Conociendo las finanzas indefinidas según Peter Thiel / 𝘜𝘯𝘥𝘦𝘧𝘪𝘯𝘦𝘥 𝘧𝘪𝘯𝘢𝘯𝘤𝘦𝘴 𝘢𝘤𝘤𝘰𝘳𝘥𝘪𝘯𝘨 𝘵𝘰 𝘗𝘦𝘵𝘦𝘳 𝘛𝘩𝘪𝘦𝘭

Conocí esta definición cuando empecé a leer el libro De cero a uno – Como inventar el futuro de Peter Thiel. Aún estoy analizando las tantas realidades que muestra Peter Thiel en este libro, me encanta su forma de explicar y hacer que todo parezca más sencillo de comprender.

I learned this definition when I started reading the book From Zero to One - How to Build the Future by Peter Thiel. I am still analyzing the many realities that Peter Thiel shows in this book, I love his way of explaining and making everything seem easier to understand.

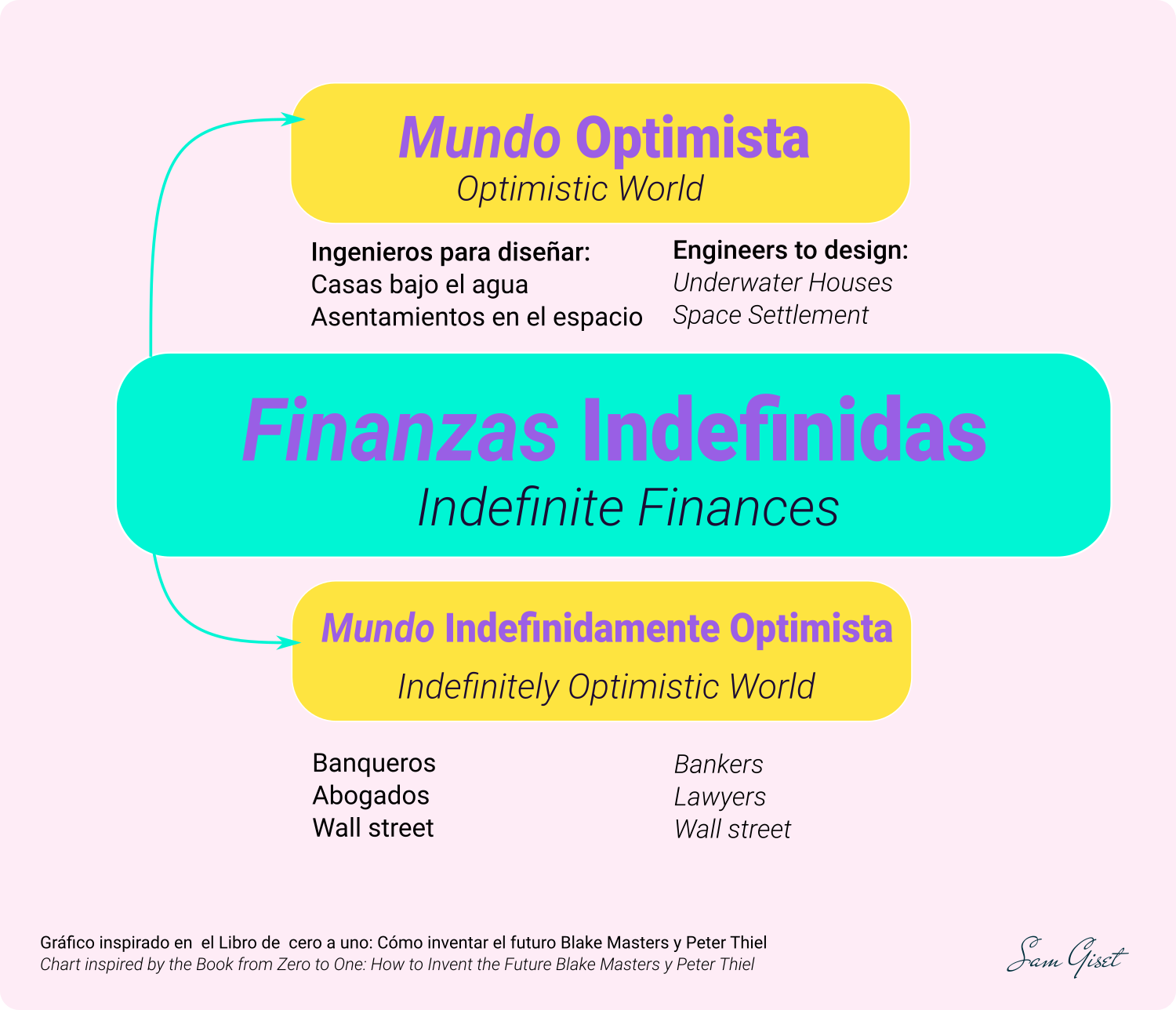

Peter Thiel nos comenta que muchos de los problemas al fracasar de muchas empresas son por nuestra forma de planificar y pensar, por ello habla de un mundo indefinido y un mundo definido, también nos comenta de un mundo optimista y un mundo pesimista. Donde un pensamiento optimista indefinido es el ejemplo de estados Unidos desde 1982 hasta el presente, no le temen al futuro, pero no es un futuro planificado. Un ejemplo de un pensamiento pesimista es China y su forma de ver el futuro, en algún momento eran pesimistas indefinidos al ver el futuro como algo sombrío y no saber que hacer, pero la China presente sigue viendo el futuro de forma pesimista, pero toma acción y copia lo que ha funcionado en occidente.

Peter Thiel tells us that many of the problems when many companies fail are due to our way of planning and thinking, that is why he talks about an undefined world and a defined world, he also tells us about an optimistic world and a pessimistic world. Where an undefined optimistic world is the example of the United States from 1982 to the present, they are not afraid of the future, but it is not a planned future. An example of a pessimistic world is China and its way of seeing the future, at some point they were indefinite pessimists seeing the future as something gloomy and did not know what to do, but the present China continues to see the future in a pessimistic way, but China takes Take action and copy what has worked in the West.

En el libro nos muestran diversos puntos de vista de estos pensamientos y en un punto nos explican las finanzas Indefinidas en un mundo optimista desde los dos puntos de vista, definido e indefinido y de eso es que hablaré en este post.

In the book they show us different points of view of these thoughts and in one point they explain the undefined finances in an optimistic world from both points of view, defined and undefined and that is what I will talk about in this post.

Conociendo las finanzas indefinidas según Peter Thiel / 𝘜𝘯𝘥𝘦𝘧𝘪𝘯𝘦𝘥 𝘧𝘪𝘯𝘢𝘯𝘤𝘦𝘴 𝘢𝘤𝘤𝘰𝘳𝘥𝘪𝘯𝘨 𝘵𝘰 𝘗𝘦𝘵𝘦𝘳 𝘛𝘩𝘪𝘦𝘭

Uno de los aspectos que resaltan es la diferencia que hay en las prioridades de las profesiones, en un mundo definidamente optimista los esfuerzos en educación deberían estar enfocados en la construcción de un mejor futuro, se necesitarían ingenieros para diseñar casas debajo del agua y asentamientos en el espacio. Por otro lado, vemos el caso de un mundo indefinidamente optimista donde se cree que habrá un mejor futuro, pero no hay un diseño inteligente para ese futuro, creemos que vendrán cosas mejores pero las profesiones de prioridad siguen siendo Abogados, banqueros y si no tienen tanta suerte en su profesión pueden terminar trabajando el Wall Street por no tener un plan real para sus carreras y siguen siendo optimistas porque nadie entra al mercado si esperar perder.

One of the aspects that stand out is the difference in the priorities of the professions, in a world that is definitely optimistic education efforts should be focused on building a better future, engineers would be needed to design underwater houses and settlements in space. On the other hand, we see the case of an indefinitely optimistic world where it is believed that there will be a better future, but there is no intelligent design for that future, we believe that better things will come but the priority professions are still lawyers, bankers and if they are not so lucky in their profession they can end up working on Wall Street because they do not have a real plan for their careers and they are still optimistic because nobody enters the market expecting to lose.

Desde que este libro se publicó hasta la actualidad han cambiado muchas cosas, pero entiendo perfectamente el enfoque, lo veo en mi país, a veces quisiera que todo el mundo supiera manejar aunque sea una wallet sencilla pero incluso hay personas que no manejan si quiera un celular inteligente, la penetración de la tecnología va sucediendo lentamente, pero la tendencia que lleva es que habrá una especie de teoría de choque y la mayoría de las personas aprenderán a manejar por plataformas digitales su dinero. Por otro lado, está el caso de la educación y las carreras que ofrece la universidad actualmente, no son las carreras para construir el mejor futuro, aquí también creo que somos indefinidamente optimistas. La sociedad espera que todo se arregle para mejor, pero en su mayoría no hace nada que pueda generar un cambio. También hay personas que piensan que algo peor no nos puede pasar. Sn duda es un caso de estudio.

Since this book was published until today many things have changed, but I perfectly understand the approach, I see it in my country, sometimes I wish everybody could drive even a simple wallet but there are even people who don't even drive a smart cell phone, the penetration of technology is happening slowly, but the trend is that there will be a kind of shock theory and most people will learn to manage their money through digital platforms. On the other hand, there is the case of education and the careers offered by the university currently, they are not the careers to build the best future, here too I think we are indefinitely optimistic. Society expects everything to be fixed for the better, but for the most part it does nothing that can make a difference. There are also people who think that something worse can't happen to us. Sn doubt is a case study.

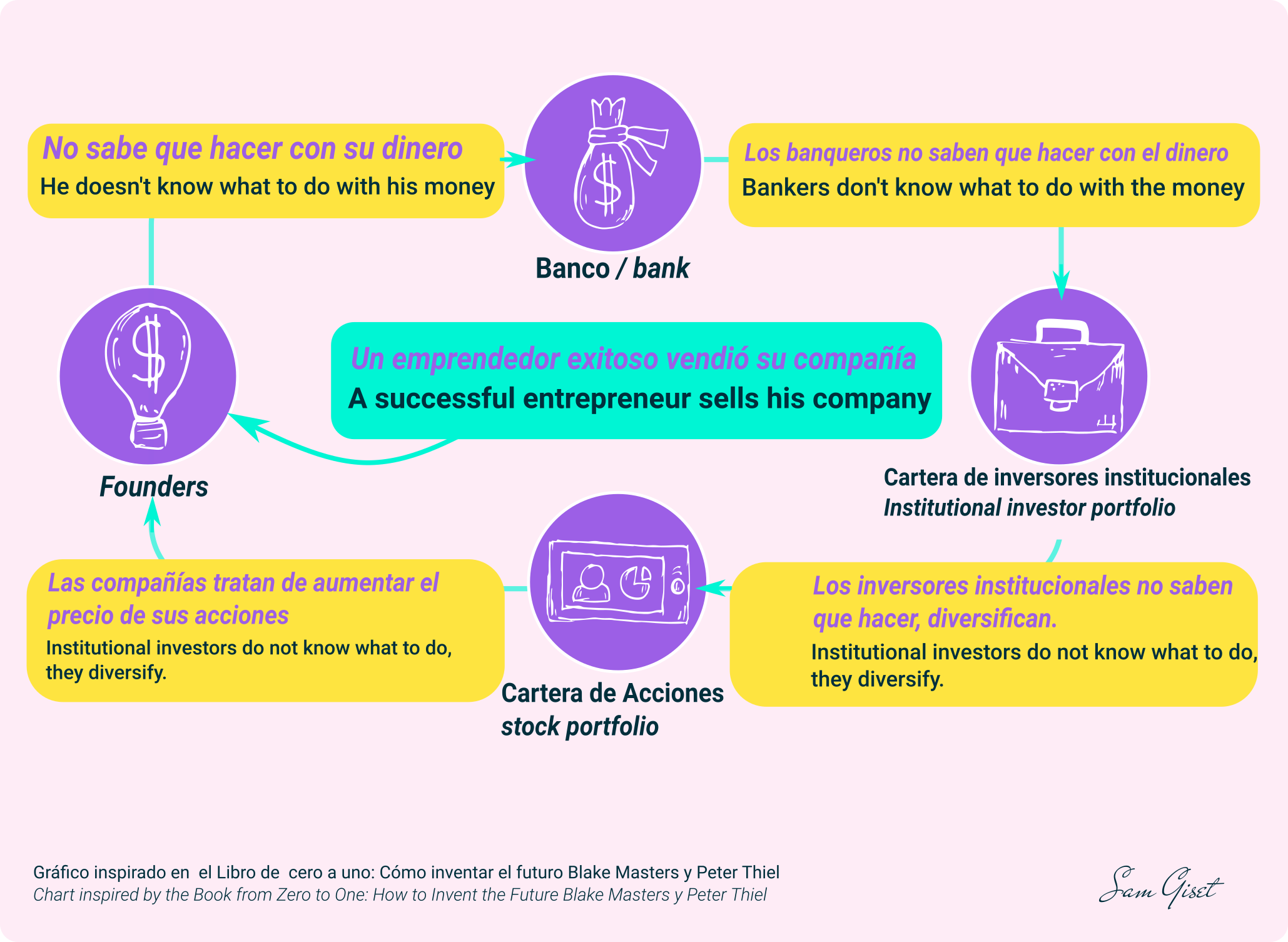

Siguiendo con el tema de las finanzas indefinidas, otro punto que llamó mi atención es que la mayoría de las personas no saben que hacer con el dinero en el mundo real, por la razón de no tener un plan. Un ejemplo muy valioso (Ver el grafico 2) es el caso de un emprendedor exitoso que logra vender su compañía, luego el dinero entra en un circulo que va desde bancos, cartera de inversores constitucionales, cartera de acciones, los fundadores tratan de aumentar el valor de sus acciones y es un ciclo que se repite. Para Peter Thiel este es un comportamiento de un mundo indefinidamente optimista, donde el dinero es más valioso que cualquier cosa que puedas hacer con él.

El análisis anterior se basa en la siguiente frase:

"Sólo en un futuro definido el dinero constituye un medio para un fin, no el fin en si mismo."

𝘗𝘦𝘵𝘦𝘳 𝘛𝘩𝘪𝘦𝘭

Continuing with the topic of indefinite finances, another point that caught my attention is that most people do not know what to do with money in the real world, for the reason of not having a plan. A very valuable example (See graph 2) is the case of a successful entrepreneur who manages to sell his company, then the money enters a circle that goes from banks, portfolio of constitutional investors, portfolio of stocks, the founders try to increase the value of their shares and it is a cycle that repeats itself. For Peter Thiel this is behavior from an indefinitely optimistic world, where money is more valuable than anything you can do with it.

The above analysis is based on the following sentence:

"Only in a definite future does money constitute a means to an end, not the end itself".

𝘗𝘦𝘵𝘦𝘳 𝘛𝘩𝘪𝘦𝘭

Conocer y comprender esta terminología puede llevarnos a cuestionar muchos sistemas actuales, lo importante de ampliar el conocimiento es que podamos ver el horizonte desde otro nivel y tomar mejores decisiones, no soy nada experta y a medida que leo descubro que tengo realmente mucho que aprender y por su puesto mucho que compartir con ustedes.

Knowing and understanding this terminology can lead us to question many current systems, the important thing about expanding knowledge is that we can see the horizon from another level and make better decisions, I am not an expert at all and as I read I discover that I really have a lot to learn and why its a lot to share with you.

¡Gracias por acompañarme en este camino del conocimiento! / Thank you for joining me on this journey of knowledge!

ABOUT ME: SAM GISET

Passionate about digital business, technology and travel.

Leader in clicblock.com

Otras redes:

My website

3speak.online| Instagram| Facebook | Youtube Vlog | Youtube Blockchain

Posted Using LeoFinance Beta

https://twitter.com/GisetSam/status/1352006720445440010

Todo país debe tener un futuro definido y nuestras finanzas deben estar definidas y tomar buenas decisiones sobre ellas nos ayudará a progresar como sociedad

Estoy de acuerdo @cryptoxicate tener un futuro definido nos ayudará a progresar como sociedad.

Gracias por leer el articulo y por tu apoyo! :-)

Posted Using LeoFinance Beta

Me encanta tu post @samgiset.

Así vivimos en vzla, en una indefinida visión optimista del dinero y la vida entera.

Gracias por compartir tus saberes.

Aprendamos. Éxito 😃🌻

Posted Using LeoFinance Beta

Gracias @zuly63! Oye, me encanta tu comentario, así estamos aprendiendo juntos. Abrazos! 🌻

Posted Using LeoFinance Beta

I listened to part of this book, some YT videos out in the field. I never finished it, I must admit. Your post serves as a reminder to me to pick it up again.

Interesting, you state the optimistic and pessimistic approach and classifying USA versus China. Who did better in terms own economic growth in the last three decades? USA or China? It's more a rhetorical question since we all know who did better. The interesting part of this is: The pessimistic approach outpassed the optimistic approach in many aspects. Not only the growth in GDP but also in money distribution. In China a growing middle class and lowering of the percentage of poor people. In the USA, reduction of the middle class, and growth of the poor people. I'm not sure what the best approach is, to be honest. Likely it's somewhere in the middle :) I know the best approach is an approach that is not centered around money, but about the happiness of individuals and societies since in the end, we all want to be or become happy persons!

EDIT: quickly searched YT and found this link, 5+hrs of the audiobook: 'Zero to One'... For all those who like to 'read' the book :)

Posted Using LeoFinance Beta

Yes, being full of hope thinking that the best will happen without taking the best actions can make us very unhappy in the end. That's why Peter Thiel highlights the importance of being definite optimists if what we want is to build a better future.

Hey! thanks for leaving the link to the book, one of my goals this year is to listen to audiobooks, I'm more visual than auditory so I need to concentrate on listening too, I also find it a good way to learn more English. :-)

Posted Using LeoFinance Beta

Yea, I hardly listen to audiobooks, When I do, I usually fall asleep. But also I like to listen more than reading. I could then listen to books while eg walking around the city or in nature. Maybe not the books by Peter Thiel, those deserve absolute attention. I'll be testing with some cool background music while listening to audiobooks. The first test still to be executed, so have no clue if this idea is gonna work out for me :)

In general, I do agree an optimistic approach is a good approach. Problems become Challenges. Though I think both are required: the Positive view but also the Pessimistic view. The later results in thinking upfront about different scenarios to reach the set goals and the associated risks with it and how to mitigate them. Applying only a positive or optimistic view turns into a little too naive approach to things in my opinion. But that's my view. I never made it as far as Peter Thiel, so I may have to follow more what he is saying to succeed in whatever I like to succeed in {LOL}

https://twitter.com/hggnooo/status/1352262784042590212