Short DoorDash...They Don't Make Any Money

According to Jay Ritter, a finance professor at the University of Florida and one of academia’s leading experts on the IPO market he noticed that this year’s average first-day return was 37%, higher than any other year since 2000. Taking things further back, these first-day rallies are almost three times bigger than the average of the last 40 years.

Lets get right into it. DoorDash went public last week and the stock rose about 80% on its first day of trading and ended the day with a market cap of about $66 billion. DoorDash’s market cap is higher than Chipotle and Dominos.

The initial public offering — one of the hottest of 2020 — caps a year of explosive growth for the San Francisco company, which has benefited hugely during the pandemic as homebound diners have increasingly relied on deliveries to their door

Some of the year's biggest initial public offerings took place this week, adding to an already record year for market debuts. DoorDash soared 86% when it began trading on Wednesday after raising $3.2 billion through its offering the day prior.

"It's silly season," Rich Steinberg, the chief market strategist of the Colony Group, told Business Insider. "Investors need to distinguish the difference between a great company and a great price or value."

DoorDash has been thriving as of late. Lockdown orders and shelter in place mandates which has resulted in indoor dining closures have made DoorDash indispensable for restaurants and customers. Through September of this year, DoorDash reported revenue of $1.9 billion. However, DoorDash has also lost $149 million through September.

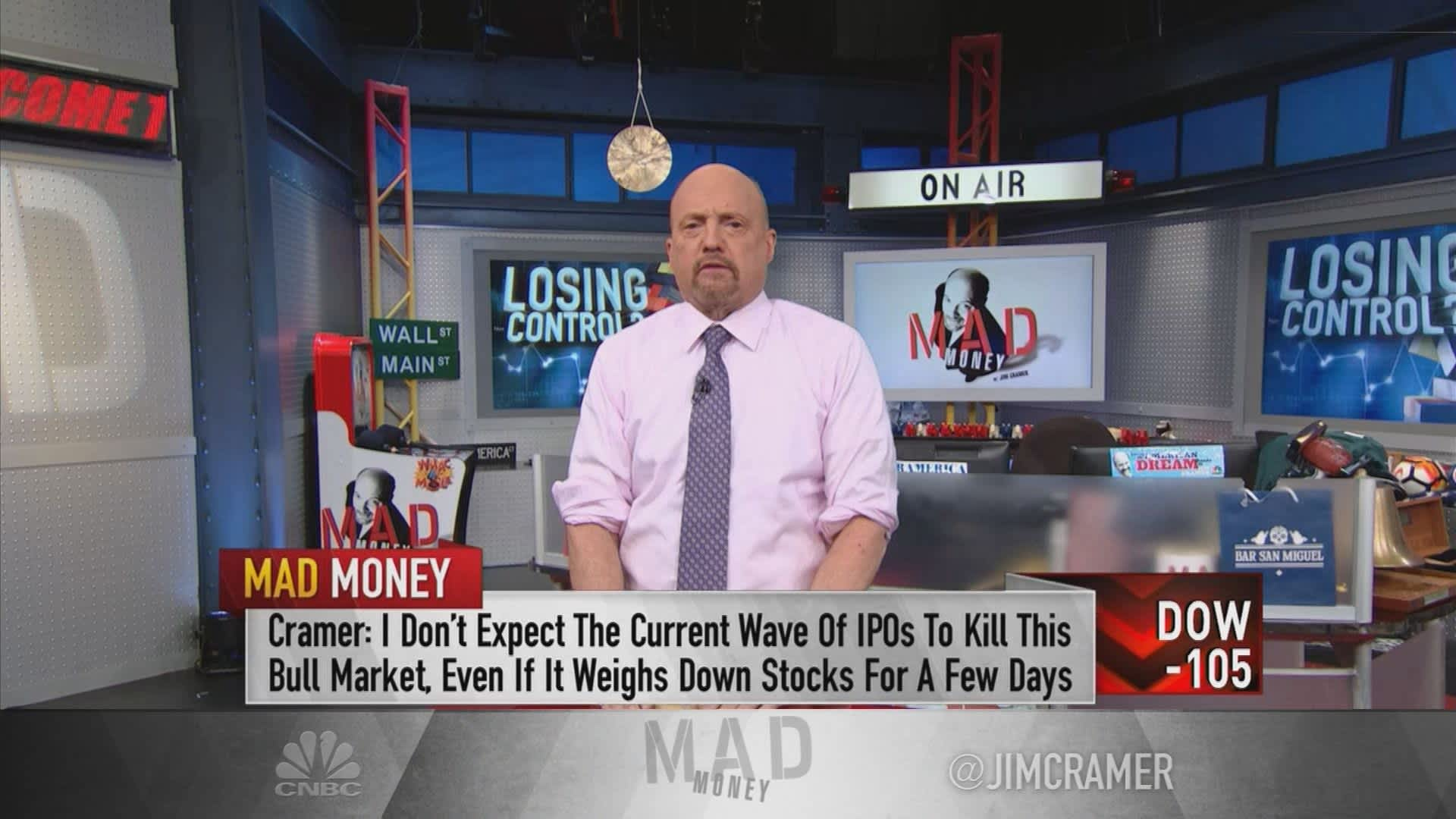

Last week, Jim Cramer said he believed there was “rabid money” chasing technology companies. In particular, he was talking about the robinhooders who frequently use services like DoorDash.

Jim sentiments are supported by data from TD Ameritrade which said about 41% of DoorDash’s trades on the platform were from millennial clients.

Jay Ritter went on to say that the current IPO climate resembles the top of the internet bubble where valuations got way ahead of themselves. Thanks to COVID-19, DoorDash has their first quarter of profitability in the quarter ending in June. Beside that one quarter, DoorDash has never made a profit. And as vaccines get widely distributed, DoorDash may never see another profitable quarter ever.

Jim Chanos is an American investment manager and currently serves as president and founder of Kynikos Associates, a New York City registered investment advisor who is focused on short selling. Jim put it best, these companies make almost no money per order, meaning there are no margins in this business. Then you go the pressure from the labor side. And to top things off, there is no growth in the restaurant business and margins are razor thin.

I’m itching to short DoorDash, but I’m going to wait until the dust settles first.

Posted Using LeoFinance Beta

Your post has been voted as a part of Encouragement program. Keep up the good work!

Try https://ecency.com and Earn Points in every action (being online, posting, commenting, reblog, vote and more).

Boost your earnings, double reward, double fun! 😉

Support Ecency, in our mission:

Ecency: https://ecency.com/proposals/141

Hivesigner: Vote for Proposal