Why Is Best Buy’s Stock Up Over 90% Since 2017, Despite Only A Small Revenue Jump???

I stole that title directly from Fontune.com as it was very fitting for a company that operates in an Amazon world. So I can’t take any credit for the title, but I think I can add my own little flavor to the article. Ready…here we go.

Best Buy had internal problems going back many years ago. Former Chief Executive Officer Brian Dunn had an affair with and a company colleague. The internal investigation was released in May 2012 and alleged that Best Buy founder and chairman Richard Schulze knew of Dunn's inappropriate relationship and failed to notify the Best Buy board. So 2012, Hurbert Joly, an outsider took the position of CEO at Best Buy, Inc. and that was the catalyst for the company’s turnaround.

Best Buy's prices weren't competitive. Customers would go to the store, touch and feel the product, then buy it online. So Best Buy implemented a price-matching policy, both in-store and online, while also lowering its prices to be more competitive.

So how did Best Buy’s earnings margin expand? This growth has likely been driven through improved cost management as opposed to revenue growth. Since fiscal 2017, SG&A expenses have decreased from 19.2% of revenue to 18.3%. The company also saw a decline in interest expense from $72 million to $64 million in between fiscal 2017 and fiscal 2020.

Hubert then cut $1 billion in cost. He strategically laid off managers and staff at corporate, but spent money on employee training to provide top notch customer service and experiences within the store.

Best Buy started shipping directly from the stores with the store employees packing and shipping online orders which gave customers access to more product and inventory and reduced shipping time and cost.

The reason for BBY’s stock outperformance over recent years can also be attributed to the company executing its two multiyear strategic plans, Renew Blue and Best Buy 2020. The company has shut down stores, exited regions, and looked to cut internal costs in order to compete in the Amazon-dominated retail market. In addition, it has been emphasizing using its stores as a vehicle for differentiated customer service as well as fulfillment centers.

But before the Renew Blue and Best Buy 2020, there were low hanging fruit opportunities that Hubert saw to make it possible for the company to exist long enough for the Renew Blue initiative.

Best Buy started shipping directly from the stores with the store employees packing and shipping online orders which gave customers access to more product and inventory and reduced shipping time and cost.

Hubert Joy expanded Best Buy’s services, which included an in-home advisory service. Consumers got a free consultation on how to connect all the products in their homes, including TVs, computers, video games, thermostats and home-security networks, etc. which led to consumers buying more products or services.

Now part of the Renew Blue initiative was the acquisition of GreatCall, a health technology co. that offers mobile products and wearables that connect users to agents who can hook them up with family caregivers or send emergency medical help. The goal was to help customers use technology to address key human needs.

Overall, a combination of margins going from 3.1% to now close to 3.5%, and revenues growing about 11%, meant earnings per share grew from $3.86 in fiscal 2017 to $5.82 a share in fiscal 2020.

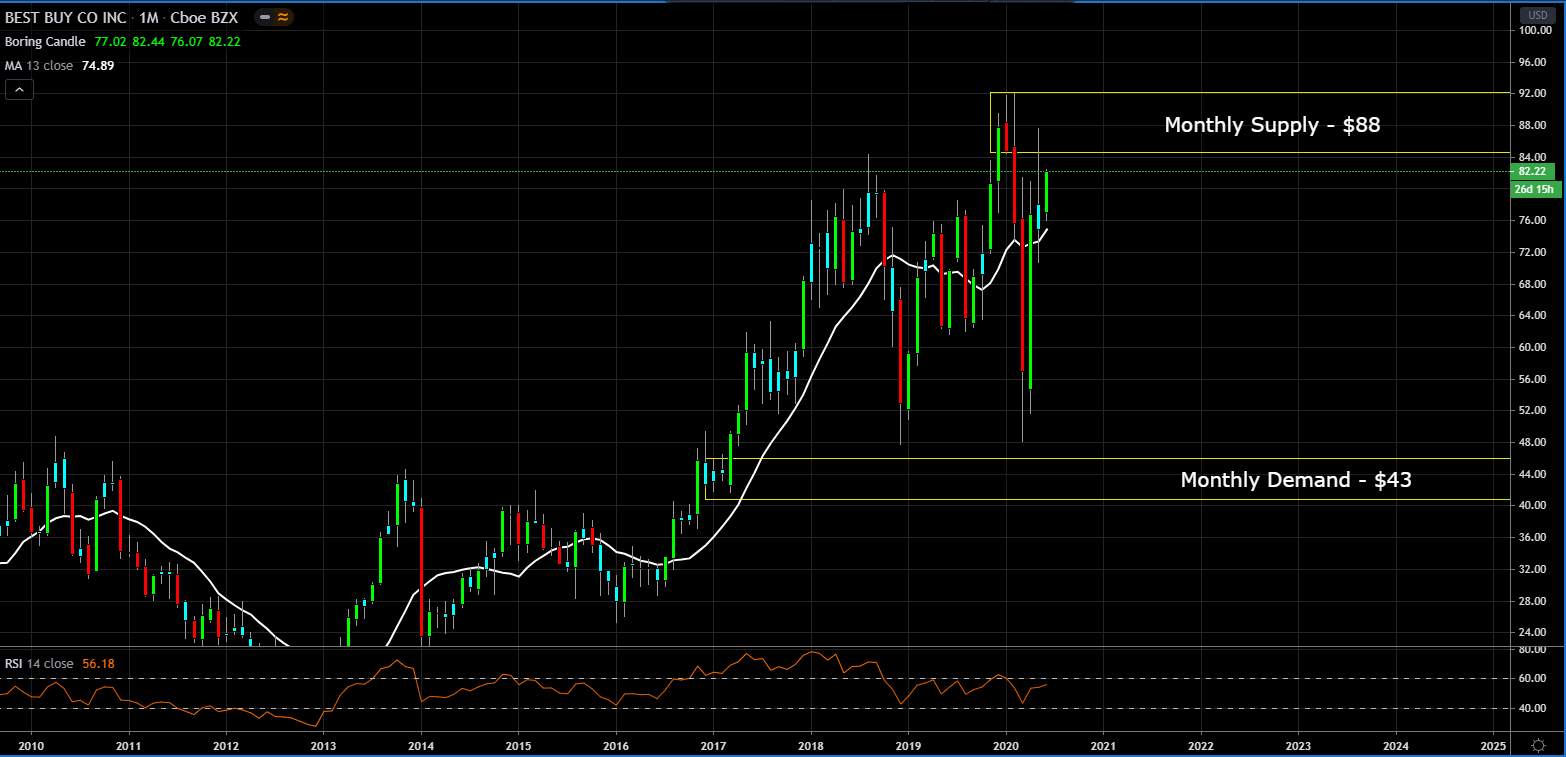

Based on price action, look for price to retest the monthly supply at $88 before a potential break out higher since the zone was already tested once.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance

Best Buy shows that traditional brick and mortar can turn things around.

It was a dying animal in the early part of the last decade. The problems you mentioned were leading them into oblivion. Now, they are still standing.

They also expanded their product lines to include appliances, which ended up being a perfect fit since they are now digitized and connected.

The death of Radio Shack also helped out.

Posted Using LeoFinance

My hat goes off to the CEO who was able to adapt, more importantly execute to make the company still relevant.

Posted Using LeoFinance