Vulcan Materials Wins Regardless Who Wins The Presidential Election

In the early Presidential polls, former Vice President Joe Biden is leading President Donald Trump in the 2020 race for the White House. Part of the early lead is because Biden is winning in several swing states, critical to Electoral College victory as we saw when Trump vs. Hillary Clinton four years ago.

Trump has been taking some stabs at Biden in recent weeks. Today, as the Markets continue to rise, with the NASDAQ hitting yet another all-time high, Trump took to Twitter and warned American that the gains being experienced as of late might go "bye-bye" if Biden wins in the Fall.

But JPMorgan thinks if Biden wins in November, it might not be that bad. Yes, Biden has been talking about increase the corporate tax rate from 21% to 28%, but he is also looking to ease tariff with China. In additional, Biden shares with Trump that American is in need of an infrastructure bill.

President Donald Trump proposal for a new infrastructure spending goes back to before he ran for Office. Trump’s plan is being developed by the Department of Transportation and would set aside $1 trillion for roads, bridges, 5G wireless and rural broadband. The proposal includes $602 billion for highway infrastructure, $155 billion for transit infrastructure, $20 billion for traffic and motor carrier safety, $17 billion for rail infrastructure. An additional $190 billion in investments is for water and broadband, etc.

If Trump is able to get his bill approve, it will lead to thousands of new jobs, which would help reduce the unemployment numbers, which will help his chances of winning again in November.

One company to benefit regardless who gets in the White House is Vulcan Materials.

These infrastructure initiatives would almost certainly boost sales for Vulcan Materials (NYSE:VMC). The company ranks as the largest U.S. producer of construction aggregates such as crushed stone, sand, and gravel and is one of the top producers of construction materials including asphalt and ready-mixed concrete.

The states in which Vulcan operates are poised to generate 72% of the total U.S. population growth this decade. Nineteen of the 25 fastest-growing markets in the U.S. are served by Vulcan's operations. It makes sense that these areas will be a primary focus of federal infrastructure initiatives.

Vulcan Materials Company produces and supplies construction materials primarily in the United States. Vulcan is the largest U.S. producer of construction aggregates such as crushed stone, sand, and gravel and is one of the top producers of construction materials including asphalt and ready-mixed concrete.

Out of the more than 600,000 bridges in the US, more than 33% are more than 50 years old. There are over 15,000 dams and levees that need repair. The majority of water pipes in America that bring water to your house are about 100 years old. About 33% of the roads in city are in poor condition.

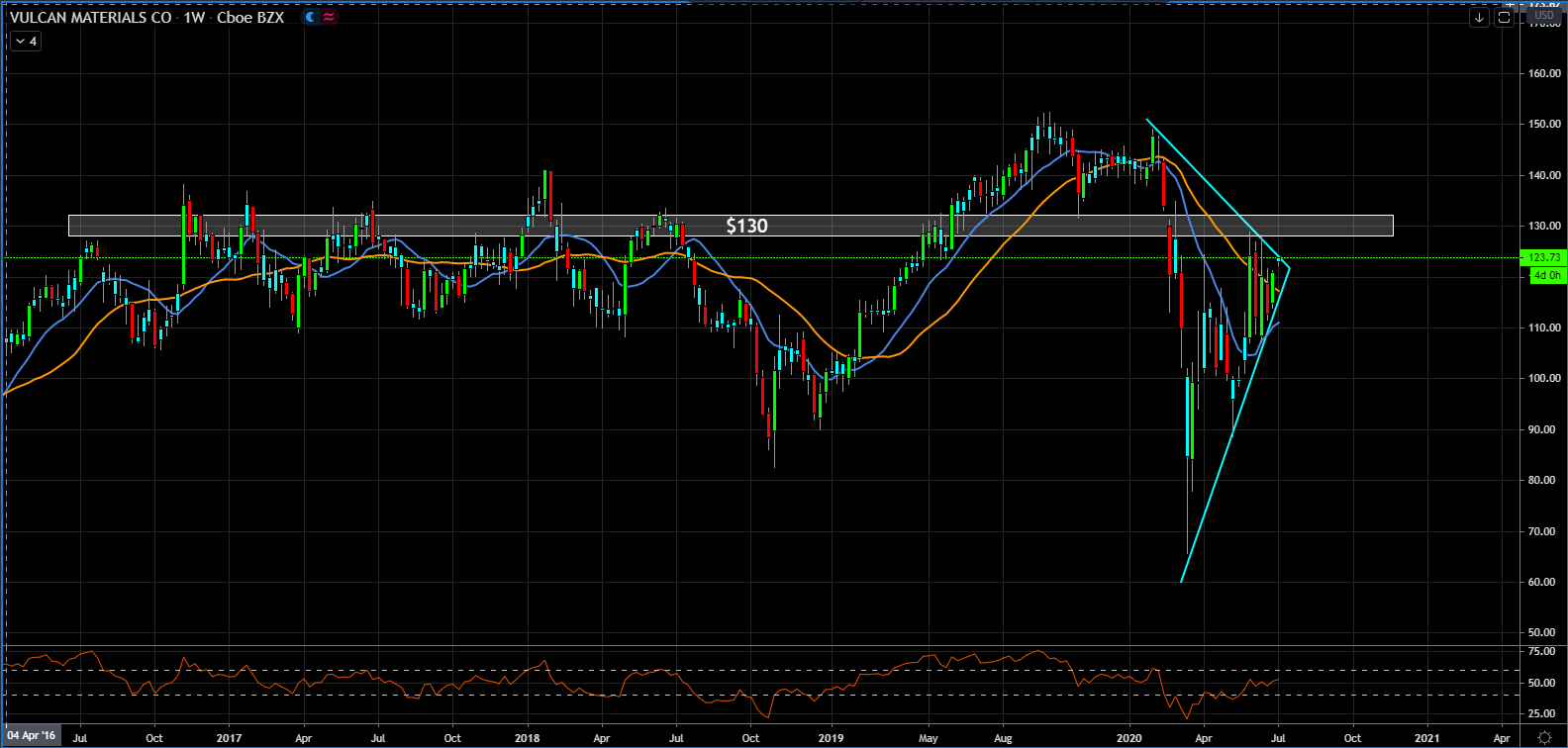

A infrastructure bill will pass at some point. Thus, the chart suggests to buy Vulcan on a breakout above the $130 level.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance