Further Diversifying My Portfolio: Real Estate DeFi??

Like it or not, this is definitely a USD57.96 lesson to see if this works or not

Fingers crossed! 🤞

As DeFi is going super crazy and making much headlines especially when uniSwap is taking the main limelight in many crypto space communities, I came across this YouTuber (when I was trying to look at different stablecoins pros and cons) mentioned about this Token asset that he has been using for quite a while now

Which is called RealT

It is basically a Real Estate token that is being issued by an agency that has purchased over the property, and turned it into shares (Real token) for investors in US / around the world to buy in and then gives return to the investors.

I didn't get this from some wikiPedia or their FAQ, I actually talked to one of the representatives

(about 2 hours ago)

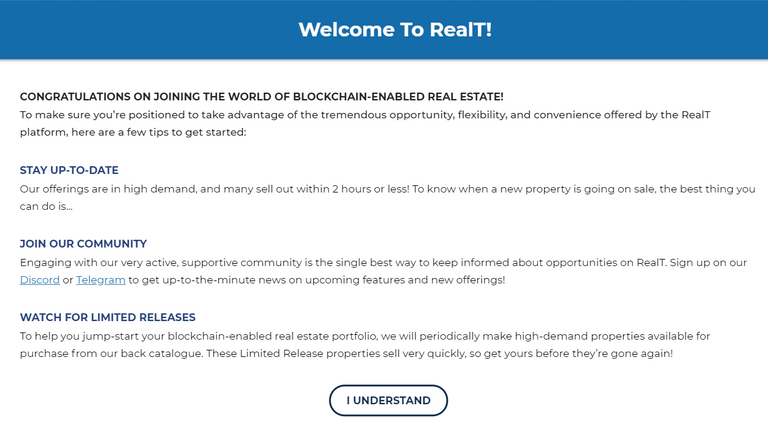

So according to RealT.co website during your sign up, it actually has pretty much the welcome overview for you to read before you proceed further.

It is not an ICO, you can't really trade it in exchanges, and it only starts dividend issuing when the whole house's token funding is fully fulfilled.

I wished I could copy the entire conversation but somehow before I could do that the session has ended when I said thank you haha

Howver their discord is real and there is a community there to support should I need to ask more question

How does it work?

- A property is acquired

- The property gets a tenant

- The property value is calculated in token value

- The tokens are listed to gather investment

- One the full number of tokens are sold to investors, then the yield dividend is issued back monthly; in USDC ERC20 token.

- Tenant pays rent monthly, all basic costs deducted by landlord, remaining balance of the month's rent is converted into token.

- Token distributes back to investors (based on number of tokens they hold)

My question: Is it a guaranteed dividend once it kicks off?

(paraphrased) The tenant rent is partly supported by the government, therefore if there's a certain difficulty for the tenant to pay the rent, there's still the government support that comes in for rent. The only time you are not receiving dividend is when there's no tenancy.

What do I like about this interesting "investment"

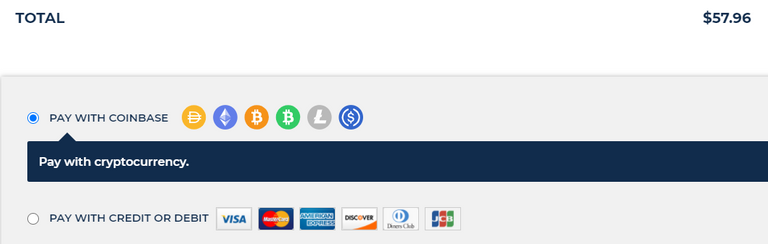

1. Diversifed payments

Even though this is issued by coinbase business platform you can pay in different crypto currency that you have and weigh on the best crypto mining / gas fee you can look into.

If you don't have a crypto currency account, you can also use debit card / credit card; however I am pretty sure there's a service fee conversion from fiat to crypto and at the same time you will need a MetaMask (Ethereum wallet) in order to receive your stable coins later.

2. You can pay from exchanges to their wallet

Although the dividend payment cannot be assigned to an exchange wallet address, however you can accumulate your crypto in a trustworthy fast service* exchange and sends it out straight to their address and the processing is real-time

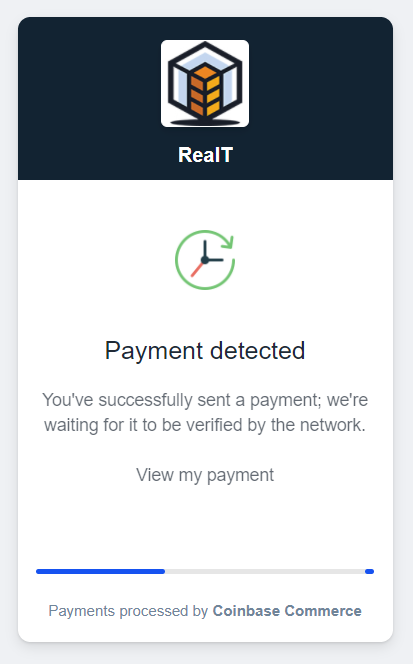

This is updated within 30 seconds on real time right after I sent out from exchange

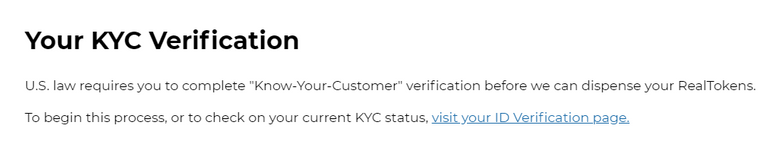

3. Super fast KYC

Once you have purchased your first realT token, KYC is actually needed. You will need to take a selfie with your passport and you can be identified within 15 minutes.

(That's what it took mine to process. I think it was because the support was online at the time)

The only drawback for this investment is that you will need KYC

Because the properties are on US soil and also they are legally compliant, KYC is definitely unavoidable.

Is this a sure thing?

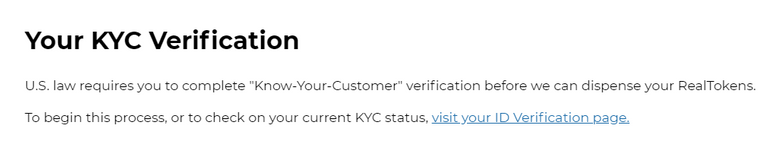

This company started in 2019 and just updated their domain renewal till 2024, I think I can safely say that at this point of time, it can be a safe bet.

Not financial advice though! Join me with this experiment in your own risk

Curious / Interested?

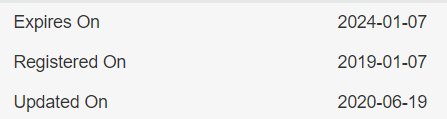

At this point of time, this landed property in Michigan that is opened for international token purchase has 877 tokens left for people to invest; and the minimum purchase is 1 token at USD $57.96.

It will not start to yield dividend until all 3,000 tokens are all sold out, and there's still 877 tokens left.

I am not certain when did it start releasing for token sales, but less than 1,000 tokens left could be a good thing meaning there are buyers.

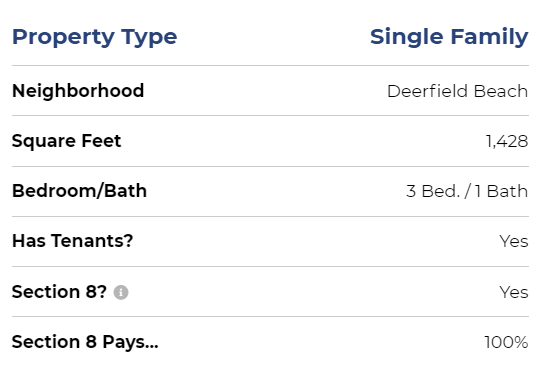

And the looks of it there's already tenants there and payments it seemed (?) to be insuranced in the Section 8 act where landlord will still receive 100% rent if tenant is unable to pay out rent.

Not too bad of a deal? Perhaps.

So right now with 82.79% of the token is mine and 17.21% is @fusion.lover's let's see if we can get something back together. 😂

Feel free to join me on this experimental crusade!

By clicking the link here or any of the pictures to find out more.

Updated: 9 September 2020

I just found this interview on the co-founders on youtube about RealT and it's concept. I like the point that they wanted to encourage small / young income earners to start earning passive income early and available to them small chucks of property ownership via security contracts, which is very interesting.

If you have time, take a look at their interview below:

Until then

my God brother stays in Michigan before Covid-19, and so far seems all right still

Thank you for your support. We will be working for a new payout scheme for you soon. Keep your chins up and stay tune!

I hope you collect a nice dividend and build a crypto stream of income with it.

Thanks @chesatochi . Right now I am not certain when will mine start, but so far I talked to a few community members there, they are not complaining.

What APR do they promise? Do they have already properties in rent which were 100% bought via this way?

They mentioned "up to 7%", of all the usual expenses.

Yes they have a few previous properties I think at a glance 6 properties already done in that way. There are 2 new ones; one for International investors, one for local US citizens investors.

How they acquire the properties, I am not 100% certain; but according to the support, they bought the place first, then furnish it to rent while issuing the tokens out for investors.

So my guess is, I think they already bought it, or at least already service the mortage.

Here is what they state @stayoutoftherz

Thanks, well 7% is not that good vs. the risk. Staking Hive is more rewarding! On dlease.io you get up to 16% APR!

haha I do stake in HIVE, just that I am looking at expanding my portfolio to see different projects.

True, always good to diversify!

Yeah, can't bank all the eggs in one basket at this time and age. lol.

Eh, what are the chances that this property that you just used a bigger portion of your HIVE savings plus mine will take off?

It looks interesting but Florida has natural disasters too.

You have a point @fusion.lover; however it could still in a sense take off because the office HQ is there. I like the concept of they are wanting to help young and small investors to have a small stepping stone in passive income in property.

Besides, our portfolio is not only just stuck in this one. There's Nexo sti just lower yield for volatile coins and gas is still high (for me) for ETH

Posted using Dapplr