Trading Journal - Four Days Green before 4th July (07.02.20)

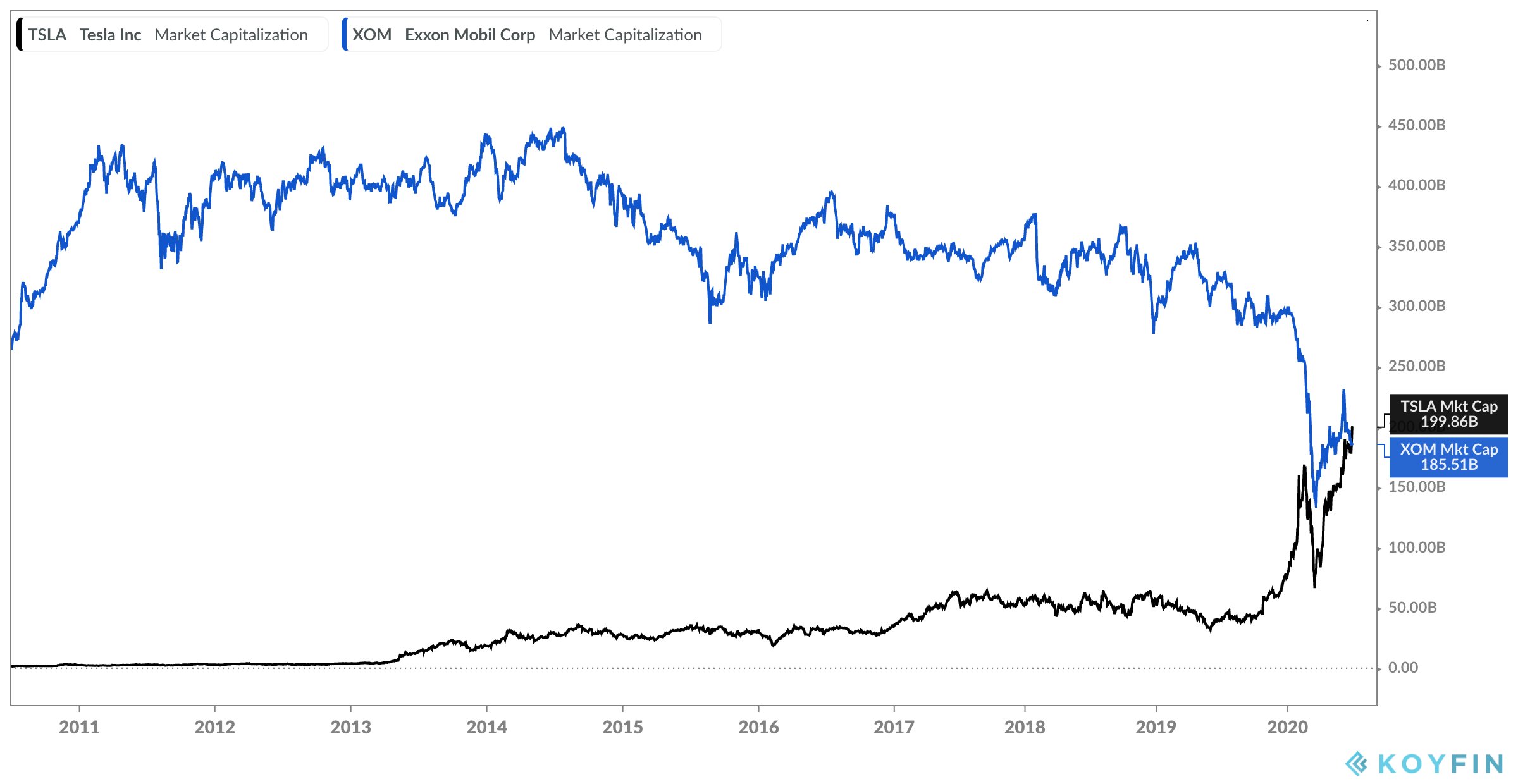

What this week brought was pain for bears and gains for bulls. Although multiple bad news kept piling up such as virus spreading faster in certain states and mortality starting to rise or the rioting turning more violent. In the end markets continue to climb and climb significantly. SPY is 6 points away from its June high at abouve 315 while QQQ is hitting all time highs again. The demand for high growth is shown ever wider when compared to long term blue chips. Just look at Telsa versus Exxon Mobil. The gains in one is the loses of the other.

With a long weekend coming up it would be safe to not be holding any position for the coming week. Not to say or predict that a decline would happen but having a whole week basically green and having tech stocks such as Shopify, Zoom, and Tesla flirting or at all time highs leads one to wonder when there will be consolidation or re-tracement to the down side.

What to do next week trading wise?

The ammunition to go short is filling up, however all drops have been met with heavy buying. Next week will be no different hence a few things to look out for prior to shorting anything.

Extended RSI may lead to a pull back in the near future.

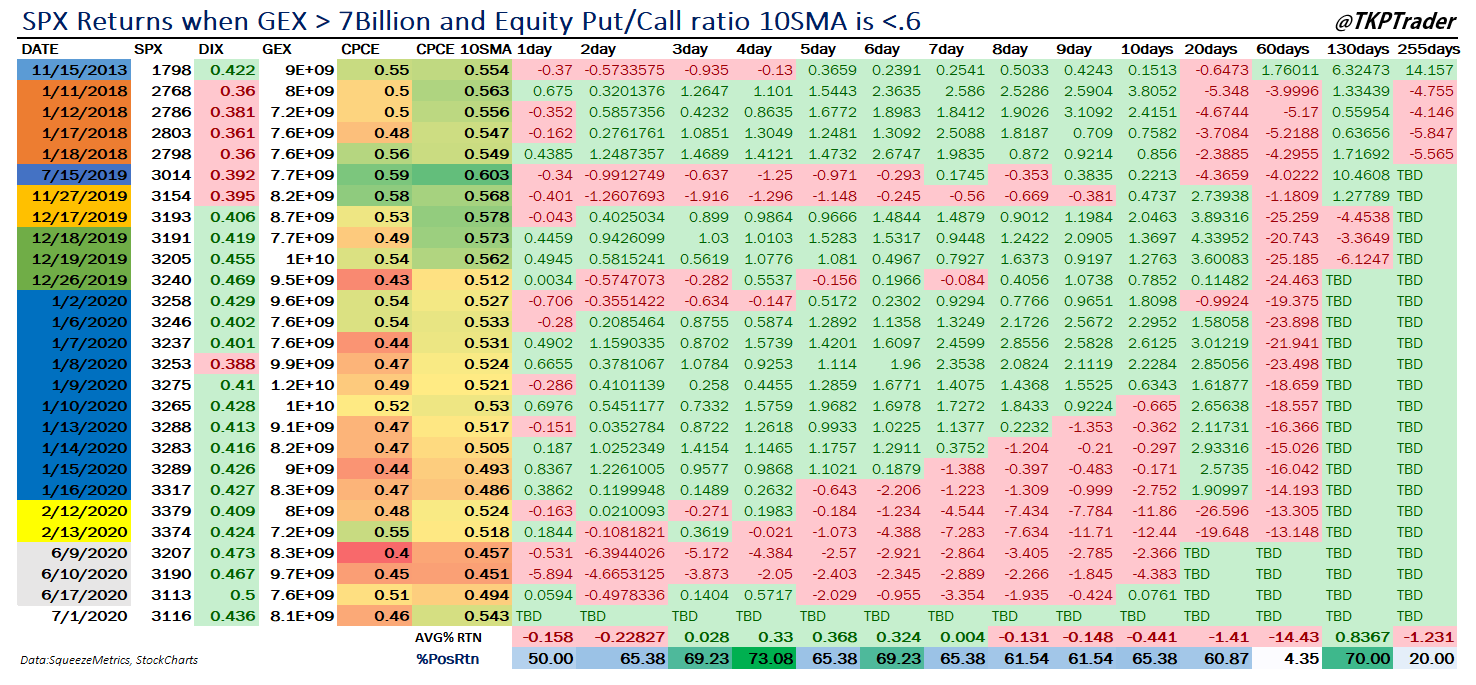

Yesterday's index closing prices had a high GEX and mid dated returns have come out to be negative while longer dated have been positive. It will be interesting to see if we will face a draw down in the coming weeks, but again not set in stone.

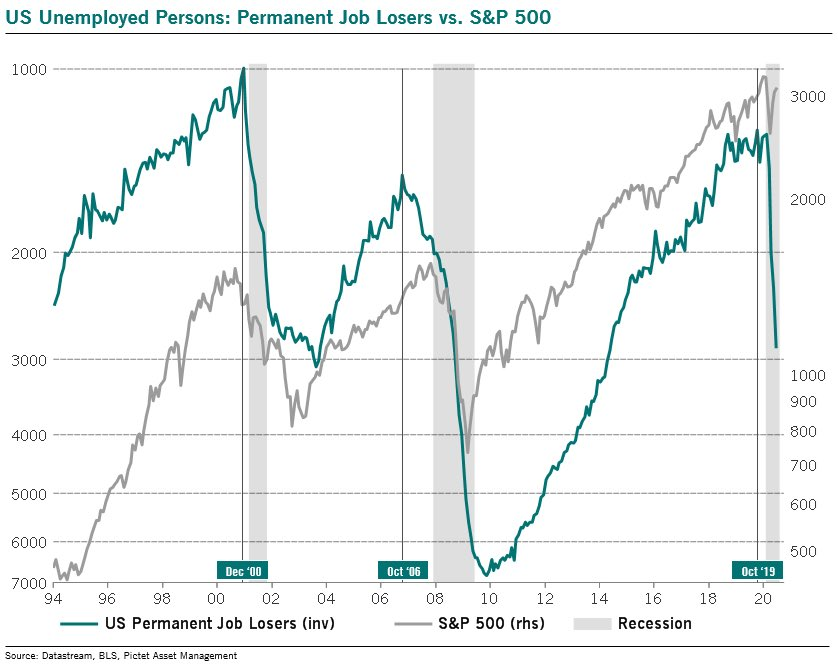

Why would I want to short? Not necessary short but hedge positions. Chart below best shows the divergence between stocks and reality.

The job less is having little to no effect on equities this year. Without income there is no consumers. The stimulus checks are coming to a stop in the next couple of weeks. Can the real economy sustain the growth in stocks? We will soon find out but I am betting it will not hence eyeing on shorting stocks. High growth such as FANG, MSFT, and TSLA. Without consumption there will be lack of demand which in turns lower profit margins.

Posted Using LeoFinance