The Degen Daytrading Diaries: Ethereum Moves to Phase B of a Wyckoff Accumulation

Happy Wednesday. After some consideration, I’ve decided to initiate coverage on Ethereum in addition to normal coverage on Bitcoin. The scope of the TA will again be limited to the 15M Intraday Chart.

With that, let’s get to the TA…

The 15M Intraday Chart

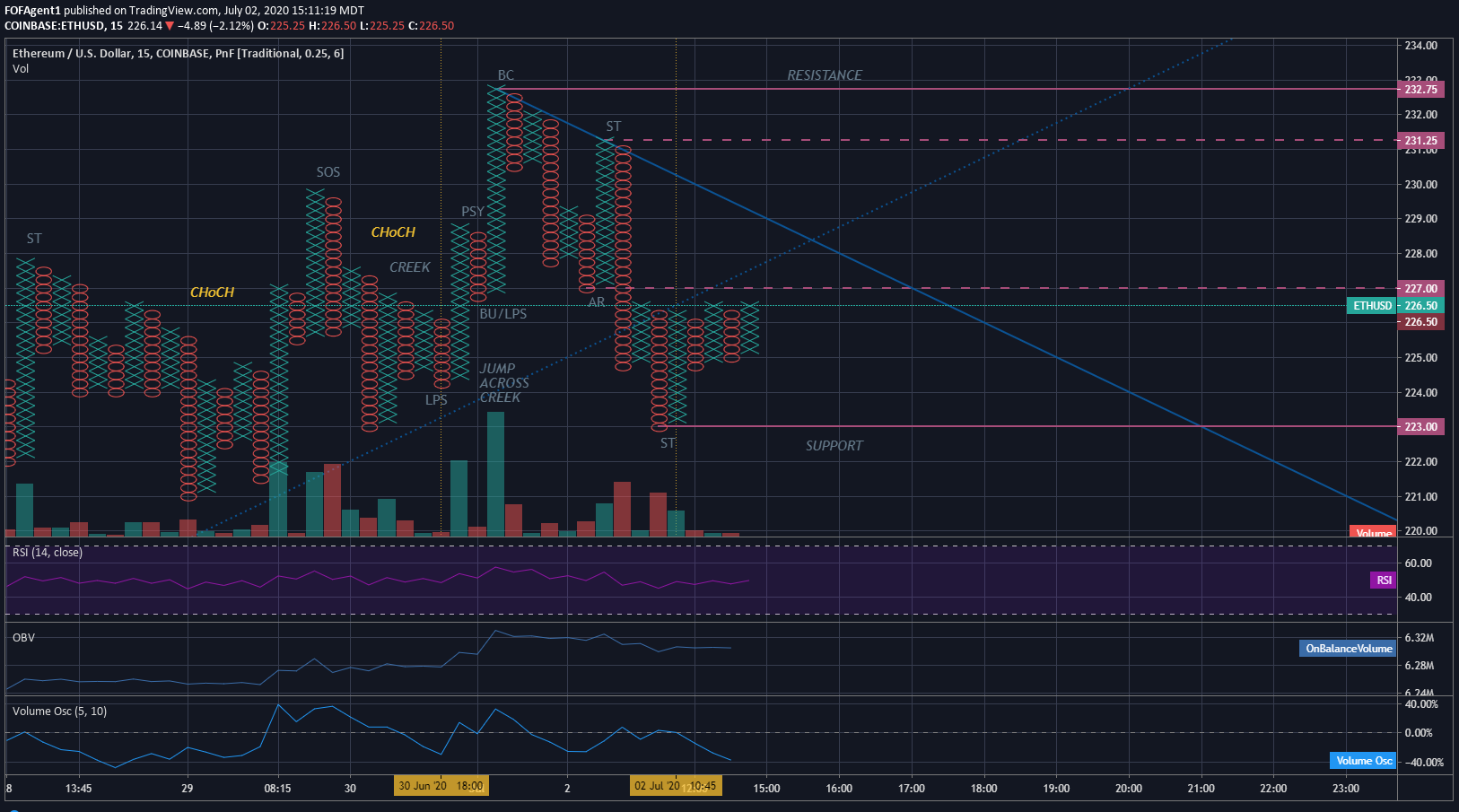

Looking at the 15M Intraday Chart, after a period of consolidation within the resistance range ($227.75 - $222.25), Ethereum broke out on a Jump Across the Creek, with PA moving to $228.75 to form Preliminary Supply (PSY). PA then moved down to print a Back-Up/Last Point of Support (BU/LPS) at the $226.75 price handle and reversed to form the Buying Climax (BC) at the $232.75 price handle - fully exhausting the cause from consolidation.

After establishing the Buying Climax (BC), the PA Fell to the $227.00 price handle on the Automatic Reaction (AR) to establish the upper end of support. The Secondary Test (ST) of resistance established the lower range of resistance at the $231.25 price handle and the Secondary Test (ST) of support, established the lower boundary of support at the $223.00 price handle, moving the formation into Phase B of a Wyckoff Accumulation.

The key takeaways for the formation so far would be (i) once PA moved down to establish the lower boundary of support on the Secondary Test (ST) to the $223.00 price handle, it broke through trend line support, flipping bias from bullish to bearish, and (ii) activity moved lower in concert with the move lower by Bitcoin and the PA has been confined within the support range since.

While I am waiting for the Phase C to provide some direction on the trend overall, the formation appears to have a bearish tone from the start. I am curious to see if Ethereum runs a counter-trend or remains married to the Bitcoin trend.

Summary/My Trade Plan

No position should be taken at this time. Two key milestones should be hit before looking to enter a position, unless the formation produces clear signals to the contrary:

The correction currently underway with Bitcoin (in a Phase E Wyckoff Distribution currently) needs to play out. Too much unresolved cause remains in the formation from the consolidation period and the PA of Ethereum (and the wider crypto markets) are very much correlated to the fortunes of Bitcoin.

The formation of Ethereum needs to move into Phase C or Phase D to determine both the cause from consolidation and direction of the PA. It is possible Ethereum prints a counter-trend to Bitcoin or leads a new breakout, but that remains speculation until the formation produces evidence supporting that conclusion.

Always remember this is not trading advice.

Outside of that, Happy Trading.

You can follow me and keep up to date on Tradingview as well. I trade under the handle FOFAgent1 at tradingview.com

Posted Using LeoFinance