YIELDBONDA Token - The 15% Yield Farming Bond

YIELDBONDA is a new token listing on hive-engine/leodex offering 15% APY.

Overview

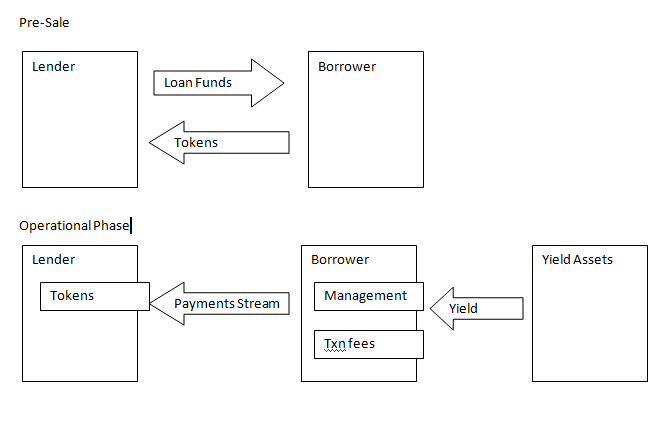

By buying this token, you are making a loan of funds to me @nealmcspadden. The funds will then be used in stable coin platforms to provide a level of principal security while obtaining a yield sufficient to pay the note.

The token is available for trading at https://leodex.io/market/YIELDBONDA

For purchases in currencies other than SWAP.HIVE, see Special Notes below.

Tokenomics

- 100,000 tokens will be created, representing 100,000 USD of value locked in the token.

- Each token holder will be paid weekly or monthly at an annualized rate of 15%.

- Example

- Joe Smith holds 10,000 tokens.

- His expected interest is 1,500 USD per year (15%)

- If the weekly mode is active, he will receive appoximately 28.84 USD in payments each week

- Payment methods may change, but at this time all payments are expected to be in HIVE at a daily fix price.

Pre-Sale

- A pre-sale will take place until at least 30,000 tokens have been sold or Dec 31, 2020 is reached, whichever comes first.

- If fewer than 30,000 tokens are sold by Dec 31, 2020 then all funds will be returned to lenders.

The token price will be fixed to 1 USD each morning.The token price is continually adjusted to be within 1% of 1 USD. As the price of SWAP.HIVE varies over time, be sure to calculate your own yields based on the current market price.Example

The morning fixed price of 8.333 is based on 0.12 $/HIVE.

Over the course of the day, HIVE rises in value to 0.14. At this price, 8.333 will cost 1.166 USD in HIVE, reducing your yield.

Future Development: We plan to implement a script that will re-list the price of the token as the price of HIVE changes rather than manually re-listing once per day.

Operational Phase

- Once at least 30,000 tokens have been sold, the loans will become active.

- Funds will be moved off the HIVE blockchain and into ethereum assets in order to obtain a yield.

- Payouts will start approximately 1 week later. There may be small timing differences based on network congestion and gas fees. If gas fees rise too high, payouts will shift to monthly.

- The token will continue to be sold until all 100,000 tokens are sold. After that point, users may sell their token on the market for any price they wish.

- Weekly updates will be provided on the status of loans and payments.

Exits and Redemptions

- There are 3 methods of exit:

- 1, Sell your token to another user. The market price will vary depending on demand and whether the total supply has been sold or not.

- 2, Once in operational phase, you may redeem your loan with 1 week notice to me. Your balance will be impacted by gas fees of liquidation. Effort will be made to pick low-fee times to liquidate, but cannot be guaranteed.

- 3, If yields collapse to the point that maintaining the 15% payment to lenders is unsustainable, lenders will have the option of liquidation & return of principal or accepting a reduced payout.

Risks

- All loans carry risk.

- These specific stable assets are chosen in order to minimize those risks, but they do not eliminate them.

- If a stable asset is found to be fraudulent or hacked, it can and probably will affect the balance of funds and the ability to pay the stated rate of interest.

- These loans are non recourse.

- Do your due diligence on the borrower and the intended uses before making any lending decision.

Special Notes

- You'll notice the name YIELDBONDA. I expect that if there is sufficient interest, more of these bonds will be offered in the future.

- If you want to pay with something other than SWAP.HIVE (e.g. LEO, ETH, BTC, etc), contact me directly on discord @nealmcspadden#9419. Minimum quantity for direct sale is 5,000 tokens. Start your message with "YIELDBONDA"

My Thoughts

I am pretty excited to see this model develop. While it's not the first crypto-based loan product in existence, it may very well be the most accessible to date. By utilizing stable coin assets, we are eliminating the majority of risk to any kind of yield farming. You are lending in USD, and we are putting USD to work.

The risks that remain are basically platform hacks (very low risk in my opinion) and stable-coin demonetization. For example, if the STABLE Act that some Democrats are pushing for passes, USDC might have to reorganize. Or if the crypto world turns on USDT, then that will impact that portion of the portfolio.

Overall though, I think this is going to go great. Effectively, it's a super high-powered savings account. If yields on farming operations come down to the point where 15% isn't feasible any more, then the loan balances get returned and you go on your way having made 15% all the while.

Watch this page for updates over time.

Posted Using LeoFinance Beta

Alright good sir, I'm in!

Posted Using LeoFinance Beta

Awesome! You're officially the leader of the pack

Posted Using LeoFinance Beta

Wow!

Posted Using LeoFinance Beta

Got a small bag.

Nice!

Posted Using LeoFinance Beta

Love this idea, sign me up for 4000 tokens via BTC 🦁

Posted Using LeoFinance Beta

Will do!

Posted Using LeoFinance Beta

Wow Great.

Is the APR fixed at 15% or can increase/decrease depending upon yield or returns?

Invested a little only 1$ but plans to buy little with time.

Posted Using LeoFinance Beta

An idea, I would love the feature to reinvest what I earn rather than getting dividend. As it will allow less gas fees and compounding affect at same time. Don't know if it is possible with partial people demanding it, but it would be a great in long-term.

Posted Using LeoFinance Beta

The 15% is fixed.

Reinvestment is just too complicated to implement at this point. You'll be able to do it manually though. The advantage to bundling here is that gas fees are spread out through the whole balance of funds. And then once it gets to hive, no gas at all.

Posted Using LeoFinance Beta

Hey man, nice idea :)

What if the price of HIVE tanks 10-15% between now and then? Like you sell $10k worth of your token for HIVE but you cant buy $10k worth of stable/ETH tokens because the HIVE price drops.

I like the way it's valued in dollars and how it's a simple idea. Simple idea's for the best. I think you'll do well, I was just wondering about the above.

Posted Using LeoFinance Beta

Yes, I am taking some market risk in that scenario. It will depend on how long it takes to hit 30k and what the pice of HIVE does in the meantime. With the numbers involved, I don't think we will see very large volatility of that type for this window of time. Worst case, my profit gets squeezed.

Fortunately, gerber is a maniac and already has the ask-pricing script done so it will constantly be repricing tokens to keep it within 1% of 1 USD.

Posted Using LeoFinance Beta

Ok, ok. Thats cool. Thanks for getting back to and explaining that.

Gerber is a good dude, good to know his working with you

Posted Using LeoFinance Beta

Great, will consider buying these tokens once I get to my next power down. I've been using the funds to acquire more tokens or transfer to projects that help with passive income. Thanks for the project! :D

Posted Using LeoFinance Beta

I'm sure there will still be plenty available.

Posted Using LeoFinance Beta

15% a year is quite attractive, I hope you succeed with your project I will analyze it and I also hope that the Democrats do not succeed with that law

Posted Using LeoFinance Beta

Thanks!

Posted Using LeoFinance Beta

Sounds interesting, having to dive in that one - seems on leofinance a lot is happening which I hoped for the main Hive chain.

Posted Using LeoFinance

Leofinance is where it's at

Posted Using LeoFinance Beta

Nice idea !

Posted Using LeoFinance Beta

Thanks!

Posted Using LeoFinance Beta

Cool idea. Anything that saves me Gas is a good investment!

Posted Using LeoFinance Beta

What's the human risk here? Eg could you get hacked or just run? Are the assets on eth secured by Multi sig via gnosis or other services?

Posted Using LeoFinance Beta

Human risk is me. I could go to Tahiti and live for a couple months on 100k. Assets are single-sig.

Posted Using LeoFinance Beta

why would anyone invest into this token when you say stuff like that? obviously it seems like you would just cut n run or say ur account got hacked yadadaadad and bam we are left fucked, no real investor will invest into this project. cause your risks are out of this world.

Posted Using LeoFinance Beta

Interesting concept. It shows that loans can be given also outside the banks, even if the rate is a killer. :)

Here the crypto needs to mature to have decent interests, for the one borrowing I mean, that cover the fees and help launch the project needed.

Just one thing, there is a risk, especially on Hive that it can have an increase of 4x-5x in the next months, which can bring this project on the edge. There have been different bank models in the pre-hive era, one successful was the one of neoxian, who made good deals and one disaster was the one of zeartul that got hit by the same issue I mention here, the increase of the token. :)

Posted Using LeoFinance Beta

Hive is just the medium exchange here. Everything is denominated in USD.

You lend 1 USD, and you get 15% interest in USD.

Posted Using LeoFinance Beta

This is much safer. The interest is a killer, but it is very appealing in a negative interest market. Every investor would love to have a ROI if 15%/yearly.

Posted Using LeoFinance Beta

You're a real hero @nealmcspadden

There were many folks who didn't get into Ethereum DeFi because the GAS fees were eating into profits. To have someone experienced like you handle everything like this is a huuuge!

You're basically like a hedge funder manager on Hive :)

Posted Using LeoFinance Beta

Except that a hedge fund is an equity share, where a loan is not.

Posted Using LeoFinance Beta

Yep. That's true!

But the effects are much similar in terms of ROI.

Posted Using LeoFinance Beta

It's a well thought out plan. I'm just getting almost overwhelmed by so many new developments on HIVE. At the end of the day I'm very positive about out future. @leofinance Aleaxa Rank climbed 471K spots during the last 90 days. With microblogging I'm expecting a lot more in the future.

Posted Using LeoFinance Beta

Thank you!

Posted Using LeoFinance Beta

How to get paid reward from leo finance? Sorry this question not relevan with your blog. From newbie.. Thanks

Posted Using LeoFinance Beta

https://leopedia.io/faq/

Posted Using LeoFinance Beta

<3

Posted Using LeoFinance Beta

I just got a couple to see how it does... sounds interesting

I assume the payout will be in HIVE, as I guess you are going from Eth farming to wrapped hive to hive?

Would you be willing to pay out in LEO or is that too complicated? or is that yieldbondb?

Another question:

why? What is in it for you?

Posted Using LeoFinance Beta

I'll probably end up going through binance. whive has no liqudiity.

I could pay in LEO if that's what people want.

What's in it for me is the spread between 15% and what I can generate net of fees.

Posted Using LeoFinance Beta

well, if you pay in leo you can go through the wleo pool which is also good for the community... and we know there is liquidity there

I like this idea of paying in LEO

Posted Using LeoFinance Beta

This is scammy as fuck.. you can run with the money anytime, invest in Wise instead its trustless:

I invested 0.39 ETH today in Wise, it was created by hard critics of HEX and I decided to give it a go.

Www.lassecash.com

Calling projects scam while spamming affiliate links to some project that has no real use-case (seems like a ponzi to me) is not the best way to get people interested.

He wrote it himself somewhere, he could run with the money... its not a smart contract, all payments are manually handled... so yes it is a scam in crypto terms.

Wise is 100000 times wiser: http://www.ilovewise.tech

Of course, there are risks. But trying to promote affiliate links to some project does not make WISE looks better.

So you get tokens for staking tokens. Where does value come from?

Also, trying to hide a referral link with a domain does not make it much less spammy.

Wise is HEX without 50% origin address and not 100% ETH to founder. HEX is the most appriciating crypto asset in 2020, so CDs on the blockchain has entered the scene, whether you understand it or not.

That being said there are many aspects about Wise that I still don't know, so I simply ask the question is Wise much better then Bitconnect and Hex?

Crypto noob @fbslo !

Hex is a total scam. Just because it's going up does not change this.

Maybe a little, but just because it's better than obvious Ponzi schemes, does not make it a good project. They are all useless scams.

Here are some reasons why I think HEX is a scam (from their website):

No legit project can give you a 40% APY. At least not in USD terms (it's easy to just create tokens).

So those who stake coins receive money from those who don't. But why would anyone keep unstaked coins if they are losing money? It works only as long there are people buying it, so they could make money from other people buying it.

Any coins that are promoting their gains to get investors are most likely "get rich quick" schemes.

Again, promising to get rich quick. Solid projects don't need this. Scams do.

As do any other ERC20 token.

Again, where does value come from? You can't just "print" new coins forever. It has no use-case, you can't build smart contracts on it (ETH), it's not a store of value (BTC)...

Remember Wise founder was the hardest critic of HEX on youtube almost a year ago!!!

This does not answer my question.

What makes WISE valuable except hoping to get a bigger sucker to buy it later (aka ponzi scheme)? Why should I invest in it?

CDs are a huge market in traditional centralized finance, much bigger market then money itself that Bitcoin and other address... Wise is the best CD on the blockchain till date in my view! Thats why!

You are forgetting few things:

But if you lock HEX or WISE, no one is investing this money to earn any profit. So where does the interest come from?

I dont agree, fiat money is a huge scam.

Not really how fiat money works, you are are a noob.

There are risk of how the token appreciate, no one deny that and Richard Heart was too greedy with 100% origin address receiving all ETH and all rewards copied to origin address too!!!

True, but not as much as WISE or HEX.

Please explain how the monetary system works then. How do banks make money to pay for CD interests?

Please watch this video: https://odysee.com/@UtahMtb:3/the-american-dream:c

Its pretty accurate but exchange the "red shield banksters" with Illuminati, then its more accurate and also they have a ball/planet in the graphics, earth is flat... other then that pretty strong video!!!

I am well aware of how does the monetary system works.

But it's hard to take someone how actually thinks the earth is flat and controlled by Illuminati seriously, lol.

How predictable. Earth is light!

I dont know if I will call HEX a total scam, but I left ones I realized that RH had so much of the supply.. 100% of the ETH and 50% of the HEX or more...

Bitconnect was obviously a scam, it was not a decentralized smart contract, just like the post authors is a 100% scam... Wise is the best we have http://www.ilovewise.tech

go on your way

Posted Using LeoFinance Beta