My Curating Experience in Leo Finance

I have had some Leo since the beginning, even bought 4 LEOMM at the start. With the ascent of the Leo Finance community I have started to try and become a little more involved. I've bought and staked some Leo, delegated some HP to @leo.voter, and started doing more manual voting and interaction on Leo Finance.

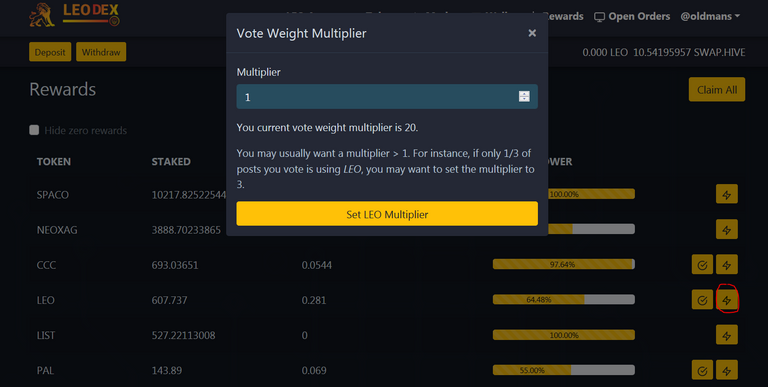

Many moons ago on Steem I ran across a post about multiplying the vote value for the tribes on Steem Engine. I hadn't thought much about that since migrating to Hive but while exploring Leo Dex I found this under Rewards.

I realize this may be old news to a lot of longtime users here but for a relatively new user here this was a great find. I am now able to vote more Leo Finance posts and not effect my Hive voting power as severely. I may need to tweak the settings some but will wait for some more data to review before doing so. At any rate, please feel free to comment or ask any questions. I will answer them if I can. :)

Posted Using LeoFinance Beta

https://twitter.com/oldmans13/status/1324772492213280768

Nice. It seems I see you receive 0.19 Leo tokens from Leo bounties, I suppose that's as a result of delegating to Leo.voter. may I know how much HP you delegated to Leo.voter?

Posted Using LeoFinance Beta

Thank you! Yes, the Leo Bounties is from my delegation. I delegated 700 HP which puts me #79 on a list of #149. If you look at @leo.voter's wallet and click on their delegations you can see the full list. https://peakd.com/@leo.voter/wallet

Posted Using LeoFinance Beta

Okay cool. Thank you

A LEO awakens! How was your nap? Glad to see you're back to take up the hunt. Noticed that new vote on my post yesterday and it's good to have a chance to say hello. And thank you. 🦁

Posted Using LeoFinance Beta

Hello to you and you are welcome! :) As well written and documented as your post was a lot of it was beyond my comprehension for now. I think I am entering the "I know what I don't know" phase right now and posts like yours drive me to learn a little more. :)

Thank you for stopping by!

Posted Using LeoFinance Beta

As you read more about wLEO v2, it'll all make sense. DeFi has seen the rise of all these different AMM's. Uniswap is probably the most popular one. We can now pair tokens and enter them into Liquidity Pools. The pools can be risky, as LeoFinance found out. But they can also pay 100-130% APR. That's not including extra incentives newer tokens might offer.

Hope that helps a bit. Balancer is another AMM with a different twist. Pairs don't have to be 50/50 on Balancer and you can have more than 2 assets in the liquidity pool.

Posted Using LeoFinance Beta

I almost took the plunge right before that all happened. I was going to add to a pool @jk6276 was running for the @spinvest group. Not sure if he is going to do that for v2 though. I may have to go it on my own because those type of APR's are too good not to at least give it a try. :)

Posted Using LeoFinance Beta

Seriously. wLEO is new and improved. They've locked down the security this time. I'll be ready with some LEO & ETH. 👍

Posted Using LeoFinance Beta

Welcome back friend, I will be looking forward to your publications and your work.

Curation and Education Project for LeoFinance

@erarium

This post has been voted on by Erarium's Curation Team Our goal is to reward financial content within the Spanish and English community for LeoFinance. We have liked the content you have expressed in this article and we would like to invite you to continue developing material of this type, and to use the #Leofinance tag in order to make the community grow.We invite you to join the LeoFinance Discord so that we can interact and continue to grow.

Erarium Discord

Posted Using LeoFinance Beta

Thank you, much appreciated! :)

Posted Using LeoFinance Beta