How Michael Saylor is Systematically Launching a Multi-Billion Dollar Bitcoin ETF, Tokenized Stocks on Bittrex and Crypto Regulation

In today's Daily LEO: Michael Saylor to buy $400m worth of BTC, MSTR is now a Bitcoin ETF and Tokenized Stocks Arrive on Bittrex.

The Daily LEO is a crypto-focused newsletter that we publish every day (Monday-Friday) with the most relevant news and happenings in the space. This newsletter is published everywhere. Make sure to subscribe to it using your favorite platforms:

Spain's Second Largest Bank - BBVA - Launching Crypto Trading/Custody

The Block reports on some news out of Spain's second largest bank which cites "two people familiar with the plans" saying that BBVA may be releasing crypto trading and custody services.

What I like about this news is the growing narrative around regulation. As people worry about regulation, one of the main things that adds to the resilience of cryptocurrencies is widescale global adoption.

The more we see banks/institutions/companies adopt BTC/Crypto, the harder it is to impose negative regulations on the industry. I think we're going to see a lot more institutions jumping into crypto over the coming months and this will only serve to solidify the industry as a whole and safeguard it from regulators with bad intentions for crypto.

MSTR selling $400 million in Convertible Notes to buy more Bitcoin!

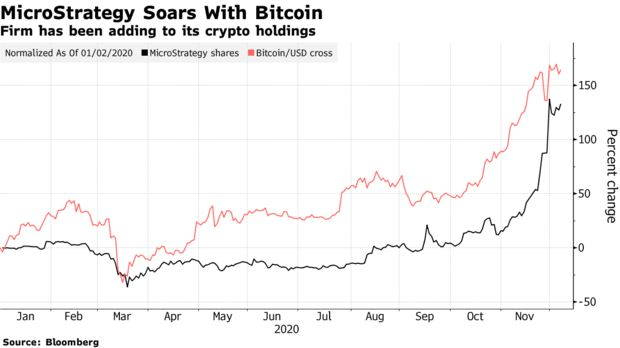

@jrcornel writes about one of the top news stories this week. Microstrategy (MSTR) led by CEO Michael Saylor is now raising $400m in convertible debt.

This sounds relatively standard... read on in their proposal and you'll find that they actually plan to use the funds to buy BTC.

This is incredible and Jrcornel hits the nail on the head: regulators are making it hard for a BTC ETF to ever gain approval. No need, MSTR is here to save the day. Microstrategy has been behaving like a BTC ETF over the past several weeks and with all of this capital flowing into Bitcoin, I doubt that will stop any time soon.

In fact, I bet this was Saylor's genius plan from the beginning.

Michael Saylor and MicroStrategy - a Historical View of a Forward Thinking CEO

@rollandthomas wrote this awesome article about MSTR and Saylor. I liked this historical view that Rolland showed in his post as he broke down some of Saylor's historical calls and bet the company moments. Michael Saylor might go down in history as one of the most adaptive CEOs ever.

He has a mission and that mission is simply to adapt to the newest evolution of bleeding edge technology before other people catch on. It seems like BTC has grasped Saylor's focus in his ongoing evolution as a public CEO who spots opportunity.

Tokenized U.S. Stock Trading is Live for 12 Different Assets on Bittrex

Here's an article from Decrypt describing the newest assets to become a part of the Bittrex platform. They're not exaclty cryptoassets this time around.

For years, many of us in the space have called for the future being in tokenized assets. The tokenization of everything is upon us.

Now, U.S. customers can trade tokenized shares of 12 major U.S. based stocks/ETFs. TSLA, AAPL, SPY and others are among that list. I'm personally excited to head over there and try buying some shares. Users can buy fractionalized shares with as little as $10 per buy.

Listen & Subscribe to the LeoFinance Podcast!

LeoFinance is a blockchain-based social media community for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Wrapped LEO | Hive Witness |

|---|---|---|

| LeoDex | wLEO On Uniswap | Vote |

|  |  |

▶️ 3Speak

I had trouble sleeping last night as my mind raced over the MSTR news and possible future implications. Specifically that this might not be the first debt offering to buy bitocin and MSTR may not be the only one that does this. :)

Haha I can imagine. It’s pretty amazing to watch what’s happening and I am now convinced that Saylor’s actual ambition is to be a BTC ETF without explicitly saying so.

I took on a short options portion (sold a call spread) on MSTR last week. That spread is doing well and is solely as a hedge against my long BTC position. - this strategy is something I’ll likely continue as we move forward in the bull market. A nice hedge when I think we reach short term tops

Posted Using LeoFinance Beta

Stocks 2.0 is the future.

BNB and other Exchange tokens are basically just stock in that company. Except they are fully a superior version of stock that has way more utility, and that utility is in the infant stages.

Posted Using LeoFinance Beta

So, MSTR is not just buying to speculate on the price huh? It shows that they have a solid plan to bring crypto to the masses and raise the value eventually. Genius, indeed!

Posted Using LeoFinance Beta

Stunning, so we had authors who wrote about this MSTR, I don't know much about it, but then it's great to see contents here that supplements the daily leo podcast

Posted Using LeoFinance Beta

That Saylor bloke is a bit a of a dude isn't he?! We better start loading up what we can before he gobbles up all the BTC that's out there!

Posted Using LeoFinance Beta

I used to think he was a gigachad that got it, but his been such a media whore of late, I kind of think he is just using Bitcoin as a narrative to remain relative, yes he is helping the space but I think his starting to feel himself too much as Bitcoin twitter keeps blowing smoke up his arse.

I feel like he knows his business topped out a market share where he pulls in 30million a year which isn't bad at all, but now his going to financialise and pivot it, got nothing but respect for the dude, but the self promotion is a bit much

Posted Using LeoFinance Beta

If he ends up with $1 Billion in BTC, that will put him over $1 Trillion when BTC goes 10X. Imagine it goes 100X. MSTR will be a monstrosity. That's assuming he stops accumulating at some point. Leviathan seems the appropriate word.

Posted Using LeoFinance Beta

Never mind, the math just clicked. He definitely needs to accumulate more to reach the numbers I was thinking.

Posted Using LeoFinance Beta

I don't think I'll ever get tired of being surprised by Bitcoin and everything it can do.

Nice update, @khaleelkazi.

Posted Using LeoFinance Beta