Unusual Options Activity In First Majestic

First Majestic Silver is one of the few miners to play a rise in silver. First Majestic gets most of their revenue from silver and will produce over 20 million oz of silver this year. of their revenue (93%) comes from silver and gold, with most of that being silver.

President and CEO of First Majestic Silver Corp., Keith was born in Cleveland, Ohio and holds a bachelor's degree in business. Keith Neumeyer has been at the head of many other companies and now holds the position of CEO for First Mining Silver Corp.

According to Keith, silver faces serious supply constraints, and although most people may not realize, it is a very rare metal that should be trading in the triple digits in price. What Keith is getting at is most of the silver dug up from the ground goes into some type of industrial use vs. in a warehouse or vault like gold. Keith thinks the price of silver is a joke based on the rise of other metals, along with gold. Keith said silver is ignored as a cheap gold substitute and that is a wrong assumption.

Federal Reserve Chairman Jerome Powell spoke to reporters following the central bank’s December policymaking decision and had the following to say about inflation.

Answering a question about prices, Powell said empirical evidence shows there are disinflationary pressures across the globe keeping prices in check even with easy monetary policy.

“I think you have to be honest with yourself about inflation these days. There are significant disinflationary pressures around the world. And there have been for a while,” he said. “It’s not going to be easy to have inflation move up. ... It’s going to take some time. It took a long time to get inflation back to 2% in the last crisis.”

“We’re honest with ourselves and with you in the [Summary of Economic Projections]: But even with the very high level of accommodation that we’re providing both through low rates and very high levels of asset purchases, it will take some time,” Powell added.

If that was the case, why has First Majestic, reported net earnings growth of 261.6% on revenue growth of 29.8% in Q3 2020, which ended September 30, 2020. Some might say silver historically has been used in coins and jewelry, but these days, silver's main use is industrial. Its anti-corrosion, antibacterial, etc. make it ideal for all kinds of consumer goods and medical medication. It’s also an extremely valuable industrial metal and that’s why First Majestic had a great quarter.

OK, so if Fed Powell is saying he sees disinflationary and not inflationary pressures, if that was the case, why has the US dollar lost 20% of its value in 2020. First Majestic has too things going for themselves. They are mining a metal that’s needed for industrial use and a metal that is serving as an inflationary hedge.

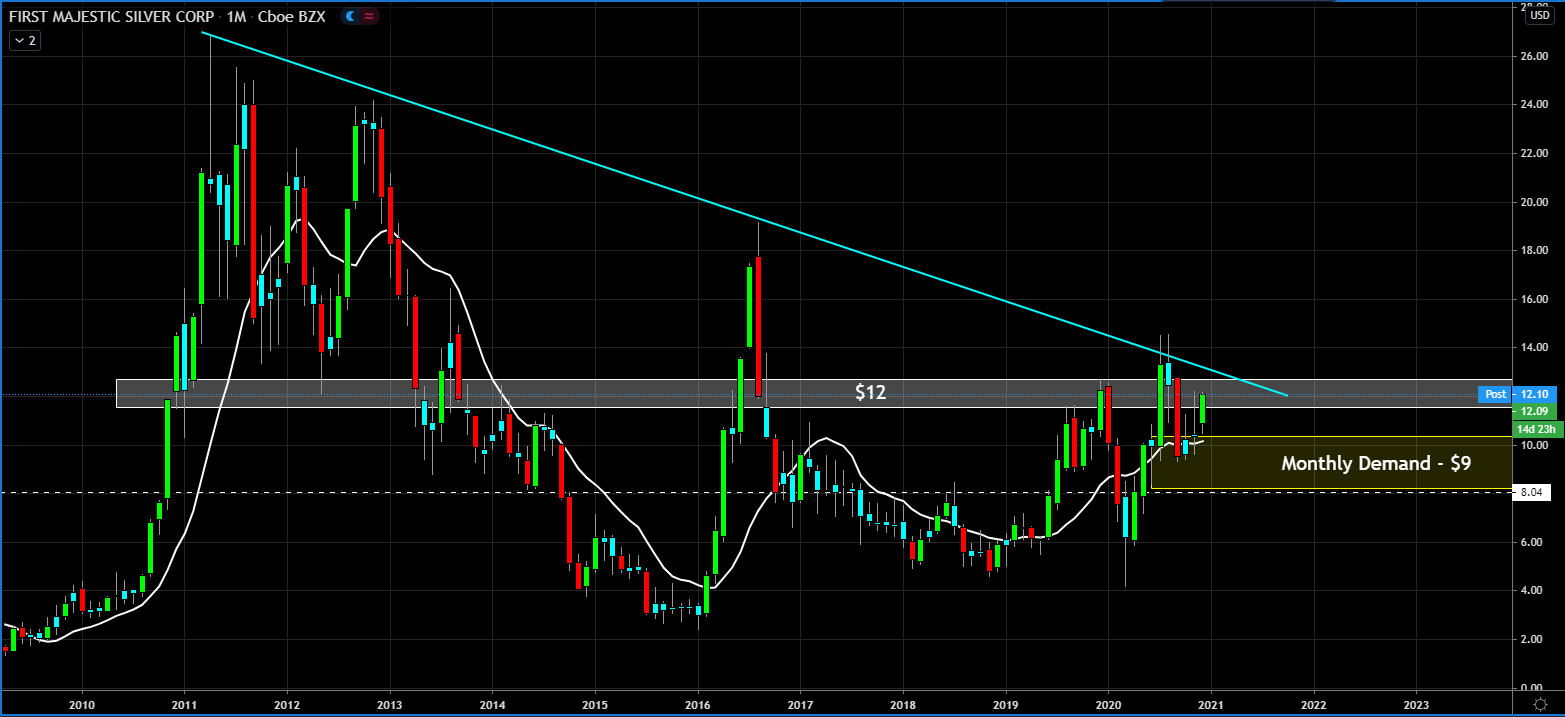

It’s the single reason why the Smart Money bought over 11,000 call option at the $12.5 strike price that expires at the end of January.

And just like that, price is already almost at $12.50.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance Beta

I like this guy, I listen to him every time he is interviewed. I have a large stake in FFGMF, another company he created and I believe they have a stake in First Silver also.

Posted Using LeoFinance Beta

Very cool, @tbnfl4sun, yeah Keith is the man as I think Silver will hit at least $50 in the years to come.

Posted Using LeoFinance Beta