Quick Guide to staking on Venus.io and minting VAI stable coin (another BNB DEFI option)

Venus.io is a lending platform on Binance Smart Chain which allows you to stake a range of Bwrapped or Binance chain coins and use them as collateral for borrowing other coins or minting the VAI stable coin, which you can then either stake on the Venus platform (to give you voting rights and to earn XVS) or swap out for other tokens on Pancake swap and use as you see fit.

You also earn interest on your staked collateral (mainly in XVS), with rates varying from 6-17% depending on the coin at time of writing.

You'll need to be set up with Metamask and have that connected to Binance Smart Chain to connect to Venus. If you haven't done this yet, read this post by @empoderat.

The Venus.io homescreen...

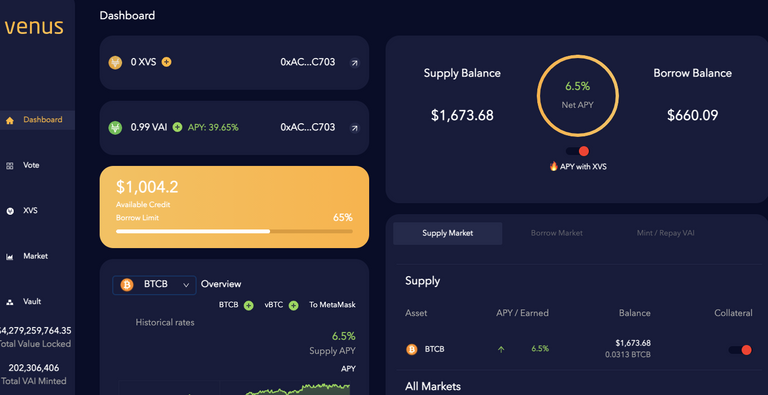

Below is what you'll see when you 'connect your Metamask wallet', your 'dashboard' is displayed as default.

To the top right you can see my supply balance compared to what I borrowed (minted VAI), and my APY in the middle - including my XVS rewards, not a bad return already, but that's just the beginning, the real return is in being able to borrow or mint coins.

You'll be able to borrow or mint around 50% of the value of what you stake - I opted for 90% of my max, then paid some of that back so I'm now at 60%.

Lending/ collateral options

If you click on the 'supply market' options you can supply any of the coins on offer from the list (you'll need them in your Metamask wallet on BSC first), at varying percentages APY. You simply click on the collateral button to supply, you approve it through Metamask, then you're good to go.

I also approved USDT for collateral, but I never supplied any (in fact I borrowed some as a test, then repaid them, silly waste of tx fees!)

Supplying a coin of your choice

If you click on any approved supply coin you get this pop up - and by entering a hypothetical amount (it won't let you enter more than you've got in your wallet!) it shows you the effect on your borrow limit/ limit used) - simply click 'supply' to supply!

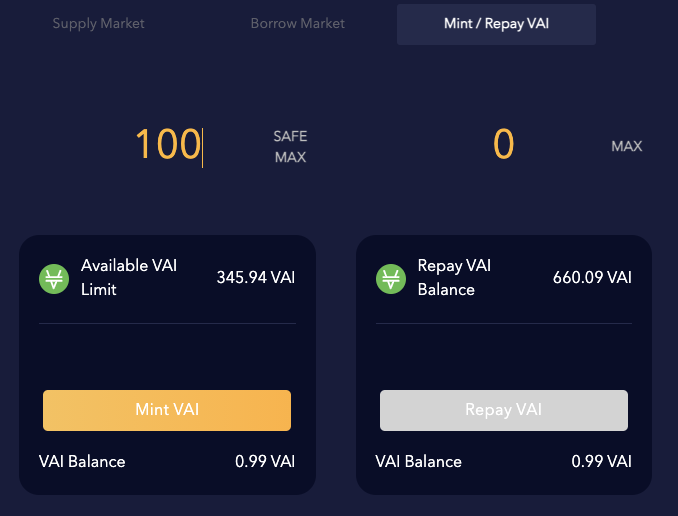

Minting VAI (a stable coin)

You then just go to either the borrow market or mint/ repay VAI options - I didn't do the former, I thought minting VAI was more exotic - you can see that I could mint another 345 VAI if I wanted ATM, but I'm holding off for now just in case there's a BTC flash crash!

I then swapped the VAI I minted for a couple of other coins and pooled them in Pancake swap, but you could keep it all on on Venus...

Staking VAI (if you want!)

The Venus platform offers you the opportunity to stake your minted VAI, which gives you voting rights - and you'll earn a nearly 40% return, rewards paid out in XVS.

You can do this by going to the 'Vault option' at the bottom left.

So yes, you can lend money and earn a 50% return in total on this platform alone.

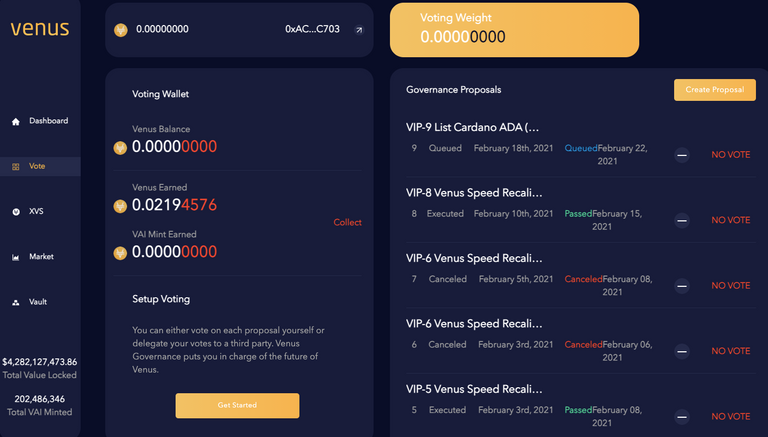

Claiming your XVS rewards

You can claim your XVS staking rewards by clicking on 'Vote' in the left hand menu (OK this isn't that ovious).

At time of writing XVS is valued at just under $80 so I'm not earning a huge amount from having my BTC staked as collateral, but the real potential is in what you mint and then stake on top of this.

Venus.io Final Thoughts...

I had some BTC sitting around in a wallet not earning so I thought I'd try this out to get it staked and earning for me, and so far I'm pretty pleased with the results.

For me this was a good way of hedging into stable coins quickly when BTC was on a run (remember that, from last week?) without selling the BTC!

Now it's pulled back I feel like I've got the best of both worlds!

However as with every financial decision you have to way up the risks with taking your coin out of cold storage and putting it into Binance Smart Chain, not to mention the initial fees of transferring the BTC to Binance.

Posted Using LeoFinance Beta

I should really check this platform out.

Thanks @revisesociology!

Posted Using LeoFinance Beta

Congratulations @revisesociology! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 210000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

I have played around a bit ...I just don't like it there is no liquidation price available, only the 100% share, how much you have borrowed ... and don't let it hit 100% :)

Posted Using LeoFinance Beta

I am assuming I just get back the BTC I put in, the liquidation price remains the same in VAI - I'm keeping it well below don't worry and I've got some funds marked to pay off some.

I didn't stake too much as it's a new thing.

I have been using the platform since last November. I am staking part of my assets to borrow VAI and stake VAI-BUSD to earn CAKE. That way, I am earning Cake from the VAI I borrowed through the platform. It's been working out well for me.

Posted Using LeoFinance Beta

Good to hear it!

Looks like someone is enjoying low fees lately :P

Posted Using LeoFinance Beta

Although I'm now resolved to moving around a certain minimum every transaction, they can still mount up!

many do :D

Posted Using LeoFinance Beta

We can see how biance is destroying ethereum-based dex.

Posted Using LeoFinance Beta

For the time being until they sort those fees out, yes!

I have no doubt that Ethereum is feeling the heat now. They had years to handle scaling but there was no viable competition to pressure them to hurry up and care about fees. I feel like things are different now.

Posted Using LeoFinance Beta

A rocket up their arse me thinks!

Thank you for an explanation that makes sense! I was trying to wrap my head around this platform recently. I get its a lending platform but I was trying to understand the best plays.

Staking loaned VAI for a nearly 40% APY looks good, but what's the interest rate on loaning/minting that VAI? would like to factor that into the equation. Also, how quickly are you able to withdraw your staked collateral, and is there fee's for unstaking within a small time frame?

Appreciate the write up.

Posted Using LeoFinance Beta

I'm only playing around with small amounts - there's no interest on minting VAI - you mint say 500 and you pay back 500 - and it's pegged to the dollar (although it does seem to vary 5-10% compared to USDT when I swap on Pancake, but in my favour recently so that's OK)

You can withdraw anytime.

The sting might come when you try to withdraw - it cost me $5 to withdraw from autofarm the other day, so those costs might be something to factor in - that was only withdrawing $150 USDT - I'd check that out, it might be the same for large amounts, i'm just experimenting myself.

NB I am very cautious about how much I mint - I like to keep it at 50% of my max! You can add in different coins to boost your potential lending amount to avoid getting anything liquidated.

I like it - I get a 6% APY on the BTC and then whatever return on what I swapped out the VAI for - but my next plan is to swap back some of the AUTO/ CAKE I've earned for VAI and then stake that in venus.

Cool, thanks for the heads up. I'll start by playing around with small amounts to feel things out.

Posted Using LeoFinance Beta

Oh something else worth mentioning is that BNB comes under my relatively high risk radar which means strictly less than 10% of my assets.

There's a video by LEOFINANCE recently in which Dalz talks them through all these options.

Thank you for the explanation. A bit above my paygrade but great information none-the-less.

Posted Using LeoFinance Beta

This is so helpful. Thanks man!

Posted Using LeoFinance Beta