Trading Telsa Options (A Legal Scam!!!) - Trading Journal (09.17.20)

Today markets started out deep in the red but closed in the middle of the drop. NDX stocks were the lagers while value stocks flat to green. I have seen this play out more than not for the past few weeks to almost two months. Tech stocks are either flat or decline while value stocks continue to ramp up. This is a common theme of sector rotation, where money flows out of one sector and is traded into another sector. End result is not necessarily a bear market but large sum of amount of money in and out, which can attribute to the price volatility we have seen lately.

Yet there has been something attributing to the price movement more than sector rotation. The retail trading options better known as Robinhood traders are buying call options to the point where it has pushed certain stocks up. Telsa TSLA is one of them.

Ever since the March bottom Telsa has rose up exponentially and even after the 5 to 1 split stock has remain closer to its all time highs. With so much red in the markets and many stocks not near their all time highs one must wonder why Tesla has so much investors buying in. Well main reason comes to retail traders purchasing call options on stocks like Tesla. Their calls when stacked forces market makers who sold the calls to purchase stock shares in order to hedge and keep delta neutral. Too many traders buying on the calls forces the market makers to but a lot of shares to keep their delta neutral. It comes to a point that there is too many call buyers and when one starts selling and the selling of the call options continues the underlying price will likely drop. This is because market makers who sold the options once buy it back can remove the shares they own by selling it into the market. Too many sellers with a small exit will likely erode a lot of investors.

Here is an example:

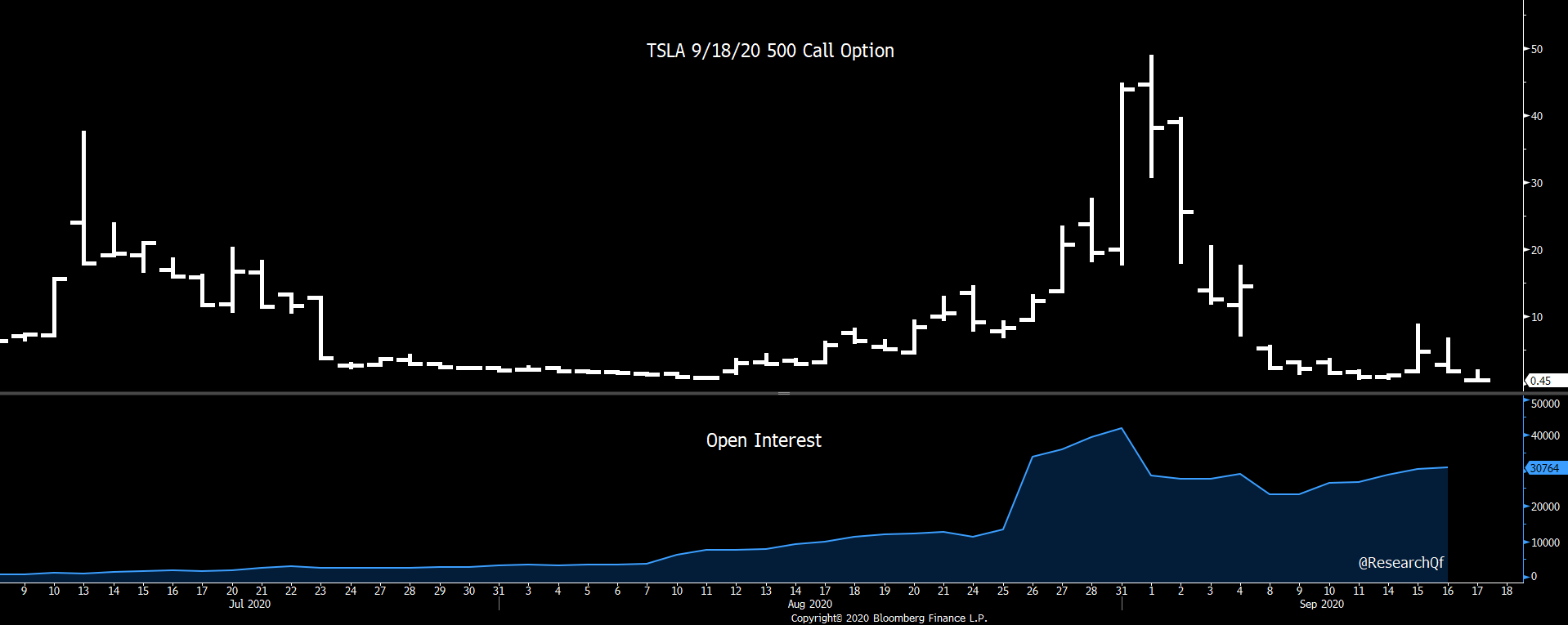

TSLA call options dated 9/18, expires tomorrow, 500 strike at its highest value was $43.85/contract.

Where it had its peak in open interest, meaning maximum contracts open, there were close to 30,000 contracts. Imagine at $43.85 x 30,000 x 100 = 131,550,000, that is $131.55 million just in that one strike at its peak. Now those contracts are worth $0.22 as the underlining closed today under $424. It still has potential to rise but very unlikely to get to $500 and above in just one trading session. Basically those millions from those who bought are now holding worthless contracts. Most of those bought contracts are likely retail and the ones who sold it to them are market makers which are the big whales of trading. So who came out ahead? Those who sold before the contracts peaked at $43.85 and market makers for being able to sell all those contracts because at the end of trading tomorrow the contracts will expire worthless.

Imagine now there are 10s if not 100s of these call options across every week and for the current week to be trading this heavily is remarkable. To those who buy these contracts its not investing as much as it is gambling. At the end of the day they are more likely to hit buyers with massive losses for the chance to earn massive gains. This type of trading truly is what is making current markets so volatile. Tesla is only one of many stocks that are in this same predicament. How many traders got stuck holding these worthless contracts:?

Posted Using LeoFinance

Congratulations @mawit07! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP