Iran To Pay For Exports With Bitcoins Mined By Licensed Domestic Bitcoin Miners

Introduction

I read an interesting article on news.bitcoin.com today. According to the article titled Iran Adopts Bitcoin for International Trade Amid Heavy Sanctions, Falling Rial, Soaring Inflation Iran is planning to license Bitcoin miners in Iran on the condition that they sell their coins directly to Iran's central bank allowing the Iranian government to pay for imports with that Bitcoin. Also, the idea is to subsidise the energy use of a licenced miner within mining quotas agreed upon with the Iranian Ministry of Energy.

Using the permissionless Bitcoin network was necessitated by heavy US sanctions making it hard for Iranian banks to operate internationally using hard currency. On Nov 5 2020 when the article was published, the details were still being worked out by the Iranian authorities.

The beginning of adoption of Bitcoin by state-level actors

As far as I know, the Iranian government is the very first one to adopt Bitcoin as an official and public policy. It is very likely that some governments such as North Korea have used Bitcoin in various types of illicit operations. North Koreans have reportedly hacked South Korean cryptocurrency exchanges.

Image by Diethelm Scheidereit (CC BY-ND 2.0)

But Iran's adoption of Bitcoin as an open and public policy is something new. So far, Bitcoin adoption has been for the private sector while some governments have fostered growth in the sector. What Iran is doing is making Bitcoin a reserve currency by default, although the Iranian government intends to use Bitcoin as a payment system to circumvent sanctions. This may end up a windfall for the Iranian government should Bitcoin continue to appreciate according to the cross-asset stock-to-flow model.

How will the US respond?

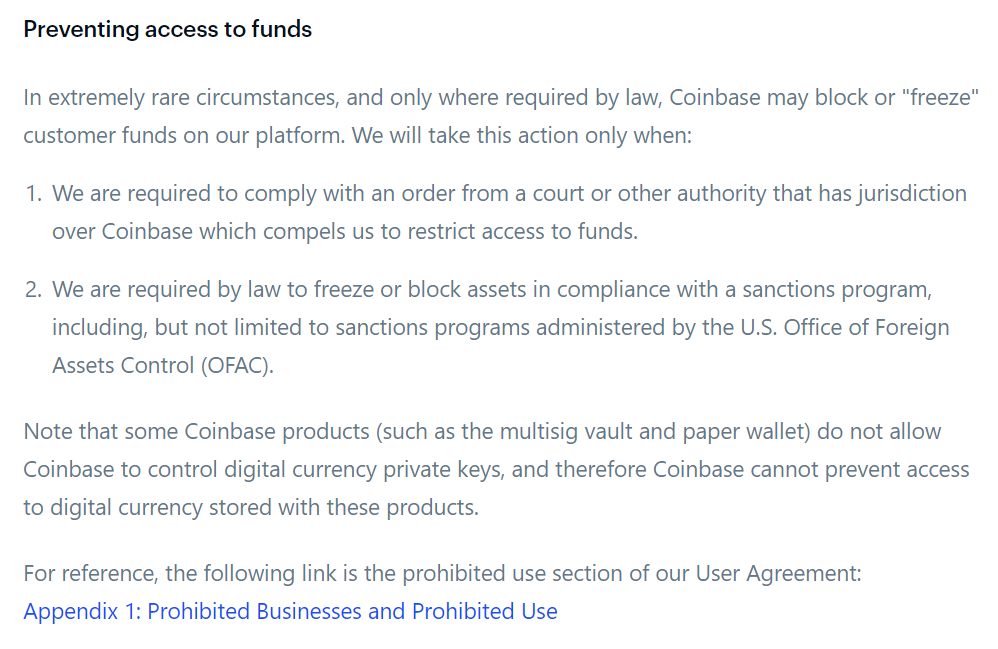

The cryptocurrency sector is not completely out of the woods yet in terms of mass adoption being a done deal. There still are regulatory risks. But rather than attempting at going after legitimate uses of Bitcoin, I believe the US government may go after Iran's trading partners who use Bitcoin to help it evade sanctions to the extent it can. However, if the Iranians are successful other countries that the US has sanctions against will follow suit. There isn't much the US can do so far. One of the first things it could attempt is use chain analysis to try and track addresses used by the countries trying to avoid sanctions and use that information to blacklist coins. While the blacklisting would nothing to stop the transactions, any addresses associated with such addresses could be, and I believe are, blacklisted by major exchanges operating under US jurisdiction and expose any individual or entity to considerable legal risks. For example, the FAQ on the Coinbase website has the following answer on it:

This is what the US already does. While Iran's imports from China remained constant, Chinese imports from China declined significantly during the first five months of 2020. Sanctions imposed by the US on individual Chinese companies are still a threat so long as the US continues to have as much clout over the international banking system as it has.

Conclusion

While Bitcoin is a permissionless payment network, its use is still vanishingly small in international trade. There is no need for the US to clamp down on the industry to an extent that would pose and existential threat to it while it could still be in the realm of possibility. What this means is that the digital gold narrative is likely to be allowed to run its course, bringing Bitcoin's market cap to a level possibly a couple of orders of magnitude higher than it is today. At that stage, Wall Street will be involved balls deep in Bitcoin and crypto. Trying to disrupt the industry could be too dangerous for the economy for the US government. This is one pathway to the final victory of Bitcoin that I see.

Posted Using LeoFinance Beta

this is so huge, biblical. iran will adopt bitcoin and that forces them to use ethereum and eos with PBTC bitcoin scaled by https://ptokens.io

It actually is a bonus for Bitcoin (cryptocurrency). While governments might be looking to go after it, Bitcoin allows for the escape from tyranny. What is interesting is the victim of tyranny, in this instance, is another government. Hence they are using Bitcoin to get around the fact the USG kicked them out of the SWIFT network.

This is why I think it a global outlawing of crypto is not going to happen since most of the world is not going to agree.

Iran is using it to get around the USG, Venezuela and others will likely follow suit.

Which is interesting since their own populations are looking to cryptocurrency to get around their governments.

Posted Using LeoFinance Beta

There are currently five countries on the US sanctions list. Individuals from a much larger number of countries are also targeted. The countries being sanctioned are not very powerful. I could see them adopt a Chinese-developed payment network instead. In any case, I believe SWIFT is toast.

I think the digital gold narrative will prevail for the next 4-5 years after which we may see more central banks than the Iranian stack up on BTC. Those countries plagued by inflation could see it as a way to shore up their reserves and bolster their currency. I imagine countries with unused capacity for solar or hydroelectric power generation that are otherwise poor could see it as an opportunity.