BSC's first algorithmic stablecoin bDollar.fi

Hello, this is kimm. Introducing bDollar.fi, the first algorithmic stablecoin based on Binance Smartchain. bDollar is an algorithm-based stablecoin project that adjusts the price of the token to the target price by adjusting the supply to provide the programmability and interoperability of DeFi.

- Original link: Introducing bDollar

For more information, please refer to the original link above.

1. Multi Token Protocol

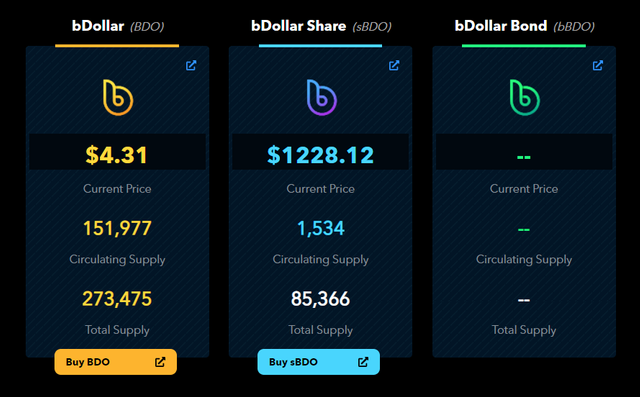

bDollar.fi is a project inspired by the Ethereum-based Basis project and is a multi-token protocol composed of three tokens: BDO, sBDO, and bBDO . A brief summary of the three tokens is as follows:

- BDO: Algorithmized stablecoin / 1 BDO = $1 target

- sBDO: Shares in bDollar (right to claim inflation accruals)

- bBDO: Stabilized bond (can be exchanged for BDO Bond depending on the price of BDO)

If you first participate in bDollar.fi, you can think of it as BDO or sBDO, and if you want to participate in mining through liquidity supply (LP), you must use pancakeswap.finance.

① BDO token information

- Total supply: 210,000 BDO

- Distribution period: 3 weeks (Week 1: 80,000 / Week 2: 60,000 / Week 3: 40,000)

- The remaining 30,000 BDO is paid as an airdrop

② sBDO token information

- Total Supply: 100,000 sBDO

- Distribution period: 1 year (12 months)

- Team allocation: 7,500

- DAO allocation: 7,500

- BDO/BUSD mining: 50,000

- sBDO/BUSD mining: 35,000

2. Unique algorithm

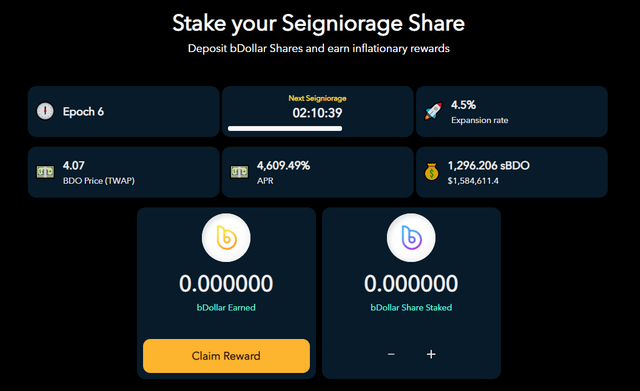

The price of bDollar (BDO) can be higher or lower than the stabilization target price of $1, depending on the market price the market participants trade. BDO operates the stabilization algorithm to maintain the target price of $1, and the rules of the algorithm are as follows.

- Duration: 6 hours

- Rebase quantity: up to 3%

- Supply/Reward Mechanism: All parameters are set through on-chain governance (voting)

- Stabilized bonds (bBDO) have no maturity (permanent bonds)

- Community Voting Pool: The new liquidity (farming) pool is set by community voting

As you can see in the screen above, by staking the sBDO token, which is a stake in bDollar, you have the right to claim compensation for BDO's inflation .

The quantity of rebase (expansion) is listed as a maximum of 3% on the official medium, but it seems that rebase (expansion) may occur at 4.5%, which is more than that in the system.

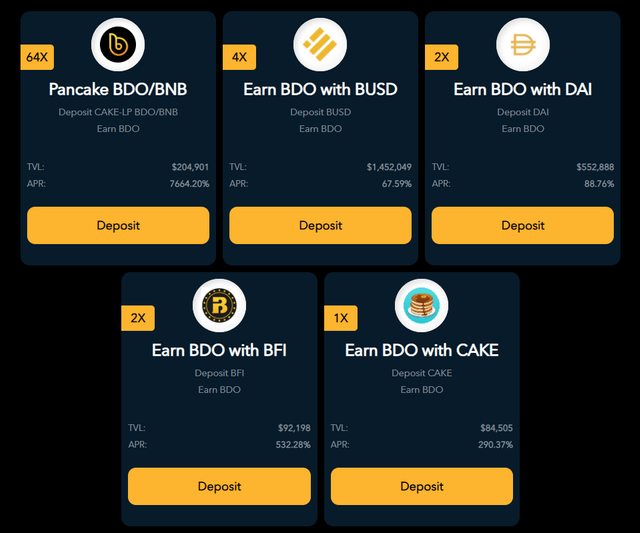

3. BDO mining method

There are three ways to mine BDO, and specifically there are a total of six ways.

① BDO/BNB liquidity supply: 64x

② Token deposit: 4x~1x

- BUSD deposit: 4x

- DAI deposit: 2x

- BFI deposit: 2x

- CAKE deposit: 1x

③ sBDO staking

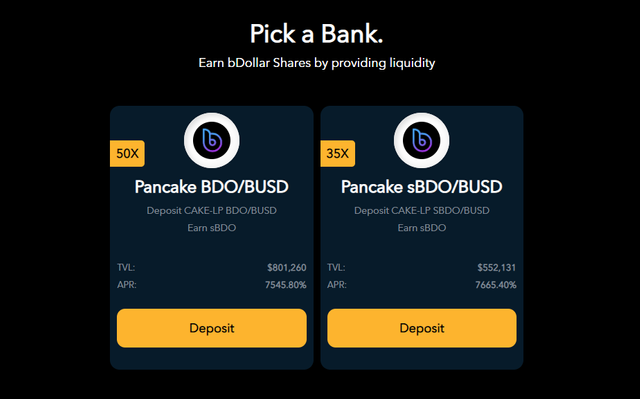

4. Mining sBDO

BDO can be mined by supplying liquidity as above, but it is also possible to mine sBDO, which is a stake in bDollar. Currently, in order to mine sBDO, you need to supply liquidity to the BDO/BUSD or sBDO/BUSD pool, and the double speeds of the two pools are different, but the APR is very similar.

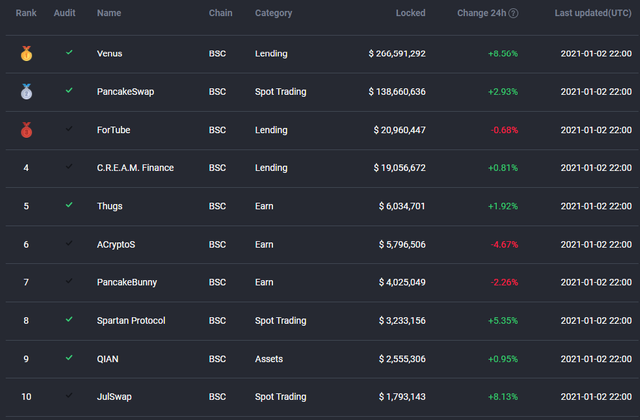

bDollar.fi has been activated from 09:00 on January 1, 2021, and it is still in its very early stage and has not been officially registered in Defistation. They are showing their growth.

Currently, the interest rates of various farming pools are very high, but the APR may decrease sharply at any time depending on the price fluctuation of BDO or sBDO, and the price volatility is high. Therefore, we recommend that you fully consider the risks before participating in farming or depositing.

Posted Using LeoFinance Beta

Binance is thinking very far