LOL S&P almost all time highs! - Trading Journal (08.12.20)

All time highs on SPY has been met. Now what is next? It is odd to think that reopening of the country post covid19 is a good news event, but at the beginning of the week this was the trade to play. Any stock related to a potential reopening due to lower cases of covid19 had a potential to the upside. Airlines, cruise Lines, travel agencies, restaurants, casinos, theme parks, retail, and so on were mostly going up at the start of the week. A mad dash toward value stocks and drop in growth stocks was the theme. It played out just like so in the first couple of days only to spin off the opposite direction on Wednesday. NDX closed up over 300 points in gain on Wednesday and is a little more than 100 points from its all time highs. In the mean time SPY was able to get over the February highs of the year and turn green.

I will be keeping a close eye on bonds and USD value as those may potentially hint on deflationary economy which in turn means head winds for stocks. The RSI and MACD are lower where it is today compare to February of this year but neither has flat line so more upside potential to come in markets.

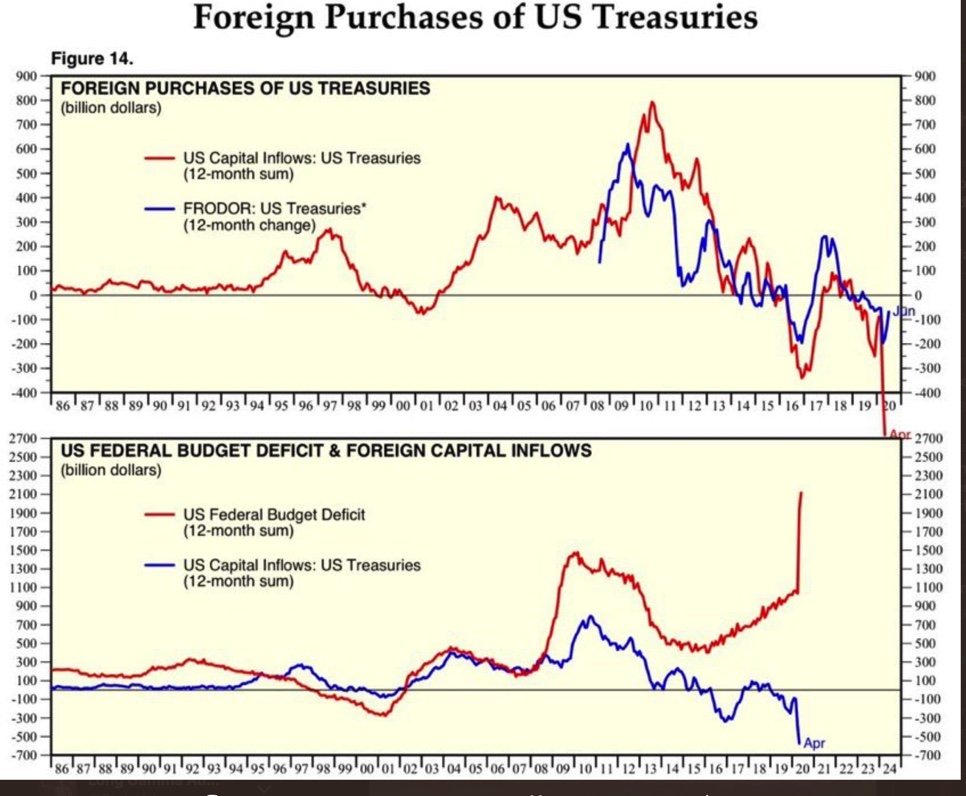

This chart struck my interest as it appears in 2020 there has been significantly less foreign buyers for US treasuries. This is not a good sign as US needs buyers to fund is deficit. The Fed will likely have to intervene with QE to alleviate the need of foreign or domestic bond buying, but this will be a challenge since currently rates are at or near zero and there are plenty of cash in banks but not enough lending.

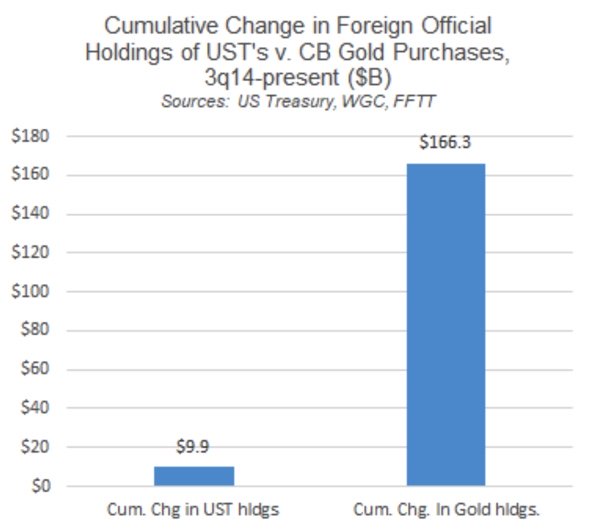

So if foreigners are not buying US treasuries it may come a bit surprise as to what they are really buying. Gold is the hot commodity here. Now on Tuesday we say gold prices collapse due likely by global central banks intervention. What I mean by this is by pushing down the price of gold artificially the impression would be to force holders of shares in commodities related to gold and silver to be sold off. In the long run there is too much demand to have prices suppressed. So in short term central banks may still try their best to decrease value of gold/silver so to pull in more buyers toward treasuries. Will this work? Will have to find out but I will hold of in starting either a gold or silver position for now since charts are technically damaged. I am playing into this central banks' plan of suppressing prices to see how low it can go before I buy. I have 2008 as a good reference and it appears the peak to through in gld shares took 5 months to play out from March 2008 to October 2008 with about 27% drop. Currently gold drop 15% from peak to through but it has only been two days. I would like to see at least a 25% from peak before I initiate a buy. This would mean gld at around $145.

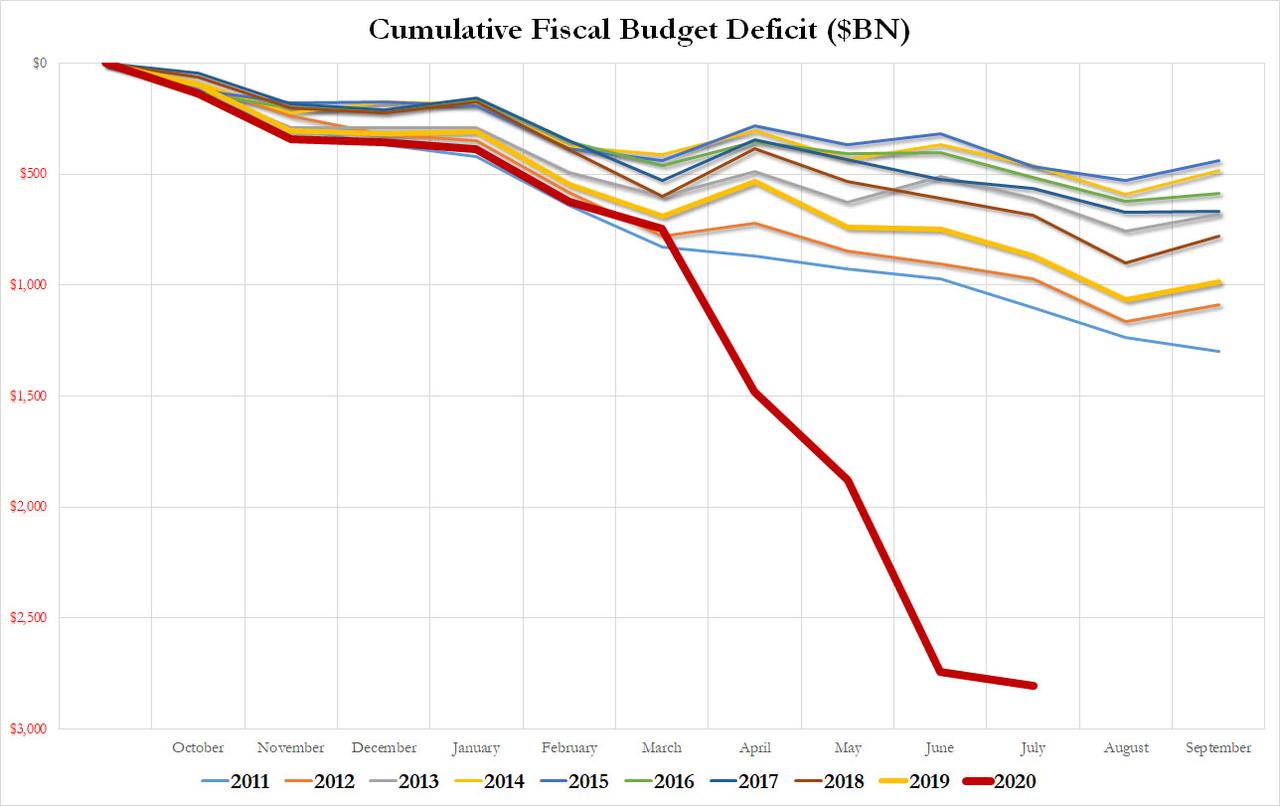

On zerohedge I found this chart being a good prescriptive of what the country is facing in 2020. The deficit is shattering records in a bad way. How this will effect the economy remains to be seen but past history has not been so kind to running massive deficits.

Posted Using LeoFinance

Personally, I’d avoid GLD like the plague. When the paper gold Ponzi scheme implodes, it will happen fast and there won’t be a way to exit unscathed.

true, GLD is more so of a hedge against weaker dollar. In no way is GLD safe just like any other stock ticker. Although not many people realize this. I seen XIV which by default should always go up since volatility in general always clams down, but those banks like to steal and smashed XIV in one single day. They can likely do the same to GLD.

The US Fed is screwed...buy gold, silver and bitcoins.

Posted Using LeoFinance

FED screwed America. Countless small businesses gone, millions of unemployed. On the back of infinite supply of dollars. The debt will come home to roost. I am getting set to go all in on metals. Still have to convince my wife with crypto.