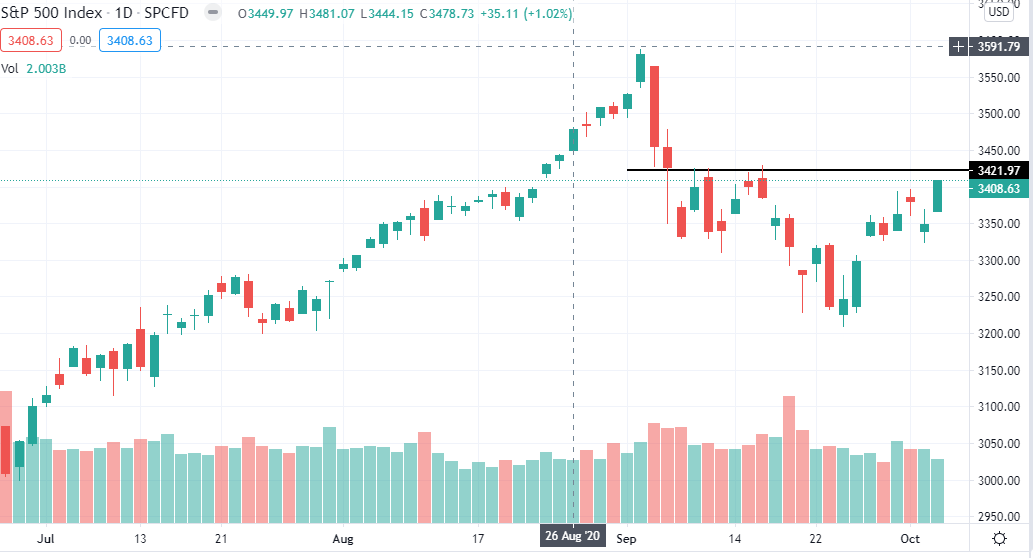

The S&P 500 is creeping up on a key pivot point

The S&P 500 has bounced 200 points of the late September lows. With today's rally price is creeping up on the September highs that proved to be a pivot point.

That pivot point is now a resistance as price failed twice there.

Rally into the election or relief bounce?

I will be keeping an eye on 3425 as a close above that makes way for a run at the all-time highs.

Running into the all-time highs isn't what you would expect coming into a Presidential election, but hey, this year has been anything but normal.

The volume was super light today to go with that green energy candle. So that doesn't show bulls being in control, but if no one is selling it really doesn't matter.

Posted Using LeoFinance Beta

0

0

0.000

It is almost inevitable that the election will not be decided on election day.

How do you expect the stock market will respond?

I can't decide if people being fearful and so sitting on the sidelines

or the Fed pumping in more money

will be bigger.

I have my eyes set on 3440 as high for the week. Tremendous bullishness in a lot of stocks but like you mention low volume so must tread carefully.

Posted Using LeoFinance Beta