You'll now need 1 ETH for every 2500 WLEO!

(Edited)

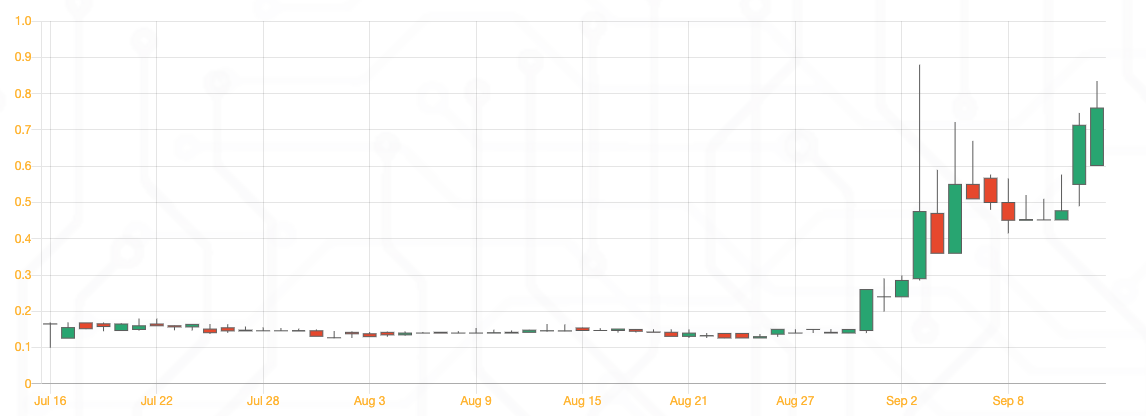

Given that LEO is now at $0.15 and ETH around $370, you'll need 1 ETH for every 2500 LEO you want to convert to WLEO.

At least I think that's the way it works!

And it doesn't look like the price of LEO is coming down before WLEO goes live, so unless yer loaded on ETH, your hopes of staking thousands are long gone!

And then there's the GAS fees on top, so that's more than 1 ETH/ whatever amount of WLEO you want.

There is always the pooling option of course, that @jk6276 is running in which he'll convert some of yer LEO to ETH on your behalf, but that'll eat into yer profits.

The other option is to buy more ETH!

Whatever your strategy for getting into WLEO, I think NOT rushing is probably a very good idea!

Posted Using LeoFinance

0

0

0.000

I do not have eth but is good moment to get a little.

Posted Using LeoFinance

If I am not mistaken, you will only need the matching ETH for the liquidity pool. If you are converting LEO to wLEO but not going into the liquidity pool, no need for the matching ETH.

Some might want to have wLEO under the presumption that the liquidity will be better so as to take advantage of some of the price swings.

That is how I understand but I could be mistaken. Hopefully @khaleelkazi sees this and can answer it.

Posted Using LeoFinance Beta

Yes sorry I don't think I made myself clear at all, I was totally distracted watching the TDF, eating lunch and thinking about LEO when I saw that latest pump, I was talking about the liquidity pool!

It's quite a risk though getting in early on that, I mean you could potentially make a lot more just by selling WLEO for ETH if it pumps hard early on?!?

Posted Using LeoFinance

That's a great point @taskmaster4450le - a lot of people miss that imo.

wLEO on Uniswap (and future exchanges/DEXes) will likely have vastly more liquidity than Hive-Engine. Wrapping LEO for the explicit purpose of selling it into ETH for speculation is a huge use case.

Other use cases off the bat:

I've heard a lot of use cases at this point. We'll see if anyone gets really creative after the launch :)

As for the point about speculation -- it's entirely possible that people who HODL and then try to time the market tops will make more than LP's. I think being an LP will yield a more predictable return, but speculation might yield a higher (albeit more volatile) return -- which is how the market should work imo.

Posted Using LeoFinance Beta

I'm much more a slow and steady main myself, but there's no reason why we can't all do both!

I mean if WLEO goes to $1 there's no way I'm not selling some! It'll be tempting with the LP bounties being paid in WLEO of course, and I'll probably keep a little liquid from my LEO conversion.

Posted Using LeoFinance

Congratulations @revise.leo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP