AskLeo - Is Earning Interest From Crypto Assets Worth It?

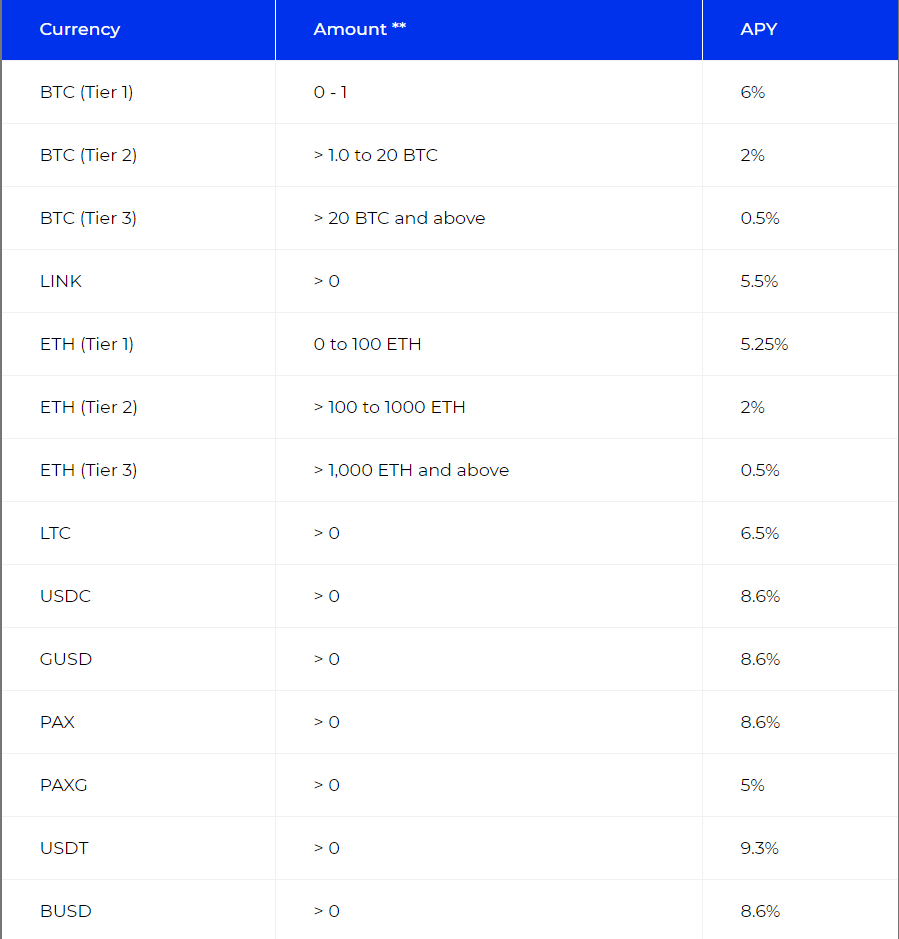

I checked out interest rates paid on BlockFi:

Source: https://blockfi.com/rates/

Those annual percentage yields (APY) certainly look decent compared what banks are capable of paying to depositors.

But as always, whether or not investing in something makes financial sense, comes down to risk/reward ratio and risk tolerance.

I have no idea what degree of risk depositing crypto in a BlockFI account involves. From what I know, BlockFi is generally considered very reliable and the website says they have a perfect track record with no losses so far. They have several risk mitigation strategies in place including lending everything to multiple vetted counterparties.

https://help.blockfi.com/hc/en-us/articles/360049343471-How-is-BlockFi-different-from-competitors-

Given the volatility of crypto, a single digit APY feels quite small.

Of course, for many investors taking out a loan with their crypto as collateral is a way to cash out without incurring capital gains taxes from selling their crypto.

But that comes with a catch. Such loans must remain fully collateralized, which means that your collateral may get liquidated. That is a taxable event. Therefore, you can only cash out a small percentage of your gains.

If you want to cash out the full extent of your gains at the top of a bull market, there is no choice but to sell your assets and pay the damn taxes - or not pay and commit tax fraud.

Posted Using LeoFinance Beta