Futures Massively Green - Trading Journal (09.13.20)

I had position myself long puts in SPY over the weekend and will be holding on to a significant unrealized loss. The puts will expire at the end of September and although this week there are many headlines that can effect the markets it is clear that bulls are taking charge. One odd feeling I have is that too much of one form of sentiment will lead to an opposite and more intense reaction. Since markets for the past two weeks have been lower one would believe if there is no further down side then a bounce is inevitable. Of course without confirmation from DIX as it is still under buy rating of 45 and up I am still leaning bearish. There has been significant bearish extremes being mentioned prior to Friday's close, but the head winds that lies ahead for the market I believe will effect stock prices sooner than later.

Reminder SPY is still above the year's open although not at all time highs. Yet the real economy is not even close to pre-covid. While the government has decided not to introduce further stimulus into the economy which had boosted spending from March to June. There is a FOMC meeting come Tuesday and Wednesday.

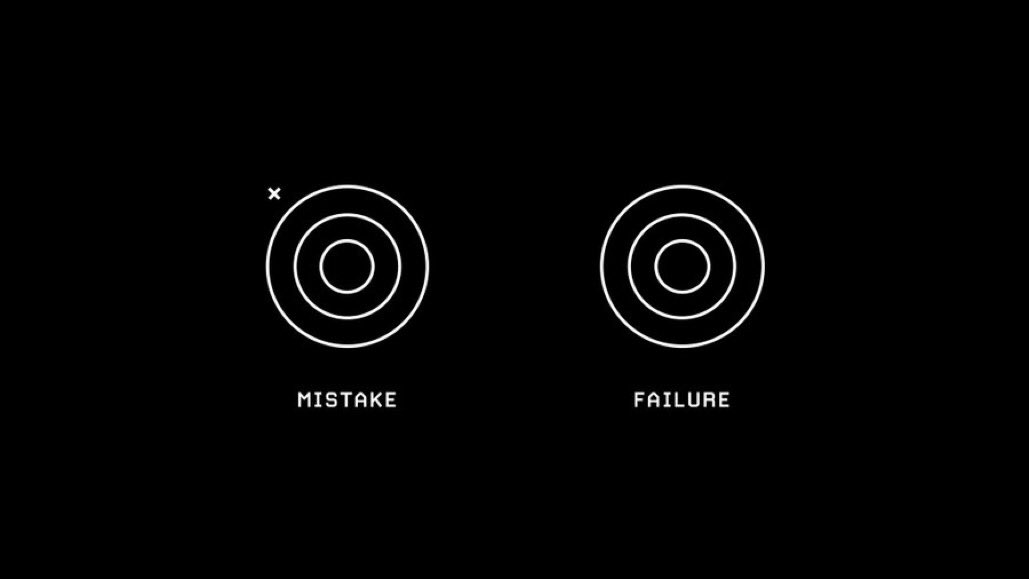

The volitality is being played out as we speak. It is being dropped like a hammer and hence the markets are heading much higher for a Monday open. The week is young and more to be unfolding. Did I make a mistake or it was a failure from the very beginning?

Posted Using LeoFinance