Now that Bitcoin doesn't even need an ETF anymore, we probably get one this year

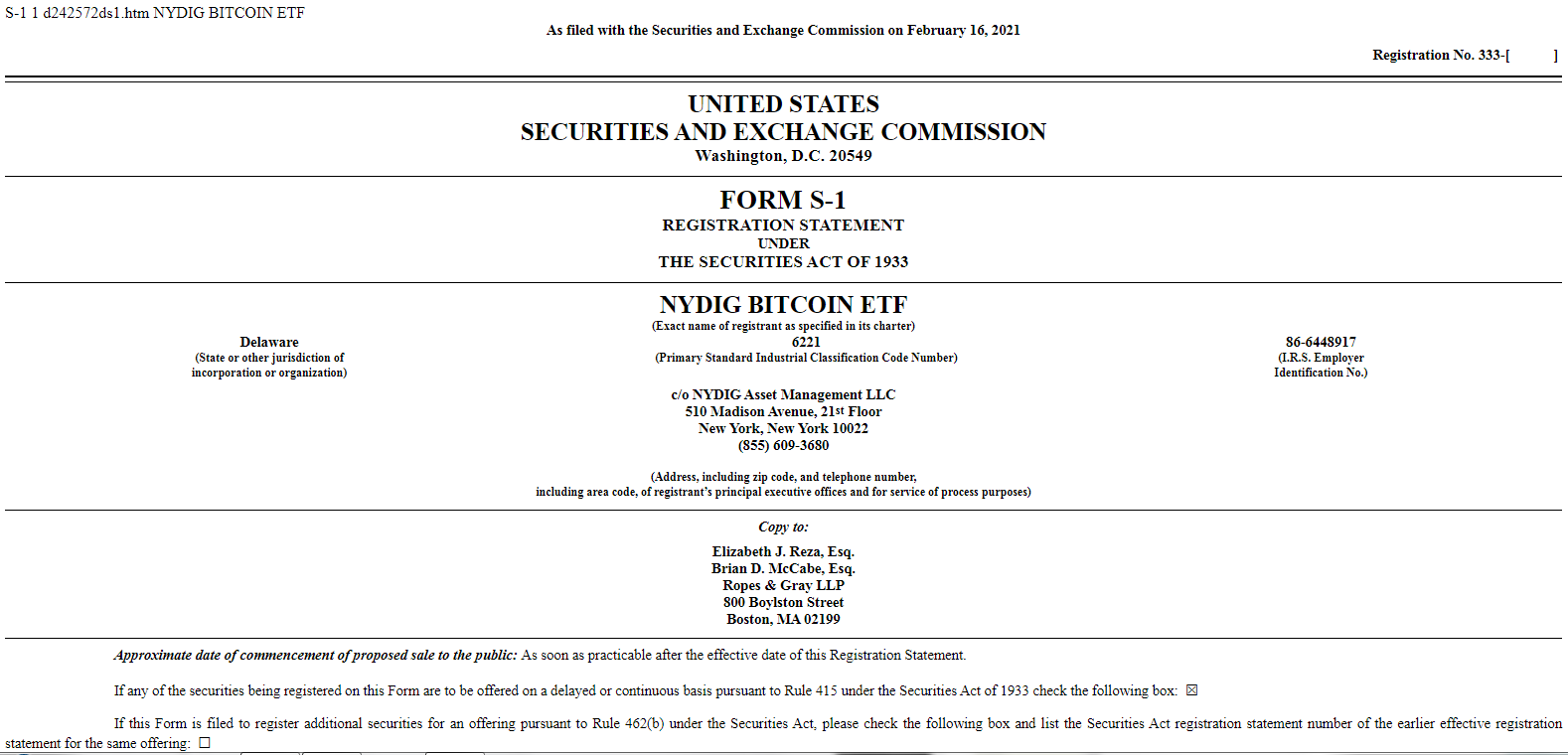

NYDIG along with Morgan Stanley filed an S-1 with the SEC today for a Bitcoin ETF

Isn't it funny how when you stop searching for something you tend to find it?

While that isn't even remotely true in most situations, it is ironic how it tends to play out like that.

As soon as I stop trying to something, it inevitably shows up sometime soon.

That's sort of how it feels right with a bitcoin ETF.

Back in 2017 and 2018, the expectation was that we would get a bitcoin ETF at some point.

With all the institutions coming in, it seemed like a no brainer that the SEC would want to work with them to meet the obvious demand.

However, that was not the case and the SEC kept moving the goal posts and here we are in 2021 and a bitcoin ETF is still yet to be approved.

However, my guess is that changes as soon as this year...

NYDIG along with Morgan Stanley filed an S-1 Registration Statement for a bitcoin ETF with the SEC today, which can be seen below:

(Source: https://www.sec.gov/Archives/edgar/data/1843021/000119312521043521/d242572ds1.htm)

This is actually just one of several bitcoin ETF registrations that have been filed recently with a couple others coming in the last several weeks as well.

Bitcoin doesn't even need an ETF anymore...

Given the amount of popularity bitcoin has and the demand it has from big money, one of these things is bound to get through...

Not to mention we finally have a change at the head of the SEC that is very likely to be more bitcoin/crypto friendly that his predecessor.

That being said, bitcoin doesn't even really one anymore.

Back in 2017 and 2018, institutions had limited options for gaining bitcoin exposure.

The could either buy the GBTC bitcoin investment trust with a 30% premium or they had to venture out into the mostly unregulated cryptocurrency markets.

Very few were US based and the ones that were were start up companies that not much of the big money was interested in working with.

However, much of that has changed now.

Not only are Exchanges much better regulated, but now you have Paypal and Square as options as well. Not to mention Robinhood.

There are also all sorts of robust futures and options markets which institutions can use for hedging purposes.

While it was once difficult to gain bitcoin exposure, it's not anymore.

Not to mention that the GBTC trust now trades with little to no premium and there are some other bitcoin trusts that have since popped up as well.

Add it all up and a bitcoin ETF isn't the holy grail for the price of bitcoin and institutional adoption that it once was.

Now that we don't really need it, it probably happens.

How's that for ironic.

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

Soon we'll see a shortage of BTC. Interesting times ahead.

Posted Using LeoFinance Beta

I agree. The price is moving up this easily without a real supply crunch yet. Can't wait to see what happens when there is one. The people buying up all the supply simply aren't selling it. There's only so much BTC out there to buy...

Canada did it so can we.

I guess reaching another $50k

is match for this year.

Nice ride #btc.

Posted Using LeoFinance Beta

That's embarrassing that Canada can get it done while the US cannot...

How much things change in less than a full bitcoin cycle...

Posted Using LeoFinance Beta

Rising prices tend to get people to do things...

This really does feel like an example of being too little too late. I think you are right, we will probably see something come to fruition finally this year, but it will be interesting to see how many people actually jump on board. I have a feeling by the time the red tape is all settled, the majority will already have found their "on-ramp".

Posted Using LeoFinance Beta

Exactly. Ironically this is probably better for bitcoin in the long run since it forced people to buy the actual coin itself, instead of shares issued by an ETF.

Yes, that is probably a good point.

Posted Using LeoFinance Beta