Peter's much better at calling bottoms than he is at calling tops

Schiff was just starting to turn bullish right about the time Bitcoin corrected

Everyone's favorite Gold Bug did what he always does today, he pretty called the exact bottom on bitcoin.

Bitcoin dropped all the way to $48k on Yellen's asinine remarks this morning pretty much saying bitcoin is inefficient and used for illicit activities, cough cough paper money isn't?!

Anyways, our good friend Peter of course used this opportunity to try and pile in on bitcoin, doing his best to dance on graves.

Which I don't blame him for because he's been beat up so badly over the last year in bitcoin, he deserves a little something just for all the crow he's had to eat.

He put out a tweet about bitcoin going to zero pretty much right at the bottom, sees:

(Source: https://twitter.com/BTC_Archive/status/1363970282818519047/photo/1)

His rational was basically that bitcoin was now closer to zero than $100k (since it was trading below $50k at the time) and therefore makes a move down to zero technically an easier get for bitcoin than $100k.

Um, ok I guess.

Not logic most people try to argue, considering that's like saying the price of gasoline is more likely to go to zero than $10 because it's technically closer to zero currently than $10.

Not exactly the same but that was my point, it's a mostly useless and redundant argument being made by a mostly useless and redundant market timer at this point.

If you do the opposite of what he says, you do very well, so I guess from that context, his market timing skills aren't that bad, there's just the opposite of good.

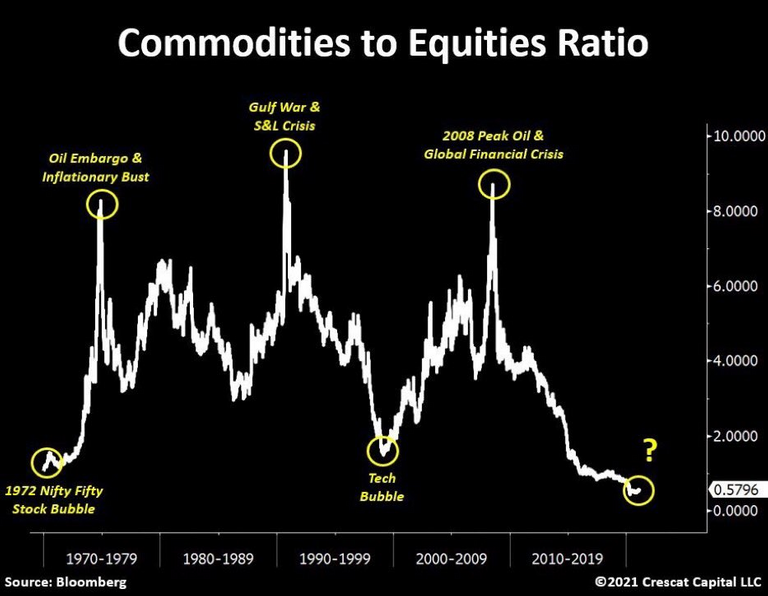

Back to bitcoin for a second though, this is something I am watching currently:

(Source: https://twitter.com/maxkeiser/status/1364004111176380423/photo/1)

I'm not sure bitcoin is a commodity, but it could be considered one.

It's done incredibly well in a low inflation environment and many models are pointing to a higher inflationary environment in the near future.

I would think that would be ideal for bitcoin, but I can't say for sure.

The response to bitcoin with rising interest rates hasn't been great thus far.

Posted Using LeoFinance Beta

Congratulations @jondoe! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next payout target is 32000 HP.

The unit is Hive Power equivalent because your rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Bitcoin has shown to move with tech stocks and other risk-on assets. It's not an uncorrelated asset. The market views it as technology and not a commodity.

The game theory revolving around the halvenings means Bitcoin has a lot of speculative upside potential.

Posted Using LeoFinance Beta

I'm noticing that as well. Does that mean a commodity super cycle wouldn't be good for bitcoin? I would think inflation would also be good for bitcoin, even if it is a quasi tech stock.