Make or Break Week - Trading Journal (09.12.20)

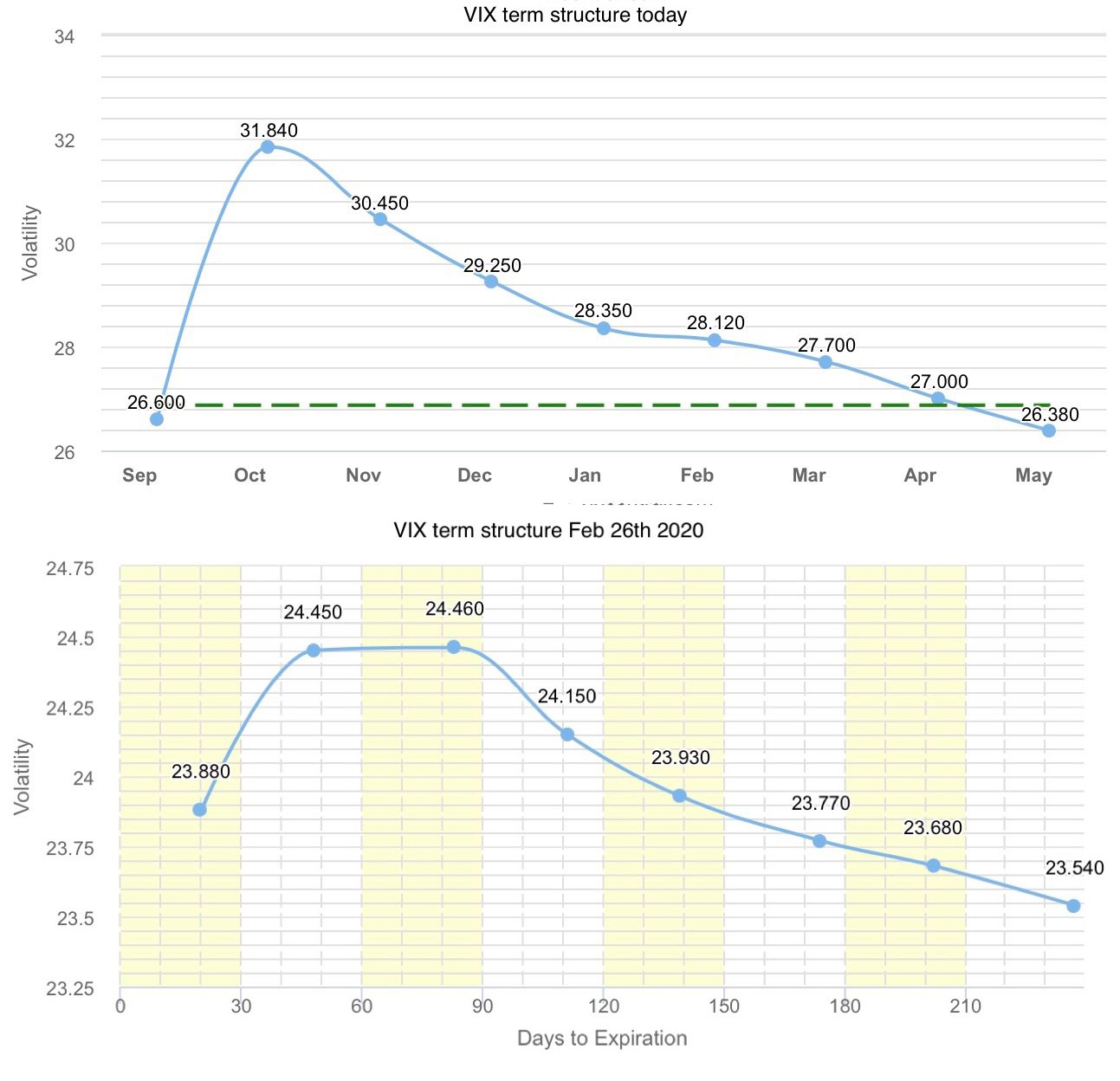

In February 2020 markets had reached an all time high while the VIX was still at record lows but rising. At the end of VIX February monthly expiration markets maintain its ramp up, only to start its massive decent the day after VIX expiration. For those who are unaware VIX monthly contracts expire on the third of every Wed of the month.

Two outcomes can happen here with the VIX contracts for Oct. They can either drop therefore push markets up higher or they can pull spot VIX up which will likely mean a fall in the markets. I am currently leaning on the former and we will know soon enough as this Wed. is the third of the month where Feb. contracts fall out and October to take their place.

Headlines Matter This Week

Many times I keep hearing traders say news is only noise and that stocks move based more on their prices. I have come to realize this is true most of the time and have tried learning more about Technical Analysis and trading strategies. What the odds are for news to actually effect the markets is really dependent on where the markets are leaning towards. Currently VIX is descending and in a down trend, however as shown earlier the future VIXs are at highs.

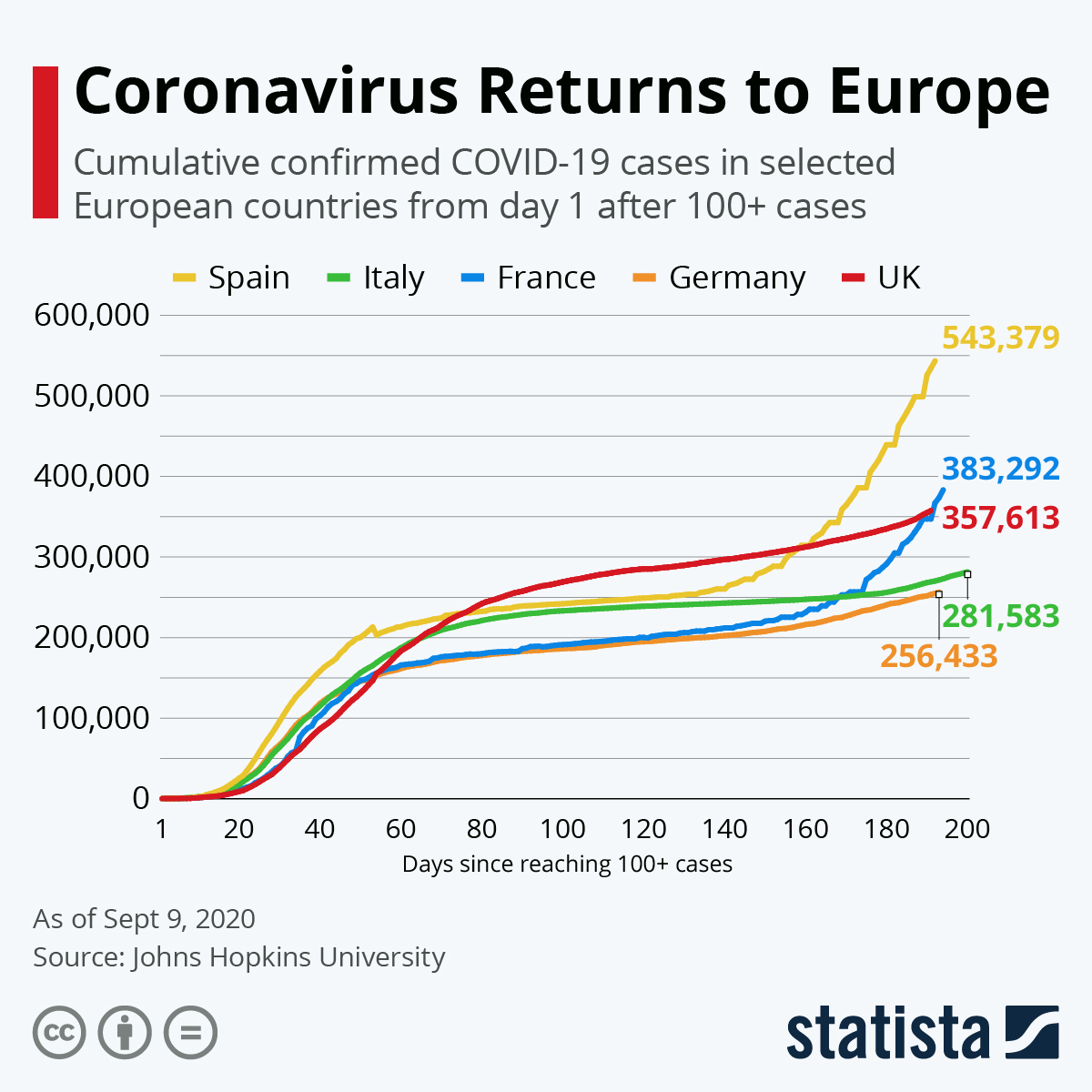

In Feb. VIX futures months were also elevated but what broke the camel's back in stock prices was that Covid was starting to effect multiple nations and stoking fear of USA Covid spreads. By March the fears came to reality and markets had already accounted this with multiple days of 5% drops. The country shut down for weeks and reopening has since been a struggle.

In Feb. the current news event started to matter to the markets because it stoke fear into investors. The process has initiated this September due in part the future VIX is pricing in turbulent times ahead. What could go wrong? Here are some head lines that could stoke fear into investors.

1- Tik Tok shuts down. (Sept. 15, 2020)

China news outlets have already mentioned China's CCP government will not allow owner of Tik Tok to sell to a US company and rather it close. This will deal a huge blow to China and US trade relations and all those years building up to current successful negotiations between both sides. President Trump has not back down from his executive order that Tic Tok will have to be sold or face shut down in the US by Sept. 15. How convenient it had to be this coming week?

2- September VIX future Contracts ends (Sept. 16, 2020)

Although not necessarily a news event but stocks/chart news never the less. As mentioned in the beginning the Sept VIX contracts are much lower than October. Why? Is anyone's guess. But what is important to know is that because of the big difference there will likely be a significant move in the markets this coming week so that Spot VIX will adjust accordingly. A steady to lower spot VIX will mean higher markets. While opposite is true with higher spot VIX will mean lower markets.

3- Stimulus Bill 2 Passing (Ongoing Date?)

How convenient that this past week the government decided to not pass a bill and announce no additional fiscal spending will be pass before the November elections. The elections are two months away but current economic conditions in the real economy is clearly not steady. A lot of expectation is riding for a Stimulus Bill but if nothing gets done how long does the bullish optimism be for stock market when expectation for a Bill was to be passed.

4- Students going back to School (Sept. Month)

As most public schools begin opening again after Labor Day caution is in the air as to anticipating what Covid will look like in the next few weeks. A lot of schools are operating differently but there are schools where students are physically in the classrooms. The spread of Covid is a concern and if cases start rising again this will stoke fear in the markets similar to how it did in February.

Colleges had reopened a few weeks before and currently are not getting ideal results in slowing down Covid from spreading. In addition data out from Europe in recent days is showing signs that with the continent reopening there has been more cases.

A caution is warranted this coming week as there are other headwinds the real economy is facing. Natural disasters to riots in many US cities. One obvious certainty is this week will be turbulent for the markets. Good luck and hope everyone profits.

Posted Using LeoFinance

It's why I'm not placing swing trades to the upside and spending more time in cryptos to find projects I want to invest in for the next 20 years

Posted Using LeoFinance