Are Inflation Spikes The Left Hook Of Inflation Impacts

There has been tons of talk about inflation coming in the U.S. do to Fed policy and the ever printing of money.

In fact, we have already seen inflation in many areas of the economy even though the "average" is still in the fed's target.

The issue is, nothing runs in a smooth line. The FED's target is to let inflation run a little high into the 3-4% range to "catch-up" for prior periods of lower inflation.

That thesis is hilarious to me but I will keep my opinion out of it. The reality is inflation isn't some interest rate they can just change on whim.

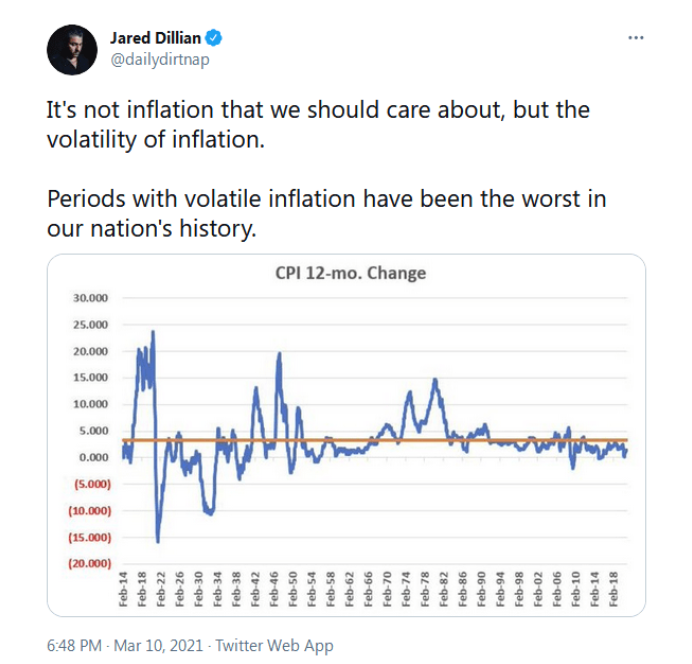

If and when inflation hits 3 or 4% is can go wherever the hell it wants in the near-term (over the course of 1 to 2 years) and the below chart shows that.

Been a while since the last rollercoaster...

Looking at this graph you can see several violent spikes over the past 100 years.

Past performance does not guarantee future results as the saying goes. However, if something has happened several times in the past it certainly can happen again.

Investing in an inflating world....

So the question is, how do we offset or even better fit from potential spikes in inflation.

I think being in crypto is a good start, so I suppose the answer is being in assets all together.

Speculating on where to invest is not my job and you can make your own decisions.

I just know I aim to have my inflating assets offset the increasing costs in the goods I consume.

Posted Using LeoFinance Beta

It’s amazing how mathematics, trends, fibs, patterns, etc. exist in data. If inflation were to breakup we could looking at some carastrophic inflation spike upwards. You can already see it in the price of goods over the past year that no one seems to care about. To the middle to low income person, it hits hard. I.e. Diapers are inflating like crazy!

Posted Using LeoFinance Beta