Unusual Options Activity In DraftKings - Part 2

DraftKings is a digital sports entertainment and gaming company created to fuel the competitive spirits of sports fans with products that range across daily fantasy, regulated gaming and digital media. DraftKings is the only U.S.-based vertically integrated sports betting operator.

DraftKings provides users with daily sports, sports betting, and iGaming opportunities. It is also involved the design and development of sports betting and casino gaming platform software for online and retail sportsbook, and casino gaming products.

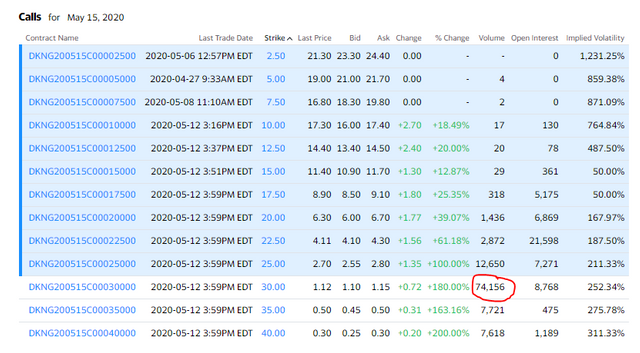

Three weeks ago, I noticed some unusual options activity in DraftKings yesterday. The Smart Money bought over 70,000 call options at the $30 strike price that expire this Friday.

After digging into the matter further, I realized it was an earnings play. Two weeks ago, we talked about it on the Leo Podcast. The Leo Podcast which comes out weekly, talks about crypto, stocks, forex, futures and trading strategies and methodologies and anything under the sun of finance. During, #43 - Leo Roundtable: A Fed-Induced Market, Silver & Gold, BTC, HIVE and the Stock-to-Flow Model

we talked about two new websites added to the LeoFinance ecosystem, the S&P500, Silver & Gold, a play on the flight to safe havens asset due helicopter money through the silver ETF, SLV. We also talked about Bitcoin, Hive and the S2F (Stock to Flow) model?

0:00 LEO Developments — Talking about Hivestats, LeoPedia, etc.

21:00 S&P 500, AAPL and the Overall Market

30:00 Silver & Gold

53:00 DAX and Nikkei

57:00 BTC, HIVE & The Crypto Markets

1:19:11 Bitcoin S2F (Stock to Flow) Model Explanation

But during the 40 min mark, we talked about Draftkings. We talked about despite sports on TV, company has created products that allow customers to engage in fantasy sports. Draftkings also mad it possible for people to bet on eNASCAR, Counter Strike, and Rocket League, as well as pop culture events such as TV shows "Survivor," "The Last Dance" and "Top Chef. Because of Draftkings continue to expand it operations in more and more states, Draftkings said on the earnings call it doesn't anticipate being affected by COVID-19.

At the time, the stock was trading at $25. I talked about how I got in with the Smart Money, but bought a further out call option to give myself a chance to be right.

Despite Draftkings not meeting Wall Street expectations, analysts were impressed with the first-quarter DraftKings revenue was up 30%, to $89 million, which includes their SB Technology unit, which provides technology services to online betting companies.

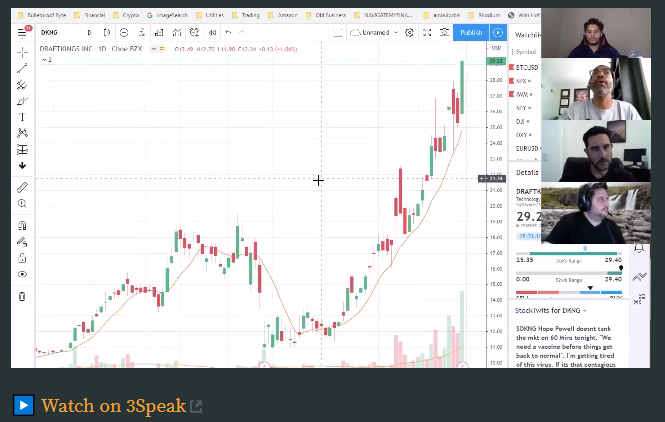

Since that particular podcast, the stock price ran up to $45 or 80%. However, my call option ran up over 200%. I have since sold my option, but I think Draftkings is just getting started.

Last week, DraftKings announced live-streamed sports games in collaboration with Sportradar, the global provider of sports data and content. In addition, yesterday, the DraftKings announced it is partnering with Bay Mills Resort & Casino to bring sports betting to the state of Michigan.

DraftKings has a lot going for itself...the chart suggests to go long at the 4 Hr demand at $36.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance