Big Lots Is The Big Man On Campus

Big Lots, Inc., through its subsidiaries, operates as a retailer in the United States. The company offers products under various merchandising categories, such as furniture, home food consumables which comprises health, beauty and cosmetics, plastics, paper, chemical, etc.

Big Lots operates 1,400 stores in 47 states. There is actually a Big Lot about two miles from my house. Other items in store I have seen include electronics, toys, jewelry and a huge arts and craft section that my wife and daughter love. For those not familiar with Big Lots, they remind me of a Family Dollar, Dollar Tree or Dollar General or steroids. Probably a better comparison is a Ross or a TJ Max. All this to say, Big Lots get excess inventory from others and sell them at a discount.

Their “Store of the Future” initiative appears to be definitely paying off. Their “Store of the Future” initiative allowed Big Lots to play with new store formats and playing greater emphasis on higher-margin categories like furniture, home furnishings, and seasonal items.

In late May, Big Lots said comps jumped 10% in the fiscal first quarter as more consumers turned to fixing up their homes. This made sense as I saw RH and Wayfair stock skyrocket in recent weeks.

So the stock rising almost 30% today after announcing earnings the day before shouldn't have been a surprise to anyone.

Shares of Big Lots (BIG) - Get Report spiked on Friday after the discount retailer said second-quarter same-store results were increasing "well ahead of expectations."

And Big Lots now expects comparable sales to rise in the mid-to-high twenties percent, moderating from quarter-to-date trends.

That number is ahead of the 13.3% growth that analysts at FactSet are modeling for the quarter.

"The company has seen a continuation of the strong demand that began in mid-April, with quarter-to-date comparable sales through fiscal June increasing well ahead of expectations," the company said in a statement.

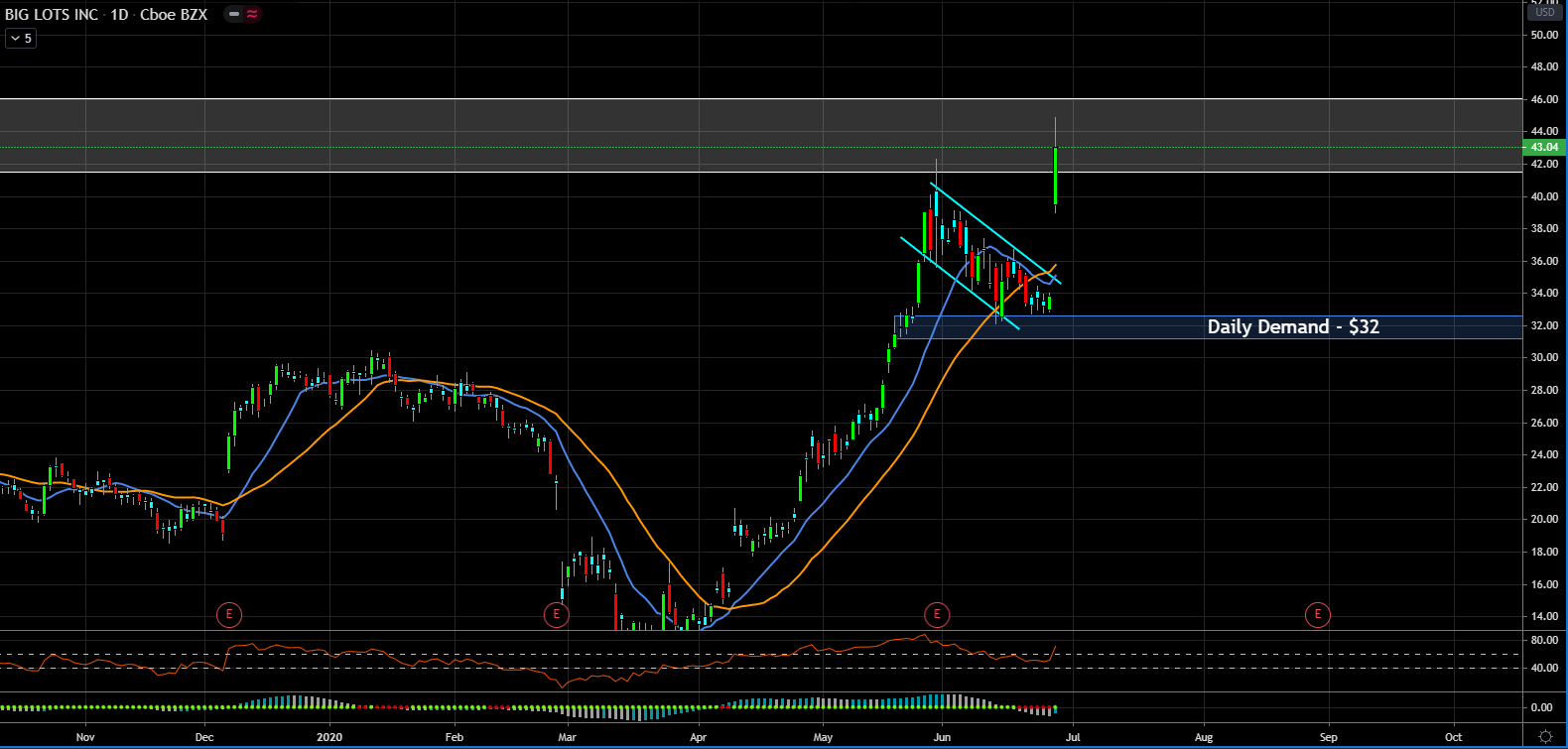

So what do we do now that the stock price has rallied over 200% from the March lows?

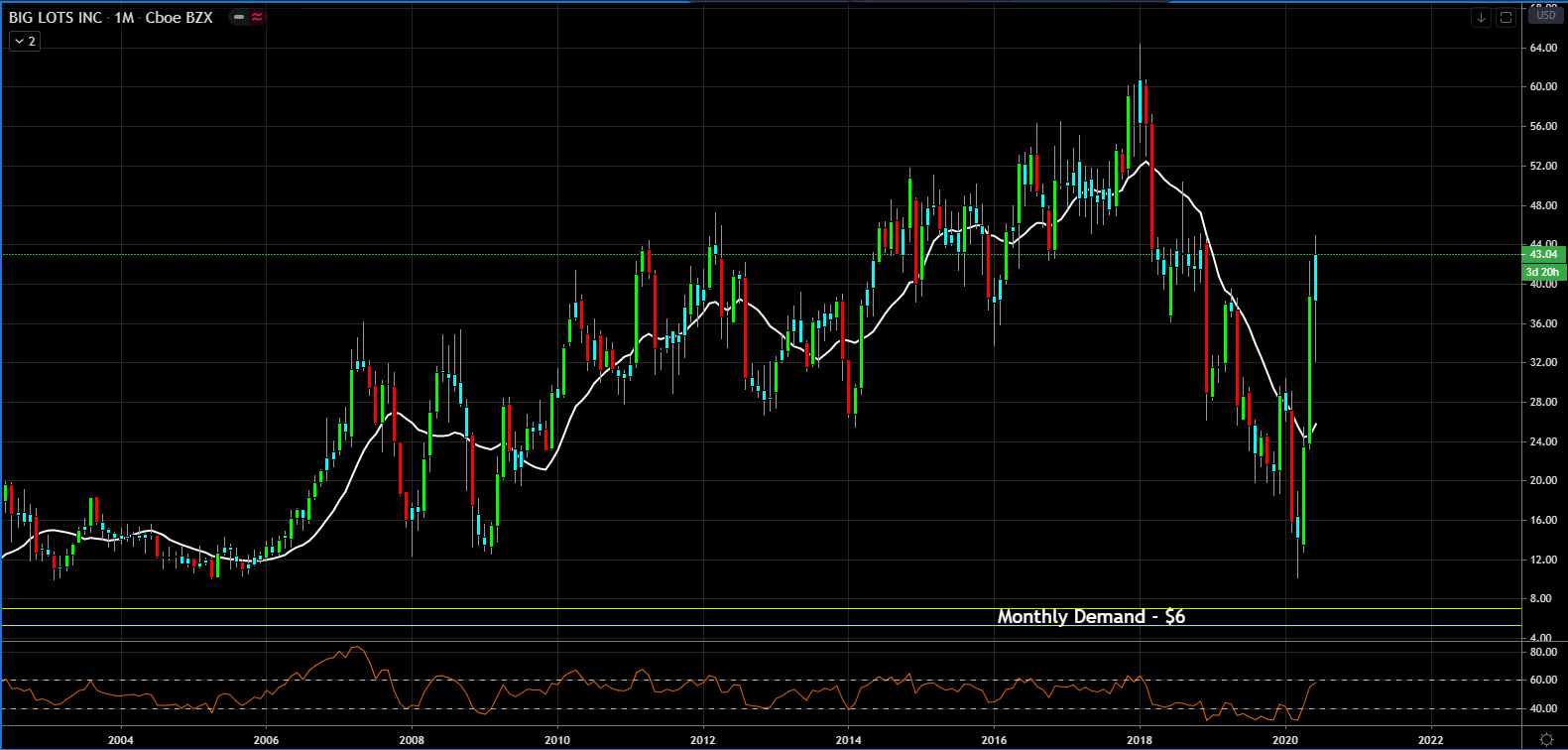

Well, price is now inside a major resistance / support band.

Because that resistance / support band was the origin of the last move down to $12 and because price shot up into the band, the chart suggest to look for a reversal pattern on a smaller time frame and take price down to the daily demand at $32.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance

Haha, I was somewhat confused when I saw the massive spike today.

If anything, it made my portfolio look better...before the reversal anyways.

Good stuff @enforcer48.

Posted Using LeoFinance