The Continue Stock Drop - Trading Journal (09.21.20)

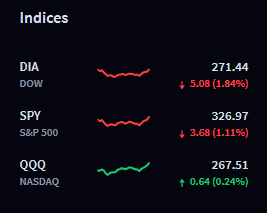

Today markets opened lower and continue throughout the day. However a late rally in tech made Nasdaq close green from as low as -200 while pulling the remainder of the market higher off their lows. Nasdaq deep red to green has not happen since 2000! A impressive feat for buying the dip. The question now is if the green in prices will continue or drop?

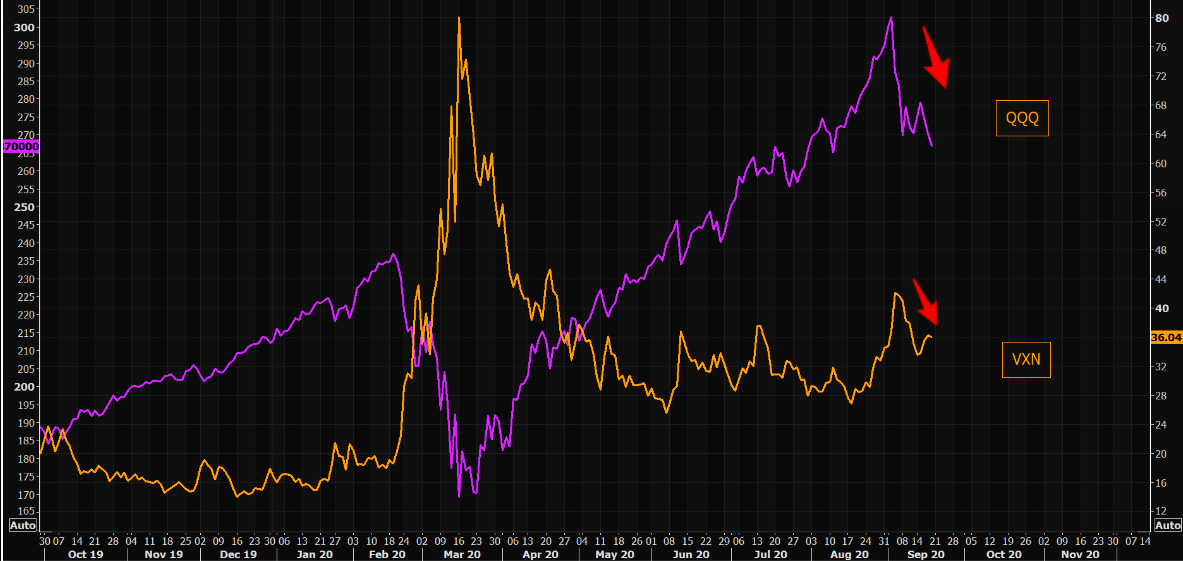

VIX is looking to ramp up even though today it sold off. The pressure from having volatility exploding may back fire. Last week even with VIX lower the markets continue lower. If prices continue to drop traders with large positions will have margin calls on their positions and may have to release their shorts on VIX allowing a big push up in volatility.

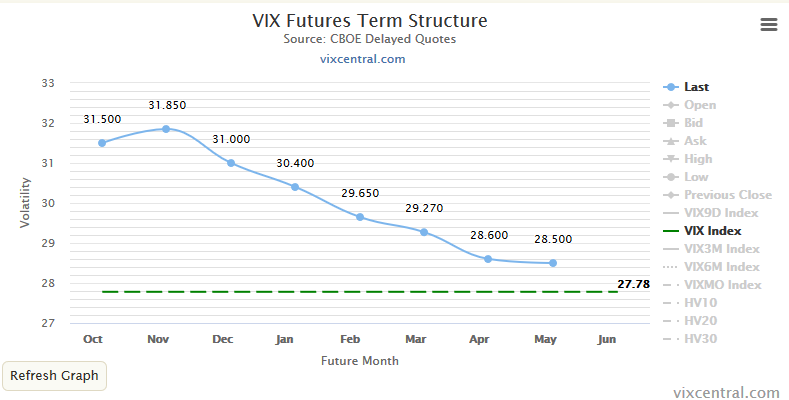

Volatility is currently in contango which is bullish for stocks. This is because the predicted future volatility is higher than the actual volatility. The anticipation is more often than not excessive so VIX futures being a lot higher than actual in time the futures VIX will likely drop. However that is not always the case, there will be circumstances that will make the actual VIX rise to meet the VIX futures. In this case it will mean stocks will roll over.

However current stock price drop for the past three weeks has shown little to no fear in the markets. The odds that actual VIX will rise is less likely because of this, however it does not mean stock prices can rise. The actual fear if introduced into the markets will likely crash the markets.

Tech - QQQ and SPY are in downtrends but near support levels. QQQ bounced off their monthly support around 260 while the SPY at 321. Today markets bounced. Will it continue is the question. Just note VIX has been calm as of late so if real fear sets in the market may likely flush down quickly. If VIX does not move higher the odds are likely prices will continue rising but again even if VIX is down does not mean prices must rise as the past three weeks have shown.

Posted Using LeoFinance