US Stocks - FEDS throws Kitchen Sink!!!

If there is any good news to speak of with the current US stock market it is that relatively speaking it has appreciated over 400% percent from its lows made in 2008 with respect to the S&P. Beyond that there is a lot of uncertainty ahead and likely more big swings in prices to come.

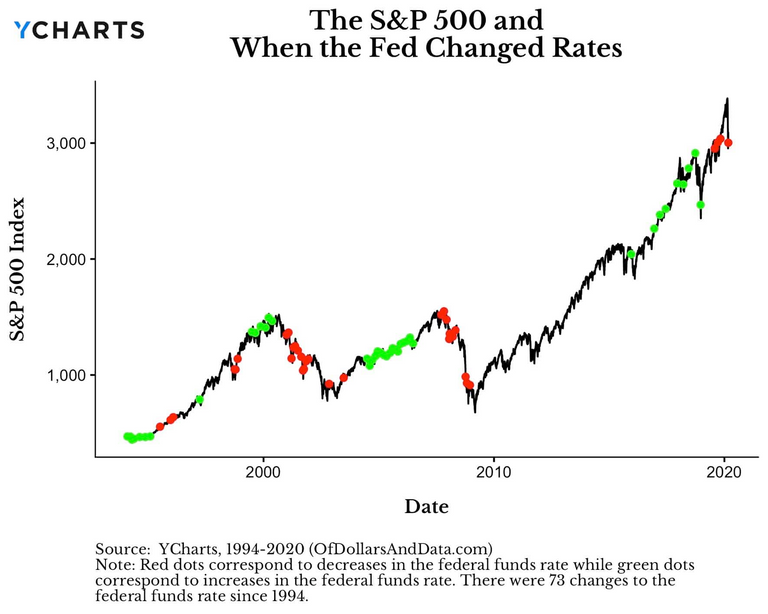

Although the country and the global economy is facing stagnate growth it is also facing the health crisis in the coronavirus. The challenge to maintain a clam and stable market has likely taken a toll in recent weeks and now it has come to the point where the FED is doing as much as it can to stabilize the markets. In a time frame the previous month the FED not only had started to reduce Repo they had also maintained the economy was strong enough to handle no more rate cuts. This was when rates where still at 1.5%. In less than a month we are currently sitting at 0.25% which is essentially zero! FED has changed its mind and whether they were lying last month or the circumstances have force them to take this kind of action the bottom line is the economy will be facing a lot of challenges ahead.

FED Emergency Cut Rates

Throughout the history of the FED every time rates were cut before its monthly meeting is a very good prediction that the future economic prospect of the USA faces headwinds. Today , on a Sunday afternoon, the FED took it upon themselves to perform what is the largest Emergency rate cut and monetary support ever in the FED's history. They simply cut rates from 1-1.25% to 0-0.25%, which basically means zero. They also will provide 500 billion in liquidity to purchase US Treasury while adding 200 billion for banks mortgage back securities.Although the country and the global economy is facing stagnate growth it is also facing the health crisis in the coronavirus. The challenge to maintain a clam and stable market has likely taken a toll in recent weeks and now it has come to the point where the FED is doing as much as it can to stabilize the markets. In a time frame the previous month the FED not only had started to reduce Repo they had also maintained the economy was strong enough to handle no more rate cuts. This was when rates where still at 1.5%. In less than a month we are currently sitting at 0.25% which is essentially zero! FED has changed its mind and whether they were lying last month or the circumstances have force them to take this kind of action the bottom line is the economy will be facing a lot of challenges ahead.

Stock Market Limit Down

Last week we had a total of three circuit breakers activating. The first two were limit downs where the S&P drop more than 7% while it finished Friday with a S&P up more than 7% for the third being a limit up. Currently Sunday evening futures are locked as they are showing a limit down of 5%. If it stays in this range by morning trading opens at 9:30am EST it will only need to drop another 2% for what would be the 4th circuit breaker triggered in the month of March. Obviously a lot can still happen since the FED seems to be proving they are willing to be the backstop to the market. However current actions proves there is still a lot of uncertainty that lies ahead in the future for stocks.What to do?

The simplest is to do nothing and continue to invest bit by bit into this drop so to lower dollar cost average into the markets. Others may have plans of shorting the market but at current conditions where markets have drop swiftly in the past 3 weeks it is worth noting that a swift rally similar to the one we recently witness on Friday can happen unexpectedly and hence trap shorts. Furthermore what is not to say Futures go green before markets open? The most passive side would be to stay in cash, which is surprisingly the safest bet currently made by the majority of investors. With current global slowdown the demand to get out of the market and hold cash has never been so high. Yet the amount of dollar even with the FED support may not be enough to handle the market sales. Basically the stock market is having a bank run, where all investors are willing to sell only to hold cash rather than any other form of investment. This includes gold, bonds, and equities.Posted via Steemleo

0

0

0.000

Congratulations @mawit07! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Have a witness !BEER

View or trade

BEER.Hey @mawit07, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking.