intend to improve the platform without this code?

Posted Using LeoFinance Beta

It’s my understanding that developers can create a new version and investors can remove their funds from the old pools and deposit in the new version.

Posted Using LeoFinance Beta

Ahh I see thanks for the explanation. Yea it was a bit weird because the Pancake guys simply dismissed it. It seems to be quite malicious to leave in (not saying that they will do that but it doesn't inspire confidence)

Posted Using LeoFinance Beta