Wally's World Continues To Hold Its Own

A year ago, Amazon's Brian Olsavsky, the chief financial officer said they are evolving their Prime free two-day shipping program to be a free one-day shipping program. The news sent shock waves through the retail space after the announcement. Over the years, Amazon has ignored Wall Street and continued spending money building fulfillment centers. In 2005, there were about 12 fulfillment centers. Today there are over 175 fulfillment centers.

To support the goal of one day shipping, Amazon started taking the logistics of moving packages from the fulfillment centers to your home by leasing/buying planes, trucks and vans.

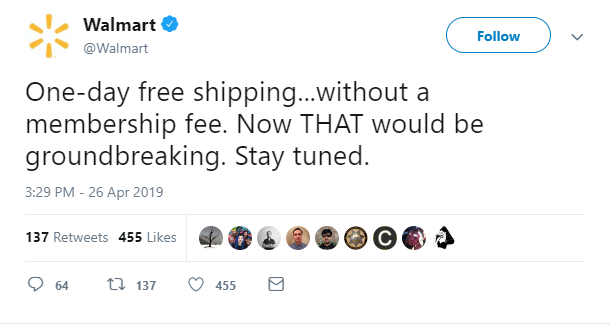

Amazon’s goal is when you run out of toothpaste or toilet paper, instead of running to the store, order it (and maybe you will see some other things you need) and you will have it the next day. The goal of one day shipping is a competitive advantage many can’t match…unless you are Walmart. The following day after Amazon announced a move to one day shipping, Walmart went onto Twitter with their own announcement.

The "Amazon Effect" has forced all retailers to step up their “omnichannel” game or face extinction. The ominichannel phenomenon is the ability to compete through brick and mortar and online by redesigning distribution networks and streamline supply chain operations to best serve customers on and offline.

So what did Walmart do, they spent a pretty penny to purchase retail site Jet.com Walmart bought Jet.com in a $3.3 billion in 2016 and has played an critical role in Walmart's transformation online.

But Walmart didn't stop there, the also implemented their own omni-channel strategy. The strategy involves shoppers going online for some purchases or visiting the brick-and-mortar stores for to purchase items or sometimes do a combination of the two, such as buying a barbecue grill online and picking it up at the store, along with charcoal and burgers.

So it appears, just like Amazon, Walmart was built for times like this.

Retail giant Walmart (WMT) reported stronger-than-expected first-quarter earnings on Tuesday, driven by a surge in e-commerce and higher traffic in stores as the coronavirus pandemic sparked massive purchases in household goods.

Revenue: $134.6 billion vs. expectations of $132.48 billion

Adjusted EPS: $1.18 vs. expectations of $1.12

Walmart U.S. comp-store sales (excluding gas): 10% versus expectations of +8.6%

Walmart U.S. e-commerce sales: up 74%

“Our omnichannel strategy, enabling customers to shop in seamless, flexible ways, is built for serving the needs of customers during this crisis and in the future,” CEO Doug McMillon said in the management commentary.

“As a result of the health crisis and related stay-at-home mandates, customers consolidated store shopping trips with larger average baskets and shifted more purchases to eCommerce,” the retailer said in its commentary.

Walmart also announced the discontinuation of Jet.com as it didn't live up to expectations. But it was still a win for Walmart, as they got to pick the brains of Jet.com founder Marc Lore, who sold his online diaper business to Amazon. Personally, Walmart is too big to fail, they use to be the "company I love to hate," that was until "Death Star" aka Amazon starting arriving on my doorstep.

Now many think because of COVID-19, Walmart exceeded expectations, but as States start reopening, consumer will eat out more and buy less groceries. That could be a reason why the stock sold off, but the sell off could be a buying opportunity near the 4 hr demand zone at $118.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance

Interesting! Did you study business? This reads like one of the case studies I read at university studying international business.

Why do you think Amazon is like the Death Star?

Posted Using LeoFinance

I have a chemical engineering degree, but live and breath the Markets because it fascinates me so much. Regarding Amazon being the Death Star, they continue to take over industry after industry to the point where they are eliminating the competition, leaving consumers with less and less choices. In addition, they have already invaded my home, thanks to my wife, but I continue to refuse to talk to Alexa.

Posted Using LeoFinance

Reminds me of a book I read called "The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google". It was very engaging and enlightening. These giants have done some great things but their power over all of humanity is getting scary. That's why I'm so passionate about decentralized projects such as Hive which transfer power from corporations and companies to individuals.

Anyway, look forward to more of your content @rollandthomas! Is your name Rolland btw?