Can Gold Really Reach $50,000

The other day, Billionaire hedge fund manager Paul Tudor Jones said he was buying bitcoin Paul believes bitcoin will serve as a hedge against a jump in inflation due to central banks printing money around the world. Paul has been a successful trader for decades and said bitcoin reminds him of the role gold played in the 1970s.

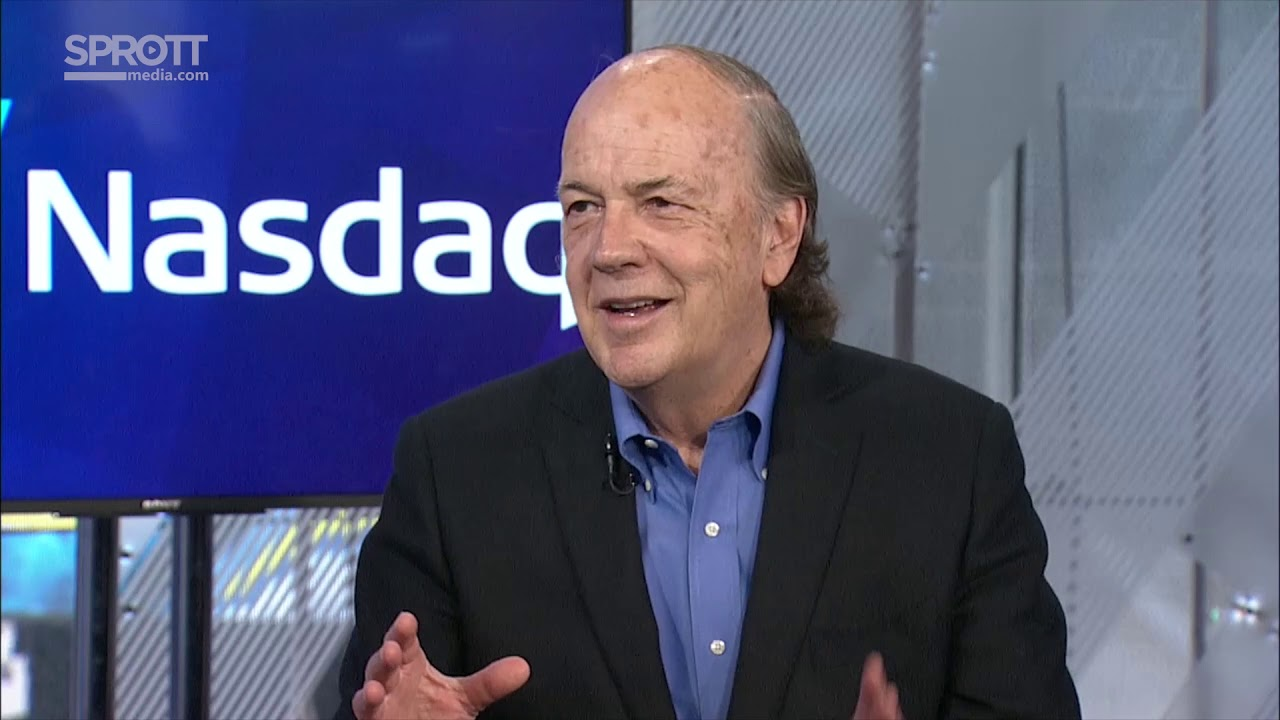

And speaking of Gold, many think gold is an equal or even better hedge than bitcoin. One economist, Jim Rickards thinks that gold will past 2,000 and reach 5,000 then 10,000 and then $50,000.

In 1944 at conference held at the Mt. Washington Hotel in Bretton Woods, New Hampshire delegates devised a monetary system in which the US dollars would be directly convertible into gold and all other currencies would be pegged to the dollar.

In 1960s, the United States had a growing trade imbalance and growing public debt which resulted in the US dollar being way overvalued. In 1971, West Germany left the Bretton Woods system and both France and Switzerland demanded physical gold in exchange for their dollars. However, the issues continued to exacerbate.

NOTE: Bretton Woods established a system of payments based on the dollar, which defined all currencies in relation to the US dollar, U.S. currency was now effectively the world currency, the standard to which every other currency was pegged.

Up until 1971, the U S dollar and almost all currencies around the world were still tied to and backed to gold. In 1971, $32 equaled one ounce of gold.

So in 1973, Secretary of State Henry Kissinger negotiated an agreement with Saudi Arabia, the largest oil exporter in the world that required all sales of its oil to be paid for in US dollars and in exchange the United States would provide Saudi Arabia with weapons and protection. Other oil exporting nations followed Saudi Arabia's lead. This event artificially inflated the demand for US dollars globally since nations that imported oil were essentially forced to maintain holdings of US dollars in order to pay for their needed oil.

Today, gold is approaching $2,000. It’s not that gold got more expensive, itss that the dollar continues to loss it purchasing power. An ounce of gold is still an ounce of gold. It just takes more dollars to purchase that same ounce.

Jim Rickards has done a lot of research on this and he has a lot to say. Jim says that when the dollar crashes, which is the reserve currency of the world, the IMF is going to come in to save the monetary system with SDRs. Now the IMF is the international monetary fund, which is basically above the central banks. The IMF in essence manages all the currencies of the world. When the dollar collapses, they’re going to come in to save the monetary system because no one’s going to trust it anymore. If you can’t trust the dollar, what currencies can be trusted?

The IMF keeps what’s known as SDRs or special drawing rights. The SDR is a basket of currencies. When the dollar crashes, the IMF will come in with a new SDR and Fiat currency of the IMF. No one will trust the new Fiat currency and the IMF will have to go back to gold backed currency because there will be no confidence in money.

So what do you think, can gold hit $50,000 or is the better hedge bitcoin?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance

Yes and Yes.

So you don't need to choose.

Have exposure to both.

Posted Using LeoFinance

So have your cake and eat it too, sounds like a plan to me.

Got more far more Gold and Silver than Bitcoin, wouldn't hurt to have some Crypto.