Bounce? Trading Journal - (09.25.20)

Markets bounce dramatically today from a volatile week.

Friday ended the up making the week green. This avoided a stat that was spread around fintwit this week, where if markets closed down 4 weeks straight it was very likely to close up in week 5. This did not happen so next week statistically can go either way. I prefer to lean bearish as there are many headwinds the markets have decided to ignore since the beginning of the year.

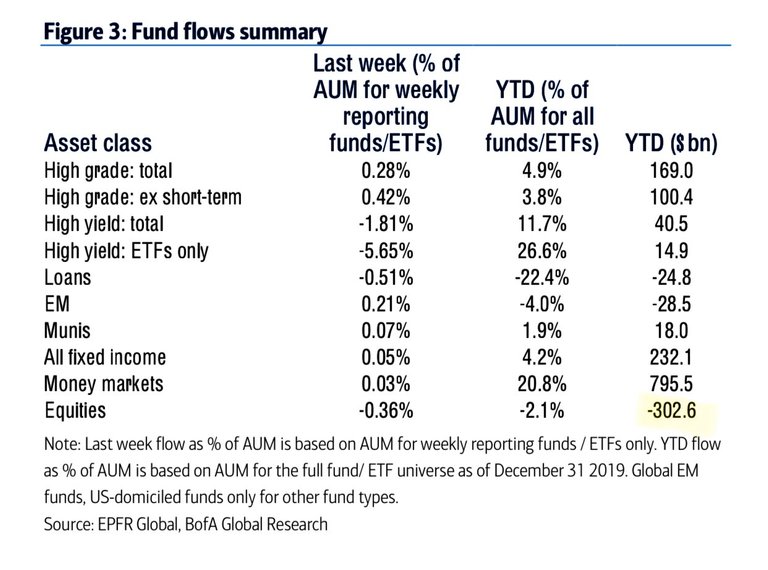

Total Market Withdraw

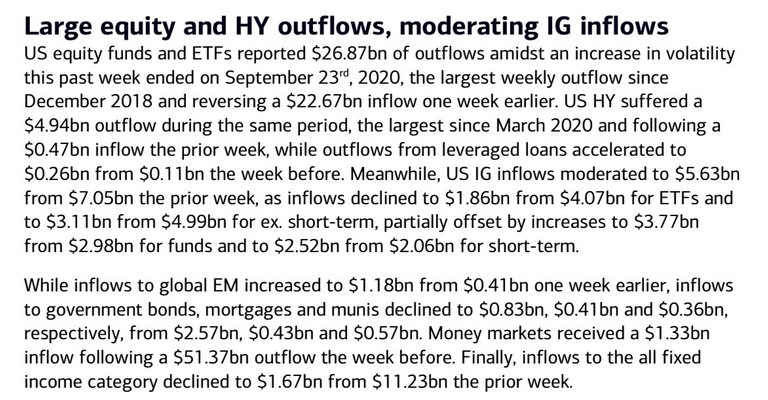

Over $300 billion in cash has been removed from the market since the beginning of the year. Not to say markets can not continue higher but flow is evident that less are willing to buy at these highs.

Just this past week close to $27 billion have been withdraw. With three trading days left in September there maybe more selling to come.

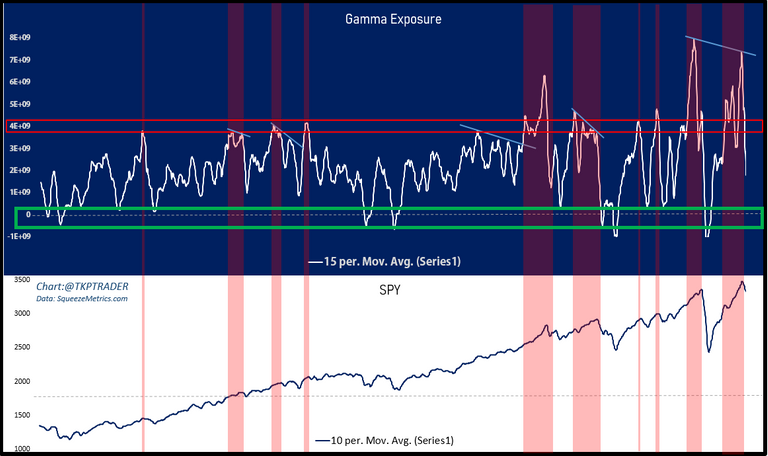

For gamma exposure it is still near middle of the zone on a negative divergence. Until gamma drops into the green box there is still more price drop to come.

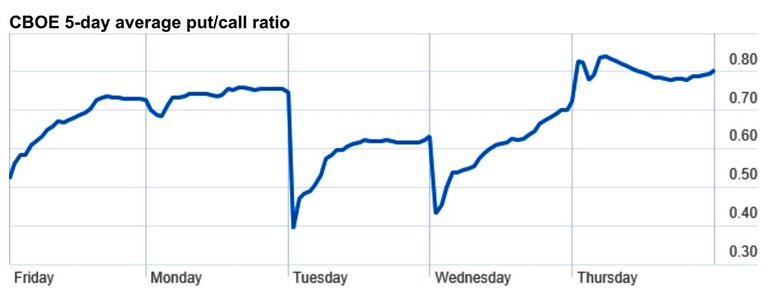

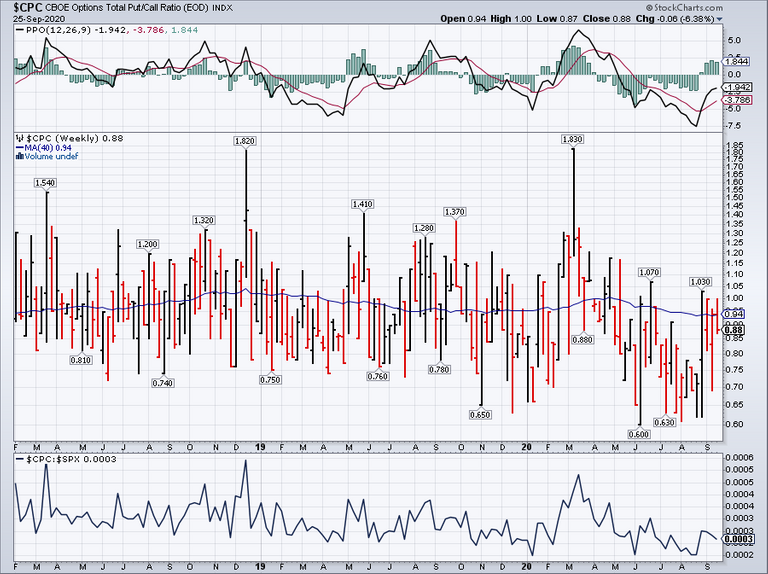

By end of this week there is a higher put/call ratio which means more traders are hedging to the downside. When more anticipate for a crash or drop in price it will likely not happen as those price levels become support. However on a weekly chart the ratio is still trending down, which means not enough puts have been place relative to the amount of calls.

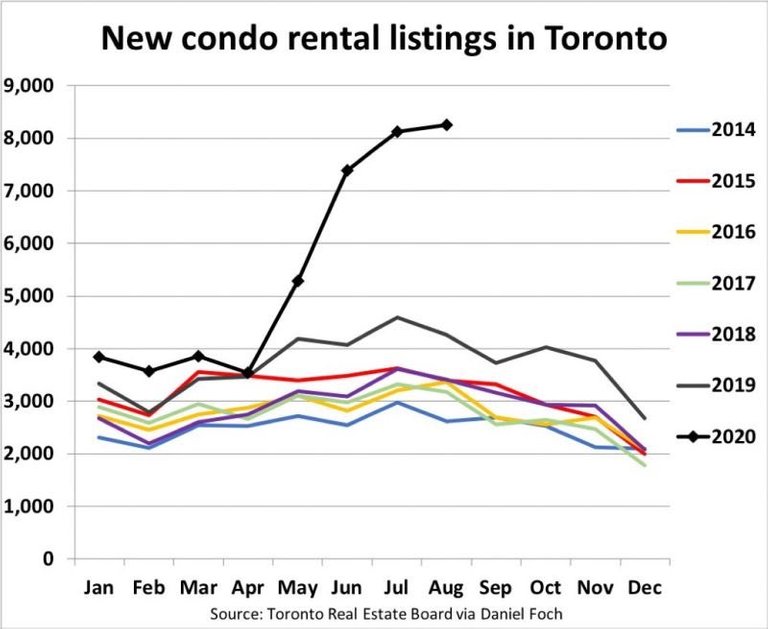

Side note the reality of the current economy can be illustrated with charts like below.

The amount of condo that are listed for rent currently is rising at its fastest pace in 7 years. Could be more since chart only show the last 7 years. The difference is staggering. This is Canada, then what about USA? Forbearance on mortgages can not last forever, and time will come when this will effect the markets. When is the million dollar question.

Posted Using LeoFinance Beta