The CLO Toxicity Crisis Could Bring the Next Downturn

In a recent longform piece in The Atlantic, Berkeley law prof Frank Partnoy warns us that the 2010 Dodd-Frank Act, which was crafted in response to the Great Financial Crisis, was "well intentioned" but hasn't "kept the banks from falling back into old, bad habits. After the housing crisis, subprime CDOs naturally fell out of favor. Demand shifted to a similar—and similarly risky—instrument, one that even has a similar name: the CLO, or collateralized loan obligation. A CLO walks and talks like a CDO, but in place of loans made to home buyers are loans made to businesses—specifically, troubled businesses."

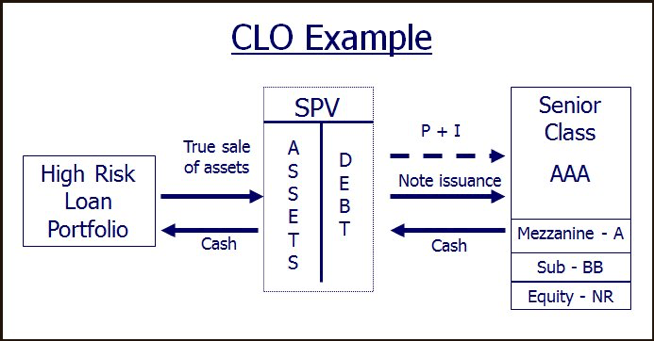

If you're unfamiliar with the CLO tranching process, hopefully you can see from the diagram above that it's basically another sophisticated way to turn shitty debt assets into AAA rated bonds. From this perspective, they are exactly the same as the CDOs that took us down the road to hell in 2008. To me, I don't care how you dress it up, a turd is still a turd.

However, our monetary policy heroes JPow & Mnooch claim that the risk of the $750 billion CLO market "isn't in the banks," which is curious because, according to Partnoy's article Wells Fargo has $29.7 billion of exposure to this stuff buried in the fine print of their latest quarterly report.

Why does this matter? Well, the entire SIFI system is overexposed to this kind of asset to such a degree that, "If the leveraged-loan market imploded, their liabilities could quickly become greater than their assets."

How did we get here? The logic is that it would be unprecedented for so many diverse businesses across different regions and economic sectors to default simultaneously. Even a 10% default rate could be withstood.

Sound familiar?

CLO debt is for companies that already can't access traditional credit during regular times. And these are very much unprecedented times that we are living in right now.

Buckle up.

Posted Using LeoFinance

#posh yeah it's on Twitter