First Trade of the Year , Tesla - Trading Journal (1.11.21)

Last Thursday I played a naked cover call in Tesla. Actually I have been playing naked cover calls in Tesla for a few weeks and last week was no different. I was selling 1 STD move from what I would think is a top and roll it out for 25%-50% gains. It was a walk in the park kind of trade since IV was high and stock was in consolidating mode since its adaption to the S&P.

TSLA at All Time Highs

However last week was different. Tesla was slowly grinding up at the beginning of last week. It only accelerated once the overall markets were green. Then on last Thursday TSLA gaped up over 800 and rising. By closing bell of Thursday stock closed slightly below 830.

My Plan and Execution

As from past trades in Tesla I went through MACD and RSI and it had appear to me by Thursday that the stock was near a top. MACD being highest since last summer and RSI at a year's high. It did not make sense to go short at the time but seeing how overbought TSLA appear to be I went an initiated a naked cover call at 850 strike expiring that week, 2 days to expiration, when the underlying was in the low 820s.

At the time my thought process was TSLA already rallied close to 10% that week and Thursday was a open gap to the upside and go. The only way for TSLA then to get over 850 would require close to 5% gain. Statistics were in my favor but reality told me otherwise.

Friday really the same as Thursday

Back to back days TSLA remained bullish. On Friday stock open gap up and went off to the races. Middle of trading sessions markets turned weak but by end of day TSLA was up nearly 8%. A close of 880 on the dot of a Friday. In the mean time I held onto my naked call and was holding a significant unrealized loss.

TSLA Option Assignment

So with a short 850 call I was basically shorting TSLA at 850. I got to keep the full premium of the contracts I sold but I now carried over 100 share short on TSLA for every contract. I would open Monday with these short shares at 880, which is basically 30 points in the red.

To make matters worse my account that held these TSLA calls did not have sufficient funds to hold the actual underlying. Basically I had a margin call and was require to put on the cash within 2 business days or face liquidation.

Luckily Monday open with TSLA gap down and immediately it took out 850. I bought back most of my shares near the open for small gain while held some for the remainder of the day but closed those too before end of trading session.

Conclusions

The call I made for a top was not intentional, since I had a feel on TSLA over the past few months and did the naked cover calls a few times with success I did the same here. However the danger of naked calls was witness first hand here as I was force to be in the underlying when intention was never to. Trap too with margin call I was doing my best to avoid liquidation but also refraining myself to extend capital. I did not want to put up capital to anticipate holding something I never intended to hold in the first place.

The same trades do not work every single time. As the market is volatile no one specific way will always work. A holy grail as to how to beat the markets does not exist. I got complacent as I was able to successfully do the same trade with great success over the weeks I got my mind thinking last week would be the same, but it was not.

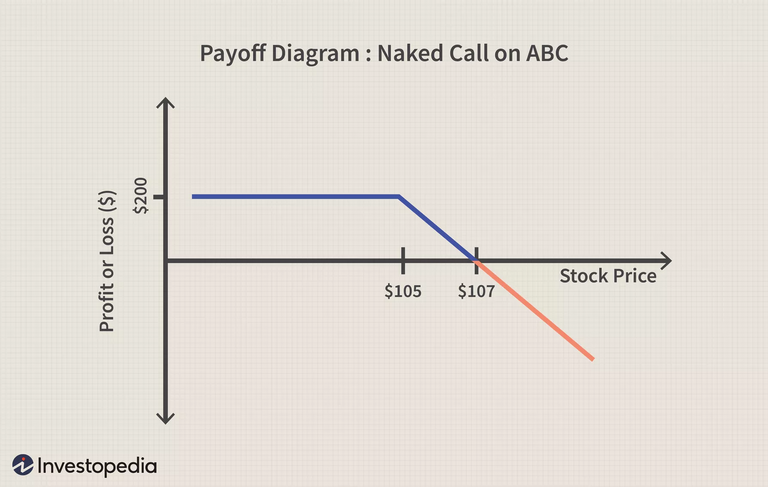

Courtesy of Investopia

The cover calls are very dangerous as anything is still possible. If I held shares that I cover against I would not have the same challenges. Furthermore the premium with two days before expiration is not that good of a risk versus reward. The risk was large as in the call got assigned and the stock closed 30 points away from the call strike. Such gaps are large money pits.

Bottom line my technical analysis was off by a day. A day may not seem like much but looking at context if I had ride the wave up and position myself for today's down drift it would have been the prefect trades. Although that was not meant to be.

I know I am not going to leave naked call options alone but I need to be aware the potential for it to be assigned is a dangerous game of cat and mouse. To earn a few pennies but risk losing a whole account over is not the ideal risk versus reward. A penny wise but a pound foolish so no go on TSLA cover calls.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HIveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto related and how to make financial gains in crypto!

Posted Using LeoFinance Beta

Your current Rank (44) in the battle Arena of Holybread has granted you an Upvote of 18%

https://twitter.com/mawit07/status/1348878867386265600

!wine

Cheers, @minnowspower You Successfully Shared 0.100 WINE With @mawit07.

You Earned 0.100 WINE As Curation Reward.

You Utilized 3/3 Successful Calls.

WINE Current Market Price : 0.000 HIVE