Would You Take Out A Loan To Buy Bitcoin (That''s What Michael Saylor Recently Did)???

If you had one opportunity in a lifetime to front run the banks, the hedge funds, the institutions, the Smart Money, but you had to take out a loan to buy bitcoin, would you do it?

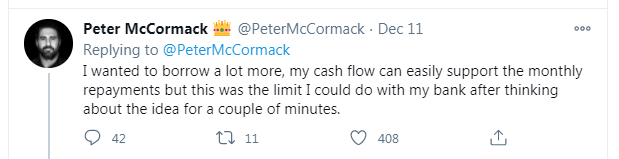

Well, that's what Peter McCormack did several days ago.

On Monday, Buterin shared a post on Twitter warning followers not to take out personal loans to purchase cryptocurrencies in hopes they will be able to pay off the loan including interest as the cryptocurrency gradually appreciates in value over the years.

“Please don't do things like this. I would NEVER recommend anyone take out a personal loan to buy ETH or other ethereum assets,” warned Buterin.

Buterin added, “7 years ago, before ethereum even began, I had only a few thousand dollars of net worth. I nevertheless sold half my bitcoin to make sure that I would not be broke if BTC went to zero.”

Is what Peter did any worse than what Don Conway or Didi Taihuttu did?

Don Conway Don was a 45-year-old middle manager at a major multi-media company in San Francisco, who earned $150k per year, but hated Corporate America. Don eventually took out a home equity loan for $200k and bought more Ethereum.

Didi Taihuttu, a 39-year-old man in The Netherlands, sold everything which included a business in exchange for bitcoin to travel the world with his wife and three daughters.

What makes what Michael Saylor did any different from Peter, Don or Didi?

Last week, MicroStrategy announced plans to offer $400 million of convertible bonds in order to buy more bitcoin. They ended up raising $650 million in two days. So that 650 million dollar offering at a 0.75% convertible senior notes isn’t due until 2025. Assuming they bought bitcoin at $18,000 they have paid for all the interests over the weekend and made a profit.

So going back to that Peter McCormack guy. Taking out that loan to buy bitcoin was a calculated risk, one in which he can easily pay back without having to eat bread and water for dinner for the next couple of years.

So, yes, I would make the same move as Peter, at least that's what I would advise the 24 year old Rolland and perhaps the 45 year old Rolland too if I knew what I know is about to take place over the next 12-18 months.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance Beta

I'm to afraid to do that, even dough I think it might pay off for him. But to live with back in his head for a couple of years can be rough ...

Posted Using LeoFinance Beta

Yeah, that is too much risk for me, but I like Peter's approach.

Posted Using LeoFinance Beta

I hope it works out for him and all the other buying bitcoin at this sub 20k level. If it breaks 20k it will be good for the crypto industry as a whole.

Posted Using LeoFinance Beta

We will see $20k by Feb. for sure.

Posted Using LeoFinance Beta

He must have a terrible credit rating to get such a high percentage.

I am thinking about taking a loan to buy some land soon, I'll probably take a little bit more than I need to buy some more BTC, but we're talking a few hundred, not thousands.

Then again that might be proportionate in wealth terms to what that guy's worth!

Posted Using LeoFinance Beta

@revise.leo I didn't even think about his APR, yeah that is a lot.

Posted Using LeoFinance Beta

I've just been looking around for loans today with three of my bank accounts - the percentages I got for much smaller amounts, around $10K were:

Quite a difference! He should have shopped around.

Posted Using LeoFinance Beta

No, that's a really dumb idea for most people.

Peter has decent cash flow and his pretty frugal about it and open so I think he’ll pay back that loan pretty quickly and skim some profits in this next run and pay the queen her share in capital gains

As for micheal corporate bond issuance well investors are desperate for yield and his kicking off like 30 mil in free cash flow a year so I think they’ll be fine with all that BTC on the books they also can leverage that asset position

I’m sure he’ll go on a Aquisition spree eventually and pump up that cash flow over the next 5 years and obliterate that 650mil down

That's an interesting thought....an acquisition spree...bitcoin related companies only.

Posted Using LeoFinance Beta

I think it’s a complex decision.

My answer is; on the one hand, your taking on debt, but on the other hand your buying an appreciating asset. If the historical rate of appreciation exceeds your loan borrowing rate, on paper it’s a good decision, I.e. sound investment, provided you can pay the loan with disposable income, and the asset is characterized by capitol preservation.

On the other hand, if it’s a highly speculative investment, with potential for great appreciation, but potential for a large downside, it gets more complicated, because you might have to carry the debt longer and you may want to get a longer term loan. This increases your loan costs, but gives you more time to be right.

Posted Using LeoFinance Beta

It's a once in a life time opportunity...it's a go for me.

Posted Using LeoFinance Beta

Isn't that move a little bit risky? Well, I can't say I would have done such or I don't even know at a decision or move I would have made, but I do know such risk is something I wouldn't have taken cause crypto isn't a stable thing.

Posted Using LeoFinance Beta

I would make the move, as the Smart Money is buying Bitcoin.

Posted Using LeoFinance Beta

Hmm, then we are two different people

HA. I had an #askleo post today as well asking the community if anyone would buy BTC with credit. Nobody has yet answered, but I'd do it eyes closed if any bank would give me any credit.

Posted Using LeoFinance Beta

I'm with you @acesontop.

Posted Using LeoFinance Beta

Having lost a lot of money in risky en-devours, I would probably say yes to taking a loan for crypto as money is almost free now. But only with one condition, that I can guarantee with the crypto I have, putting a mortgage on it. Let the crypto work for me. :)

Posted Using LeoFinance Beta

So do it. I bet you can get a better rate than Peter did too.

Posted Using LeoFinance Beta

A certain WHALE suggested people take out a loan to buy $STEEM a couple years back, glad I did not take that advice!

Short answer? I am with Vitalik Buterin on this question:

Posted Using LeoFinance Beta

The writing on the wall

is getting clearer

day by day.

This kind of risk is a prelude

for bitcoin to reach $50k

Posted Using LeoFinance Beta

Its iresponsible to NOT take out as many loans from as many sources a spossible, because fiat is a scam, and bitcoin is the future, and if you cant accept that dont try to parrot the advice of our LITERALLY DYRING parents and grandparnbets, who are LITERALLY being executed en mass by a holocaust that, like the ww2 holocaust, was and is and will always be DENIED

they deny they are locking peopel in their houses to die, its happening and , no one in china died of any virus, they died of starvation and the government went around telling people they could survive just fine without food and wayter, it was a virus killing them

this world is a joke

if theer wa s areal viral outbreak the us military would have already shut down everything for real, including the actual roads and airports, like on 9/11

we dont actually see this .

so yeah just sayin, they tell us to NOT take out loans when you literaly cant get in any troubvle for not paying it back if you cant, so who cares? Debters prisons were outlawed

dont tell peopel to avoid bitcoin

vitalik said not to get a loan to get ethereum because he doesnt actually believe in his own scam

Posted Using LeoFinance Beta

Individually, it makes sense. In the aggregate, however, it can be a recipe for disaster. If the price of cryptos is propped up by leverage, then at some point there is a risk of liquidations like people going long using margin. You see this every time a whale dumps and causes a cascade of liquidations.

In these cases, the loans are 1X rather than 2X or even 10X. Therefore, there is time to come up with the cash by the time the loans are due. Or, if they are installment loans, then it would also work out.

I think, in broad terms, it works out if you are borrowing an amount that you can afford to pay back if your gamble doesn't pay off.

Posted Using LeoFinance Beta

That's ballsy af

Posted Using LeoFinance Beta