QE is Deflationary, here's Proof - Trading Journal (09.28.20)

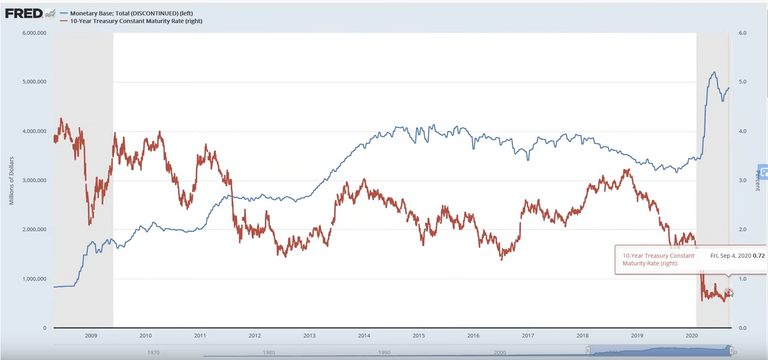

The chart at the front of this post is the prefect reason why QE is deflationary. Since 2009 to date all QEs that have operated the end result has brought the 10 year bond yield from a little over 4% in 2009 to 0.67% in 2020. How would lower bond yields equate to higher inflation? It does not. The irony though is with money being deflationary it does not mean the real economy is deflationary. Far from it. Expenses and goods have risen over the decade while the value of the dollar has continue to decline. Yet the rate of return for holding the dollar in bonds is at record low. Imagine down the road bonds that are 20 years or 30 years being sub 1%. It would be anticipating the dollar saved will only come back with $1 cent in interest for the next 20 or 30 years respectively. No where near expected GDP growth of 3-4% and no where close to growing enough passive income to live off for retires. Hence people are piling into stocks and risky assets in hopes of earning higher returns to beat out the drop in value of the dollar.

The stock market has for years played the role of inflation as traders and investors pile into FANG stocks and high growth to fend of dollar inflation. However what if the play was actually incorrect and the reality is the dollar is becoming scarce and demand for it is rising. We saw this first hand in March of this year where the market basically rolled over continuously and drop more than 30% at the fastest pace ever. The stoppage of this roll over was no other than FED's promise of infinite QE. Yet it is clear that QE is deflationary towards the supply of the dollar.

Then there is the virus that has been plaguing the reopening of the country and on top of all that is the US presidential election year. So many uncertainties and yet the market continues to rise and increase in evaluation.

The FED is buying up more and more assets but it has yet to really spur the economy. What the future holds for the US is very clear as many other foreign central banks have done exactly the same as US and more but yet are unable to create sustainable economic growth in their respective countries. Just look at the yields in Euro Bonds.

Bonds there have now gone negative forcing investors to move out of bonds and into risky investments. The final outcome for the US with all this FED intervention has yet to unfold therefore stocks have yet to get align with the economy. Until that day comes it is easier to be long index funds than trying to short.

Posted Using LeoFinance Beta

But will this still hold true if/when the velocity of money pulls out of its nosedive?

https://fred.stlouisfed.org/series/M2V

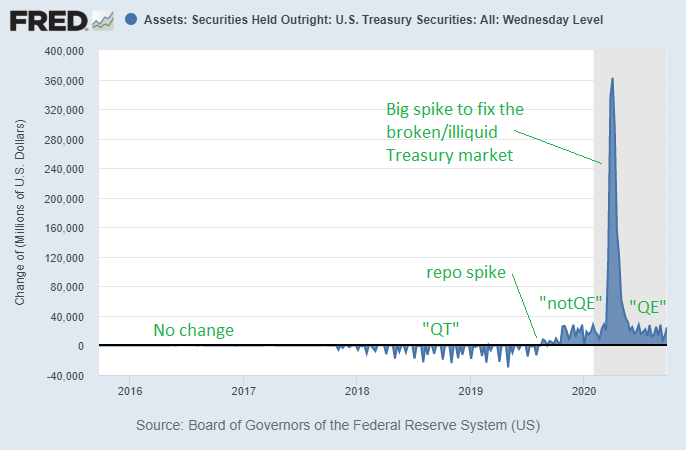

Yes MV turning will create inflation. The current condition is deflationary and MV dropping hard should led to stock markets sell off. When exactly is the sell off is in question since a lot of what FED has really done up to know has mainly been draining money out of the system but yet markets remain close to all time highs.