Jack Dorsey just got the blueprint on how to get $425 million into BTC without moving the price...

Microstrategy continues to enlighten people on all things relating to their bitcoin investment, and it's been awesome!

For those not following along, Microstrategy bought $425 million worth of bitcoin over the last several weeks.

Over the last several days they have revealed more into how exactly they did it.

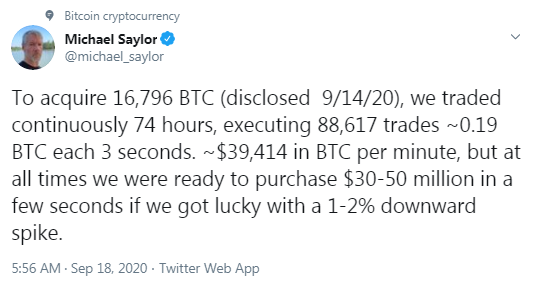

With the latest revelation coming here:

(Source: https://twitter.com/michael_saylor/status/1306940165160656897)

They just traded continuously for 74 straight hours, executing 88,617 trades and acquired .19 BTC every 3 seconds.

Which is a little less than $40k in BTC per minute.

And if prices dropped they were ready to snatch up a nice chunk.

That's it!

That's the playbook!

Looking at a chart of Bitcoin over the last couple weeks I have an idea when they might have done much of this accumulating.

Check this out:

(Source: https://twitter.com/tulkooo/status/1306943394124627968/photo/1)

That range is a little over 74 hours but I would bet they were a big chunk of that range.

They didn't let that CME gap get filled and now, I would not be surprised if it doesn't get filled for a long time, if ever.

The playbook is there for everyone...

Now that Microstrategy not only laid out why they did what they did, they have laid out how they did what they did.

Apple, Microsoft, Google, Facebook, and all sorts of large tech companies have the playbook right in front of them now.

It took MSTR about 6 months from the time they decided to make bitcoin a part of their treasury assets to the time they made it happen, which means if those companies start now, early and mid next year could be a whole lot of fun for bitcoin investors!

I know one person in particular who is likely getting the process started as we speak...

(Source: https://twitter.com/woonomic/status/1306853275539394560/photo/1)

His Twitter only has one word on it...

"Bitcoin"

His companies hold a combined $10 billion in cash on their balance sheets that are losing purchasing power every day...

I think there is a very good chance he will be one of the next to make this same type of a move.

A move to bitcoin.

The next 12-18 months are going to be wild for bitcoin and crypto folks.

Stay informed my friends.

-Doc

Posted Using LeoFinance

Everyone is taking note.

Just keep your feet wet.

!BEER

Thanks for the cold drink!

View or trade

BEER.Hey @jrcornel, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Cool, thanks. Everyone loves a free beer!

k but when lambo?

12-18 months.

I don't see Jack going the path that Michael went. Jack has far too many hurdles and he holds or controls only 2% of Twitter's stock while Michael holds 22.6% of Microstrategy.

Jack is also in the cross hairs of activist hedge fund Elliott Management who in an agreement with Twitter put 2 members on the board. This hedge fund will squeeze every nickle of value out of Twitters stock after taking a 1 billion dollar stake. I would see no reason for Elliott Management to support value creation from moving Twitters cash to BTC as it would be diluted. They would be better off directly buying BTC. Activist shareholders generally are not long term holders, they will drive up the stock price and sell, push up dividends or spin off assets.

Jack also said he was moving to Africa for 3-6 months this year because he sees Africa as a good opportunity for BTC. He later walked that back in light of COVID. Point being it was a psychological tell in that he is ready to move to the next adventure in the business world. He left the CEO seat at Twitter for 7 years after being pushed out with the interesting part being rumors of why. Further consider his training.

While he is pro BTC I don't see Twitter as the business vehicle he will use to develop a strong BTC enterprise but I could be wrong.

Jack may however be able to move some cash from Square treasury to BTC, I have not reviewed their board.

However applying a little game theory to the approach of companies taking large positions in BTC is interesting. I can't put it all here, but what will happen to Microstrategy in say 10 years assuming BTC is a million dollar coin? Their 38,250 BTC would be worth over 38 billion dollars far eclipsing the current value of the company. This would put them and any other company that did this in the similar position as Yahoo.

The sale of Yahoo's digital assets to Verizon created a shareholder revolt due to Yahoo's 50 billion dollar stake in Alibaba. Any company having major cash or cash equivalents on the the balance sheet has always created problems. The same thing happened to Apple.

Also consider why it took the Yahoo holding company years while spending million to sell off the Alibaba stake, tax.

These companies and whales that have large holdings of BTC will almost become vassal states. This will drive governments to use regulation and laws to extract that value from the holders. And with US politicians, as well a others proposing "wealth taxes", what will they do when BTC is at 10 million a coin?

In the end governments are in a good position to become stackers.

Cheers

Lot of good points in there. Regarding Jack doing what Michael did... he doesn't have to go all in. As I mentioned in the post, they have roughly $10 billion combined in cash and if he just put $500 million (a similar amount to MSTR), it would only represent 5% of their total cash reserves. Seems well worth the risk and doesn't eat up their cash if everyone's wrong about bitcoin.

I do agree that it convolutes things in case of a merger or acquisition, or even valuing the company. But the bottom line is if the move adds value (or at least keeps them from losing value in the case of inflation) it seems like a prudent move to make irregardless of the valuation problems.

I also consider Michael "learned" about bitcoin with his board, whereas Jack is a bitcoin advocate. I also believe that if he bought 25 satoshi's with company money Paul Singer would have his head.

There is also a political angle that has standing.

While I fully understand the roles and goals of hedge funds, Paul Singer the founder of Elliott Capital and Republican could achieve god like status by ousting Jack and taking more operational control of the company.

The asymmetrical political war in the US has been going on for many year has many fronts, Twitter is one.

Let's see what happens in 18 months, I hope you are correct. I will put this one in my calendar ;)

Cheers

Haha nice. I hope I am right as well! Make sure you remind me about this when it goes off in the future, either way. :)

Would you look at that...

https://www.coindesk.com/square-buys-50m-in-bitcoin

Looks like we were both right. :)

Yep and good for us all. Love to see liquidity come out of the market.

I expect to wake up some morning to a parabolic rise in BTC which in itself will cause the mother of all FOMO's. Welcome to the era of the 1M BTC.

Cheers

Yep I could see that as well.

MASTER STRATEGY:

Be a bull during a bear market.

If it's not a bear market just buy the dip!

lol.

This guy wants people to think he's some kind of Bitcoin wizard.

I find this to be absolutely hilarious sentiment... because they did increase the price, we just never saw it because they were all limit buy orders. The real price increase will be seen when Bitcoin goes x10 and they still aren't selling.

Yep exactly. From weak hands to the strongest of strong hands.