Crocs or Lululemon, Which Comeback Stock Would You Buy Now???

Crocs, Inc., together with its subsidiaries, designs, develops, manufactures, markets, and distributes casual lifestyle footwear and accessories for men, women, and children worldwide. It offers various footwear products, including clogs, sandals, flips and slides, shoes, and boots under the Crocs brand name.

They sold their first pair of Crocs at the Fort Lauderdale Boat Show in late 2002 and by 2007 the company was selling 50 million pairs per year earning $850 million annually.

But over expansion and the Great Recession nearly bankrupt the company. In 2009, they ended the year with a loss of $200 million. That’s when they reinvented themselves and came out with a bunch of new designs.

In 2018, Crocs became a hit with Generation Z. According to a Piper Jaffay study, the shoe move from 27th to become the No. 13th-most-popular footwear brand among teenagers. Also, in 2018 the stock found it grooving rising almost 200% from 2018 to 2019.

Lululemon athletica inc., together with its subsidiaries, designs, distributes, and retails athletic apparel and accessories for women, men, and female youth. The company offers pants, shorts, tops, and jackets for healthy lifestyle and athletic activities, such as yoga, running, and training, as well as other sweaty pursuits; and athletic wear for female youth.

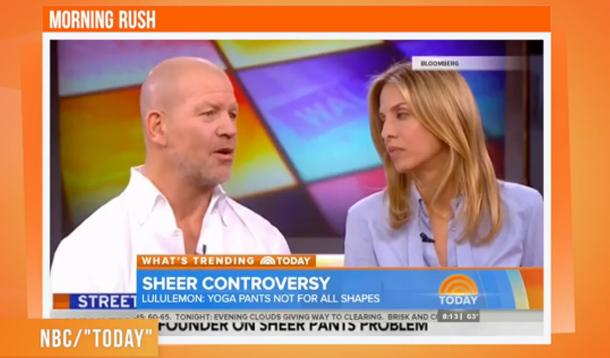

“Quite frankly, some women’s bodies just actually don’t work” for pants. “It’s really about the rubbing through the thighs, how much pressure is there.”

That’s what Chip Wilson, the founder of Lululemon said when he started to receive complaints that its new line of yoga pants were sheer. Needless to say, Lululemon lost about a third of its market value shortly afterwards, Wilson was forced to step down as chairman and $67 million in revenue of faulty pants were recalled, Chief executive Christine Day resigned and Luluemon started losing market share to the competition.

Fast forward a couple of years and the company is in great shape. Lululemon invested in their direct to consumer channel by making investments in digital marketing. This engagement has led to having the right product mix, at the right time and at the right location, which has allowed them to control inventory and drastically cut down on discounts. And when you put it all together, you have the online experience, driving traffic to the stores, where customers don’t have any problems paying $100 for women’s yoga pants.

To me Crocs, represent consumer staples, everyone should have a pair because they are like a utility footwear. I better not say that out loud because the company would tell me they are a fashion footwear company.

To me Lululemon, represents consumer discretionary, everyone wants to have their apparel, but it's not necessary.

Both have cult followings, but which stock is the better buy?

It is hard to believe that Crocs’ stock outperformed Lululemon’s - especially since Lululemon’s revenue growth for the 2017-2019 period stood at 50%, while Crocs’ revenue grew by 20%. Keeping in mind that Crocs’ stock has shrunk 36% year-to-date, while Lululemon stock added another 20%, doesn’t Crocs’ look like a buying opportunity?

Lululemon’s profit margins (net income as a percentage of net revenues) are higher at 16.2% versus 9.7% for Crocs. Lululemon’s strong revenue and margin performance over recent years are reflected in its much higher P/E multiple of 56x (based on its current market price and FY’19 EPS), compared to Crocs’ P/E of around 15.7x.

LULU has a huge customer base and faces less competition in the athleisure space. On the other hand, Crocs faces stiff competition from the large, established players like Nike and Skechers as well as local players in the fragmented footwear market.

Fundamentally, Luluemon is a much better company. But technically, Luluemon is a not touch due to the stock price at all-time highs.

However, regarding Crocs, I wouldn't touch either as the stock price is approaching retail (expensive) prices.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance