Top And Worst Asset Performers For The Week Of 5/18/20

Intermarket analysis is a powerful tool that gives traders/investors a macro predictive direction of stocks, bonds, commodities and currencies. Intermarket analysis states that all asset classes are interrelated and that you can’t definitively determine the direction of one asset class without examining the other asset classes.

There are several key relationships that bind these four markets together. These relationships include:

The INVERSE relationship between commodities and bonds.

The INVERSE relationship between bonds and stocks.

The POSITIVE relationship between stocks and commodities.

The INVERSE relationship between the US Dollar and commodities.

The overall goal of the intermarket analysis is to identify top performers or the markets that are outperforming others. With all that said, the top and worst performers from this past week are the following:

Top Performers

Platinum +2.35%

Platinum and silver are almost identical with both making parabolic moves to the upside, and other than a brief pullback Monday, have gone straight up. There should be a pullback soon, as the speed and distance silver and platinum are tracking is too far too fast. A small sell-off is healthy and an opportunity. If the rally continues at this speed, it will signal they are nearing the end of the rally. We remain long across the board.

Cocoa: +2.31%

Silver: +1.94%

Price hit the supply zone at $18, so I anticipate we should see a pull back going into next week with the next target being $20.

Worst Performers

S&P 500 VIX: -2.59%

The VIX measures the volatility over the last 30 days on the S&P 500. Also known, as the fear gauge, VIX values greater than 30 represent risk off trading environments and VIX values less than 20 represent calm Markets.

For the week, Dow gained 3.3% to post its best weekly performance since April 9. Most of the gains came earlier in the week when Moderna announced some positive trial results on its COVID-19 vaccine candidate. On the news the DOW rose over 900 points.

Class III Milk: -2.72%

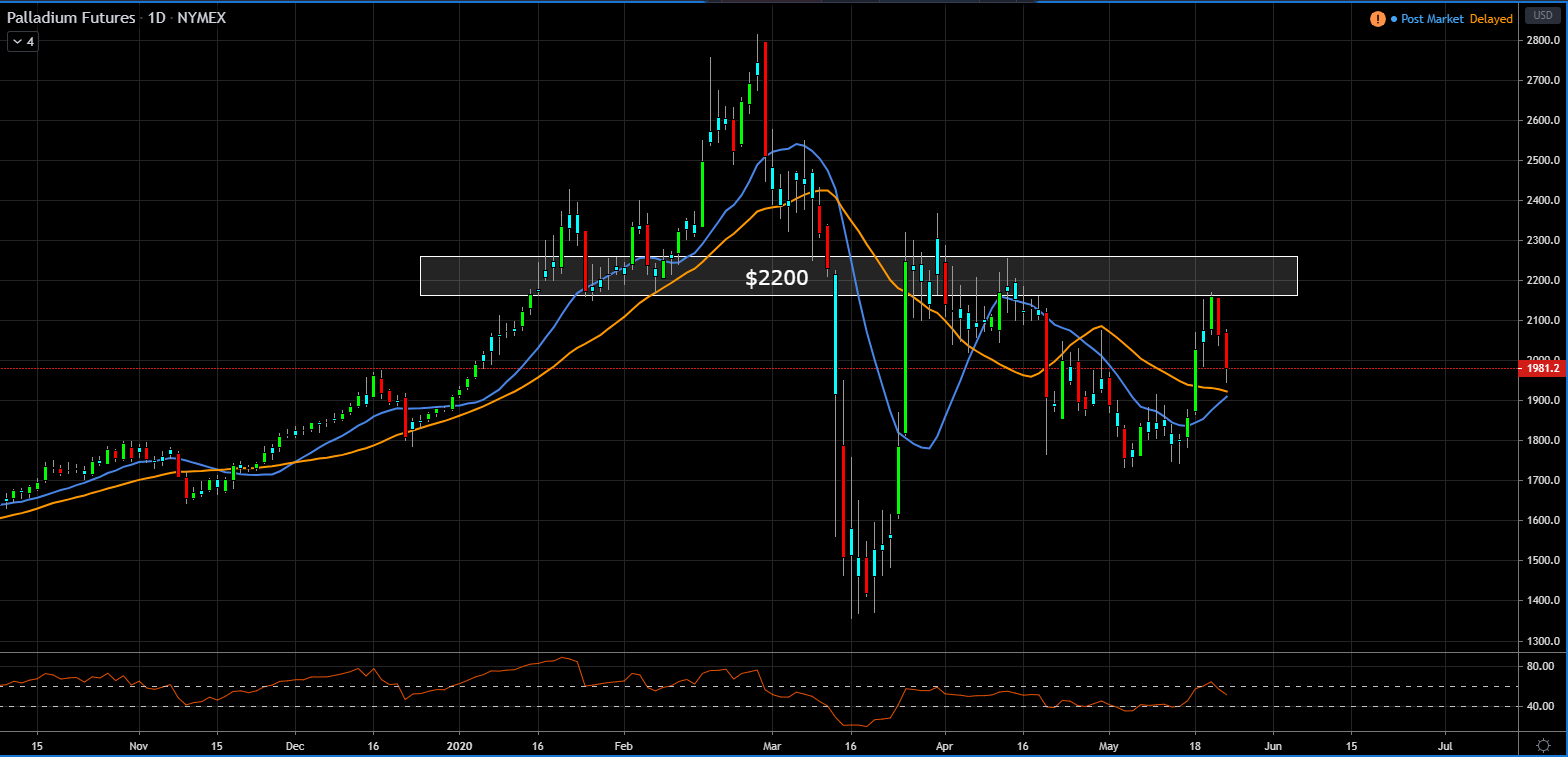

Palladium: -3.31%

Despite the decline this week, Palladium jumped by the most since March amid renewed optimism about China’s economy reopening and planned stimulus for automakers, the biggest consumers of the metal. Palladium closed just below the round number of $2,000 an ounce, after being rejected but the major resistance/support band at $2200.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance