RED in Markets Today - Trading Journal (09.03.20)

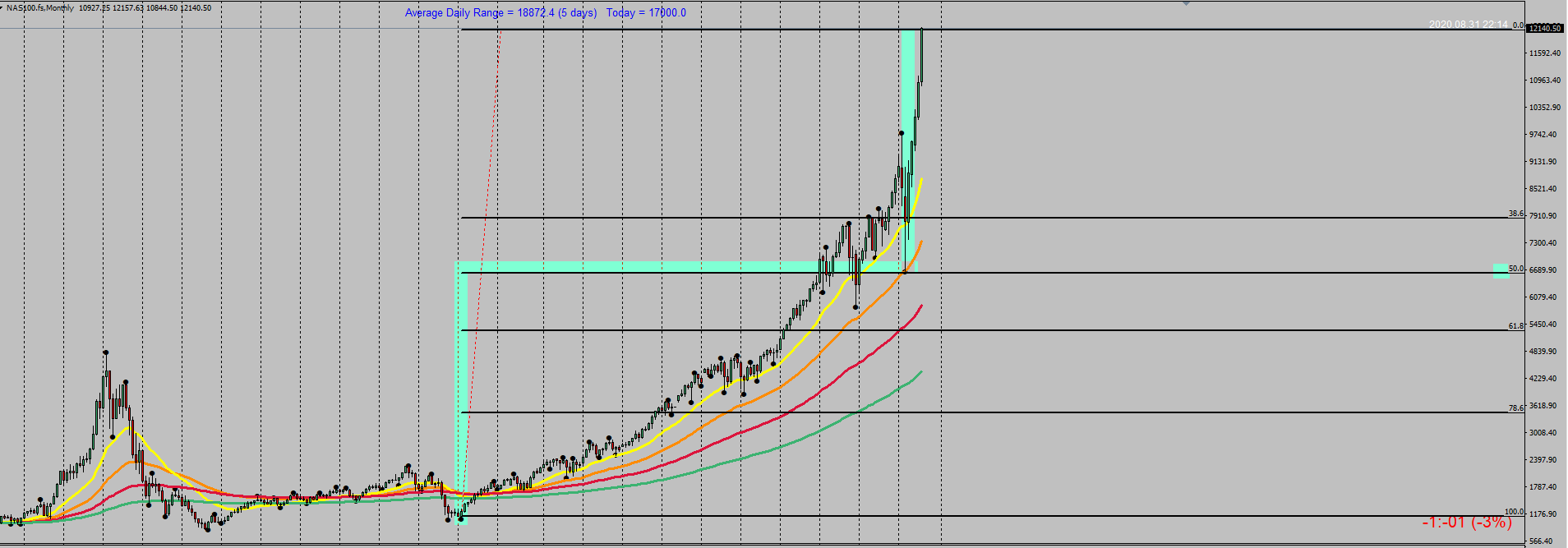

Prior to today's meltdown the NQ had risen almost the same magnitude that it did from March to yesterday compare to that of the 2008 recovery up tp beginning of 2020. Remarkable. What happen today was a decent sell off where SPY drop close to 15 points and closed around 345 for a total drop of 13 points. Yesterday was a all time high and now first sell off the day after all time highs.

The DIX continue lower to 35.5% however the GEX has dramatically fallen from a lower high. The dark pool value being at a low for the year similar to March has me believing that we are near a bottom and that price will be pushing up very soon. Contrian view here is that as stock prices drop to a point where there are no more dark pool sellers it will mean they will buy up the stocks. This is not to say with certainty that markets will swing up tomorrow. As a matter of fact today's drop in NDX, tech sector, as been hit exceptionally hard. It will take time to recover from if indeed we are still in a bull market.

Some interesting charts I spotted through fintwits.

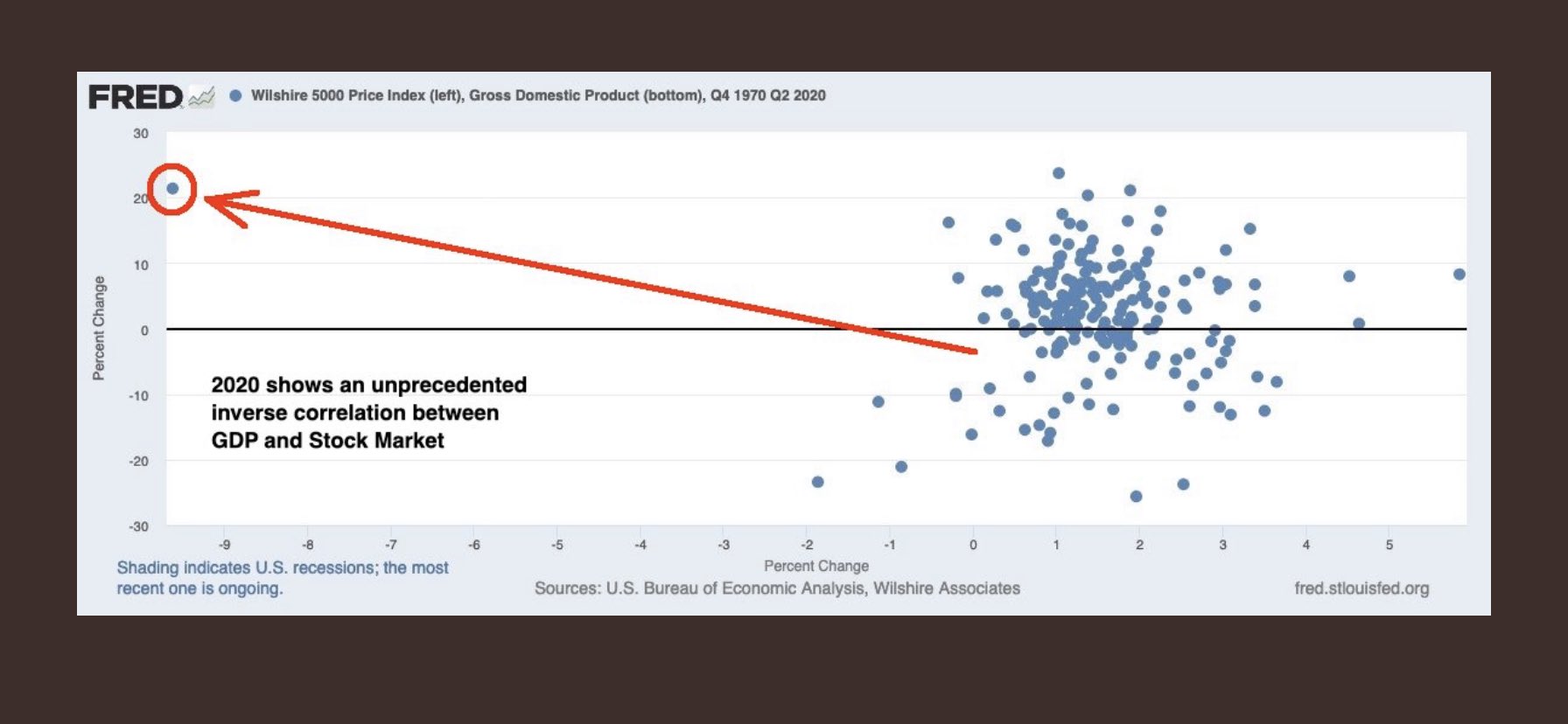

Current stock price appreciation while GDP is negative is an out lire compare to previous years.

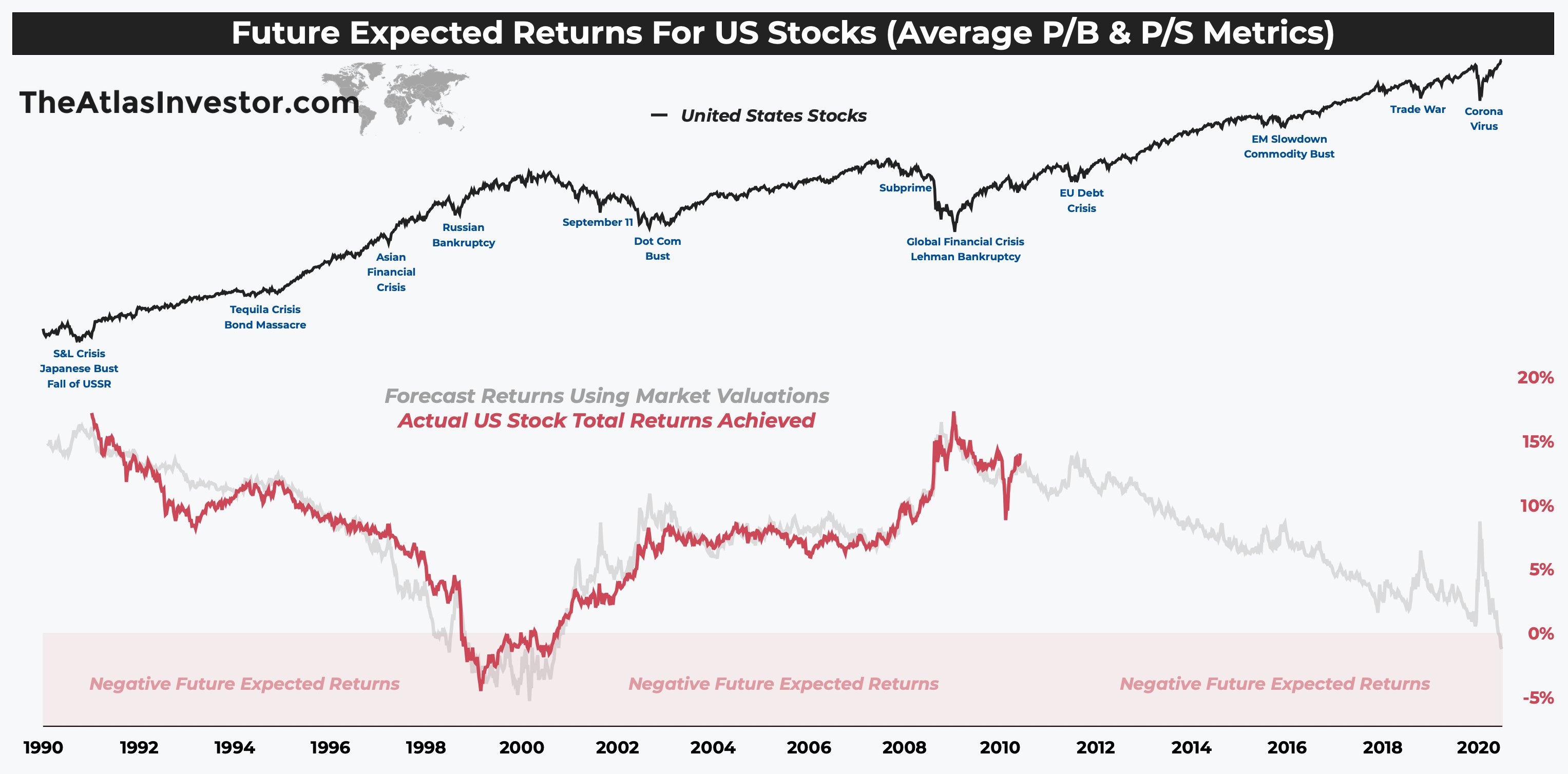

This chart is showing a comparison between current market's evaluation of stocks for future revenue/profits while the chart on the bottom is showing realized revenue/profits. Not matching at all and it is showing that there is mountain of optimism with higher evaluations.

Another omnious sign is the ticker ACWI which represents many global companies around the world and it has reach the top of a megaphone and just turned red. Has the top in US stocks appear to have approached?

On a side note my put trade was a successful profit although I sold way way too early. The Sept. 18 2020 @ 351 strike I sold for a measly gain compare to what the day turned out to be, which was total stock market carnage with very few places to hide such as bonds and gold/silver.

Posted Using LeoFinance

🤙🤙🤙👍👍👍