The Seller's Came Out on the S&P 500 Today as Stimulus and Election Uncertainty Start to Creep In

The S&P 500 saw the sellers out unloading today. Volume was not high which means it may have just been a lack of buyers with sellers doing a little liqiudation.

Through the recent low...

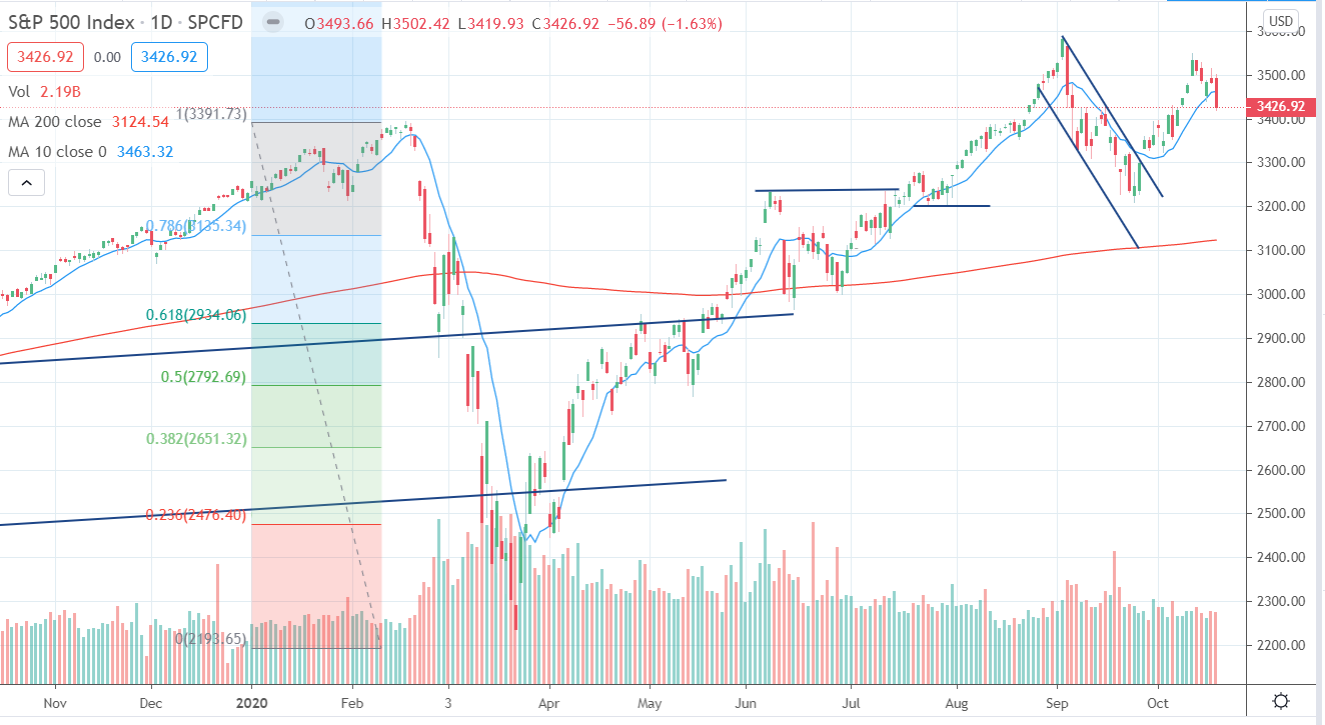

Looking at the chart you can see that price dove through 3,440 which was the most recent reversal low back on October 15th.

Also, you can see by looking at the red dotted line (representing today's closing price) that it comes across the tops made back in September.

So this area could find some support. I would expect to buyers to put up a fight if price gets down to 3,415.

Of course, news items can blow all of this out of the water in either direction.

Posted Using LeoFinance Beta

0

0

0.000

Do you have a date where it's too close to the election to trade US indices like this?

What's your cutoff?

Nope. I'm gonna ride or die my short through the election. I'm hoping for some big swing next week and the week of the election that will allow me to take some trades/profits.

Posted Using LeoFinance Beta

Sorry for the slight shameless plug, but come join the daily discussion Leo thread I’m trying to start. I’m sick of Reddit and stocktwits and I would love to get a trading chat going here.

Posted Using LeoFinance Beta